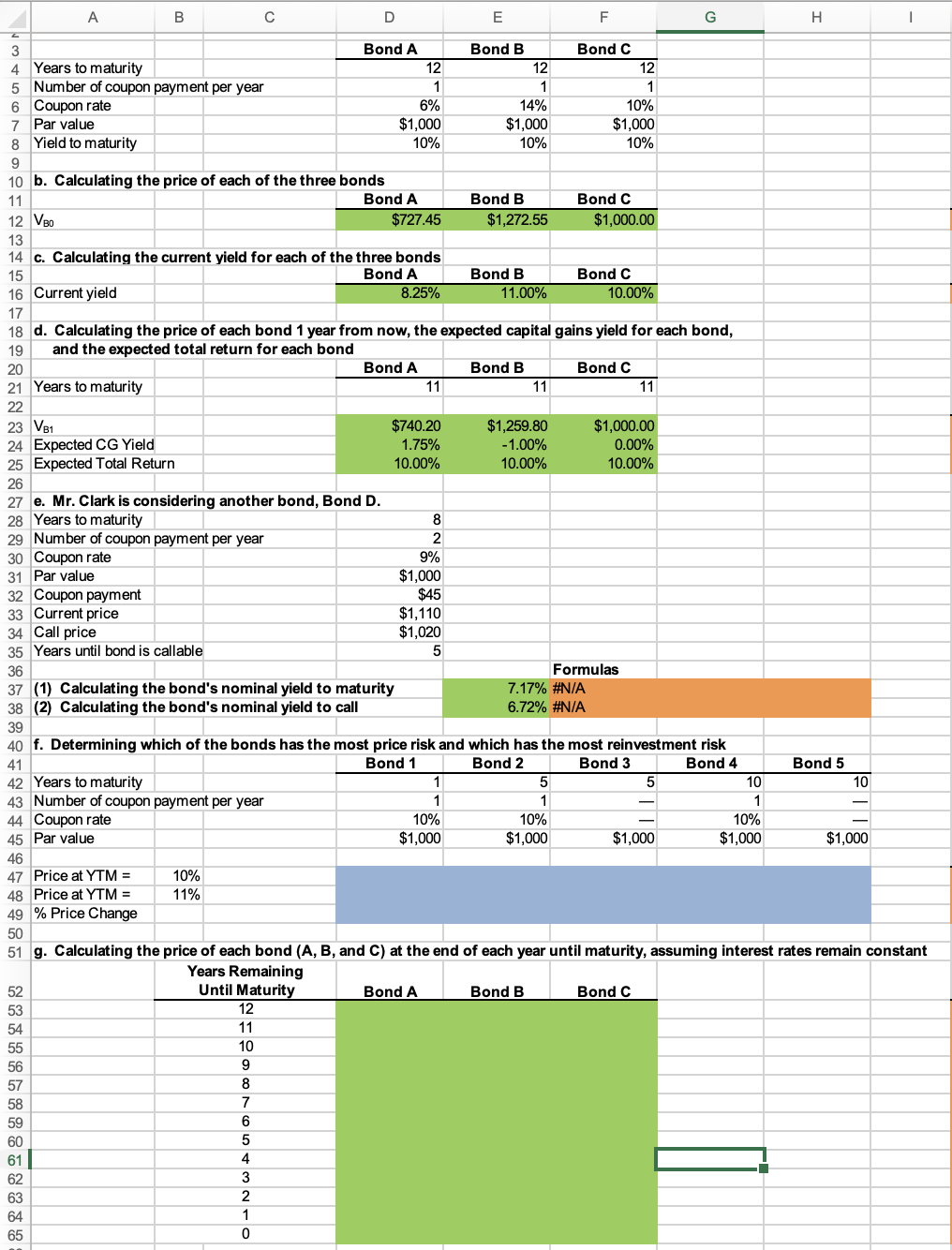

Question: All I need help on is how to put the formulas into excel for each column on Part G? B D E G H I

All I need help on is how to put the formulas into excel for each column on Part G?

All I need help on is how to put the formulas into excel for each column on Part G?

B D E G H I 10% 3 Bond A Bond B Bond C 4 Years to maturity 12 12 12 5 Number of coupon payment per year 1 1 1 6 Coupon rate 6% 14% 10% 7 Par value $1,000 $1,000 $1,000 8 Yield to maturity 10% 10% 9 10 b. Calculating the price of each of the three bonds 11 Bond A Bond B Bond C 12 VBO $727.45 $1,272.55 $1,000.00 13 14 c. Calculating the current yield for each of the three bonds 15 Bond A Bond B Bond C 16 Current yield 8.25% 11.00% 10.00% 17 18 d. Calculating the price of each bond 1 year from now, the expected capital gains yield for each bond, 19 and the expected total return for each bond 20 Bond A Bond B Bond C 21 Years to maturity 11 11 11 22 23 VB1 $740.20 $1,259.80 $1,000.00 24 Expected CG Yield 1.75% -1.00% 0.00% 25 Expected Total Return 10.00% 10.00% 10.00% 26 27 e. Mr. Clark is considering another bond, Bond D. 28 Years to maturity 8 29 Number of coupon payment per year 2 30 Coupon rate 9% 31 Par value $1,000 32 Coupon payment $45 33 Current price $1,110 34 Call price $1,020 35 Years until bond is callable 5 36 Formulas 37 (1) Calculating the bond's nominal yield to maturity 7.17% #N/A 38 (2) Calculating the bond's nominal yield to call 6.72% #N/A 39 40 f. Determining which of the bonds has the most price risk and which has the most reinvestment risk 41 Bond 1 Bond 2 Bond 3 Bond 4 Bond 5 42 Years to maturity 1 5 5 10 10 43 Number of coupon payment per year 1 1 1 44 Coupon rate 109 45 Par value $1,000 $1,000 $1,000 $1,000 $1,000 46 47 Price at YTM = 10% 48 Price at YTM = 11% 49 % Price Change 50 51 g. Calculating the price of each bond (A, B, and C) at the end of each year until maturity, assuming interest rates remain constant Years Remaining 52 Until Maturity Bond A Bond B Bond C 53 12 54 11 55 10 56 9 57 8 58 7 59 6 60 5 61 4 62 3 63 2 64 1 65 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts