Question: All group are doing NPV calculations on four different mining projects and note the amounts on in $000. All mining projects will have cash outflows

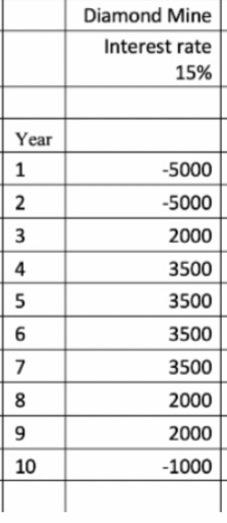

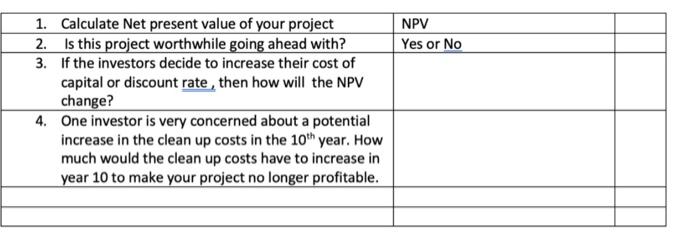

All group are doing NPV calculations on four different mining projects and note the amounts on in $000. All mining projects will have cash outflows for first two years while in construction and preproduction. This shows as - cash flow. Each mine will be in production for 7 years from 3rid year to 9th year and showing profits. In the last year, or the 10th year, the mine will be closed and will require to pay for clean up and rehabilitation of mining area. Each mine will have a different cost of capital or discount interest rate expressed in an annual \%. \begin{tabular}{|l|r|} \hline & Diamond Mine \\ \hline & Interest rate \\ 15% \\ \hline & \\ \hline Year & \\ \hline 1 & -5000 \\ \hline 2 & -5000 \\ \hline 3 & 2000 \\ \hline 4 & 3500 \\ \hline 5 & 3500 \\ \hline 6 & 3500 \\ \hline 7 & 3500 \\ \hline 8 & 2000 \\ \hline 9 & 2000 \\ \hline 10 & -1000 \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 1. Calculate Net present value of your project & NPV & \\ \hline 2. Is this project worthwhile going ahead with? & Yes or No & \\ \hline 3. If the investors decide to increase their cost of \\ capital or discount rate, then how will the NPV & \\ change? \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts