Question: All four final answers should be rounded to 2 decimal places As the CFO of Frito-Lay, you are considering building a cookie factory and enter

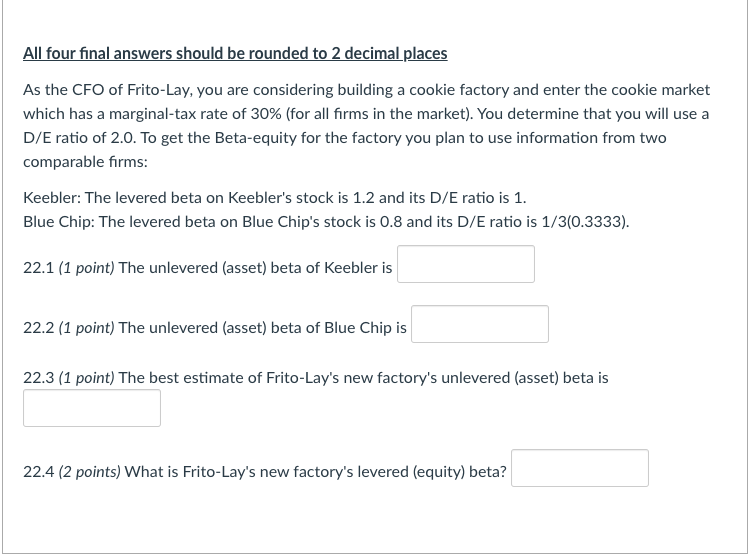

All four final answers should be rounded to 2 decimal places As the CFO of Frito-Lay, you are considering building a cookie factory and enter the cookie market which has a marginal-tax rate of 30% (for all firms in the market). You determine that you will use a D/E ratio of 2.0. To get the Beta-equity for the factory you plan to use information from two comparable firms: Keebler: The levered beta on Keebler's stock is 1.2 and its D/E ratio is 1. Blue Chip: The levered beta on Blue Chip's stock is 0.8 and its D/E ratio is 1/3(0.3333). 22.1 (1 point) The unlevered (asset) beta of Keebler is 22.2 (1 point) The unlevered (asset) beta of Blue Chip is 22.3 (1 point) The best estimate of Frito-Lay's new factory's unlevered (asset) beta is 22.4 (2 points) What is Frito-Lay's new factory's levered (equity) beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts