Question: All final answers, unless otherwise indicated, have been rounded to the nearest $10. Also, assume that each question is independent of any other question. please

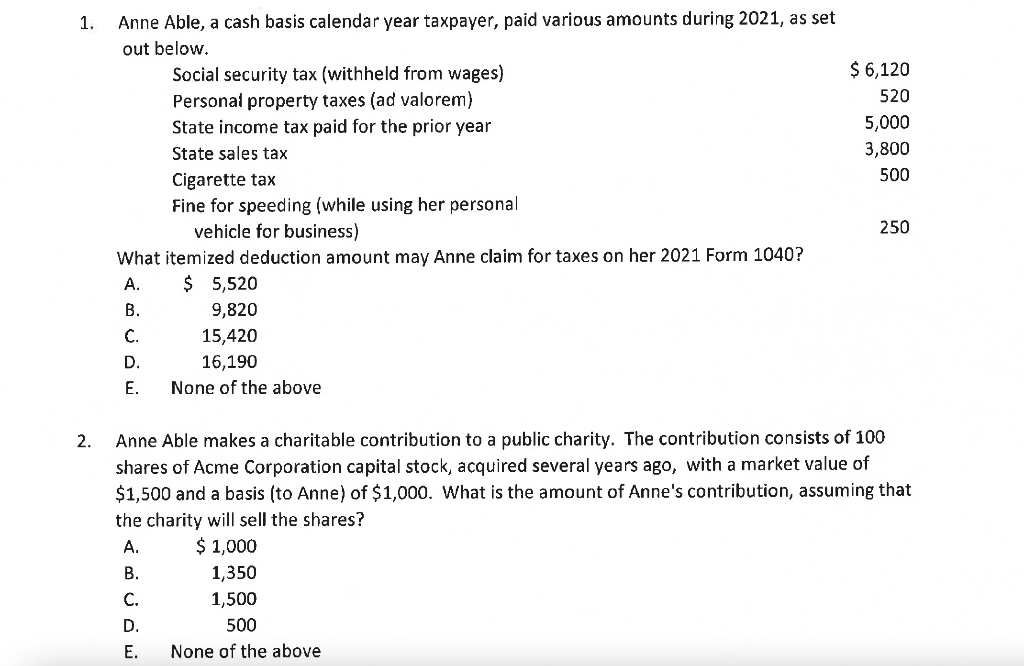

All final answers, unless otherwise indicated, have been rounded to the nearest $10. Also, assume that each question is independent of any other question. please answer questions using tax rules in effect for the year 2021, but ignoring temporary Covid-10 related changes.

A. $5,520 B. 9,820 C. 15,420 D. 16,190 E. None of the above 2. Anne Able makes a charitable contribution to a public charity. The contribution consists of 100 shares of Acme Corporation capital stock, acquired several years ago, with a market value of $1,500 and a basis (to Anne) of $1,000. What is the amount of Anne's contribution, assuming that the charity will sell the shares? A. $1,000 B. 1,350 C. 1,500 D. 500 E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts