Question: All I need is answers for problems 2 and 3 please. I have added the initial problem and question number 1 (which is already answered)

All I need is answers for problems 2 and 3 please. I have added the initial problem and question number 1 (which is already answered) in case you need information from it.

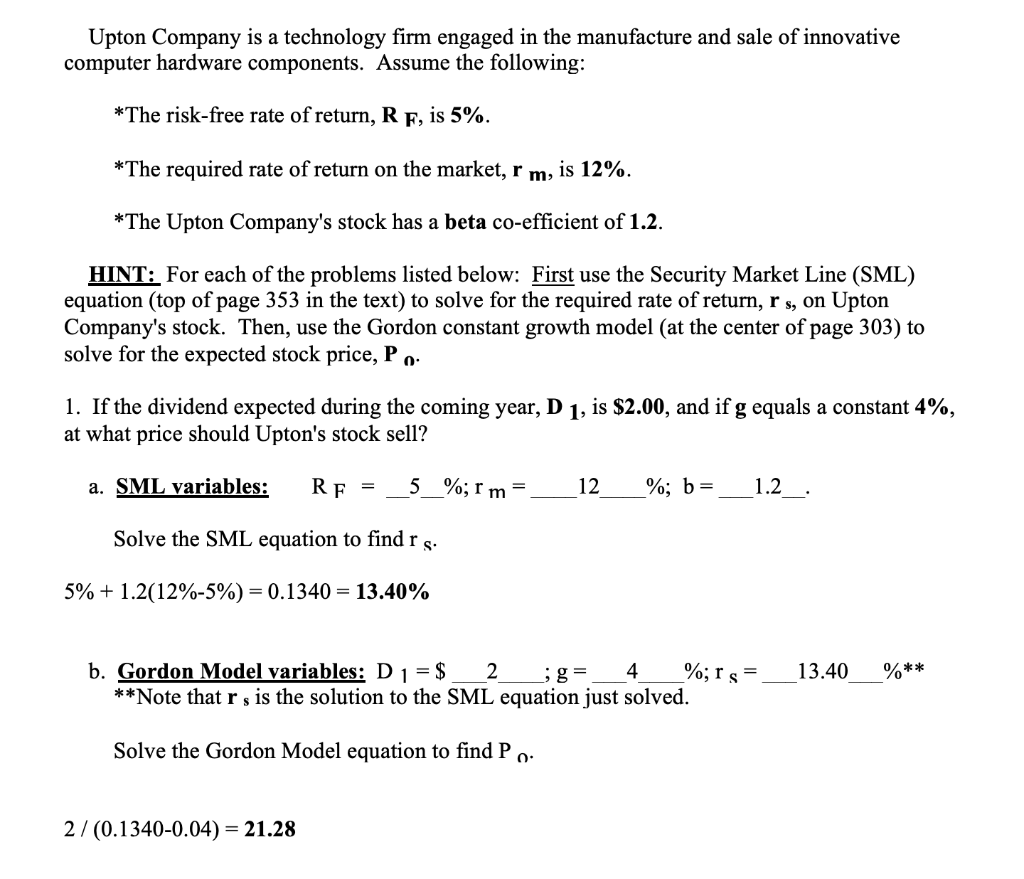

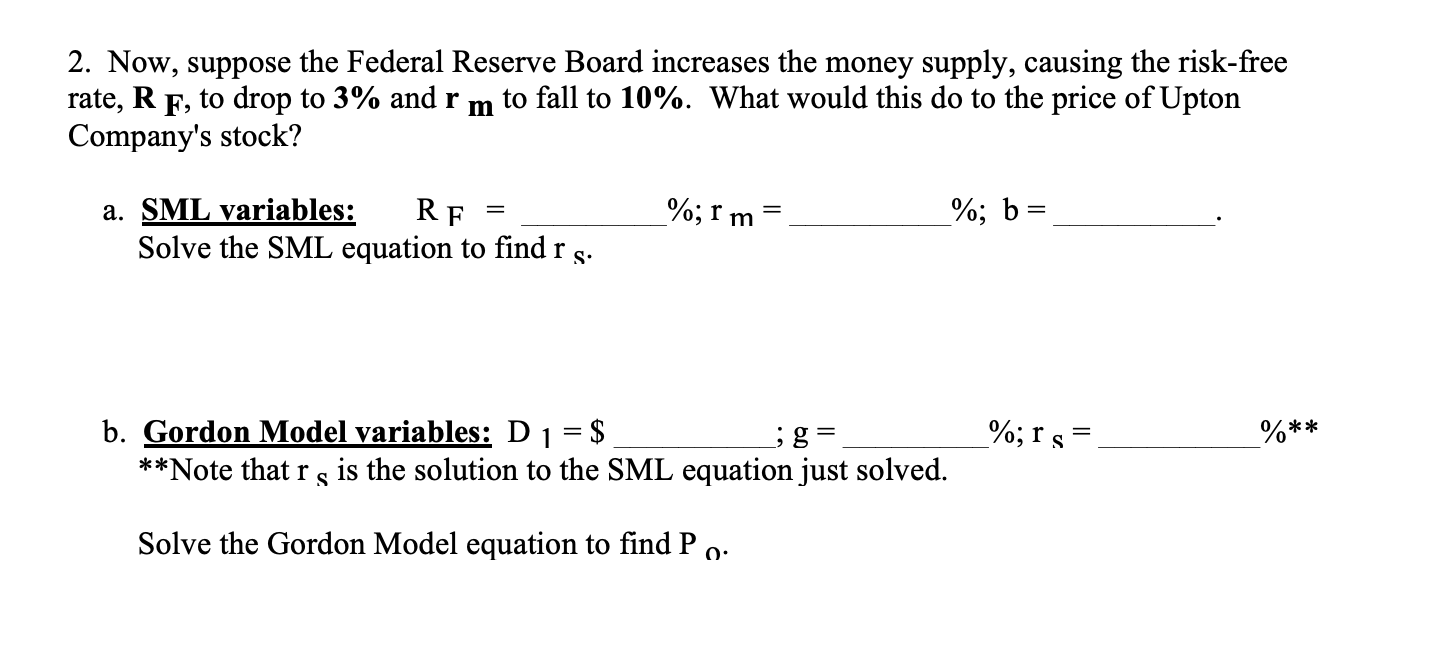

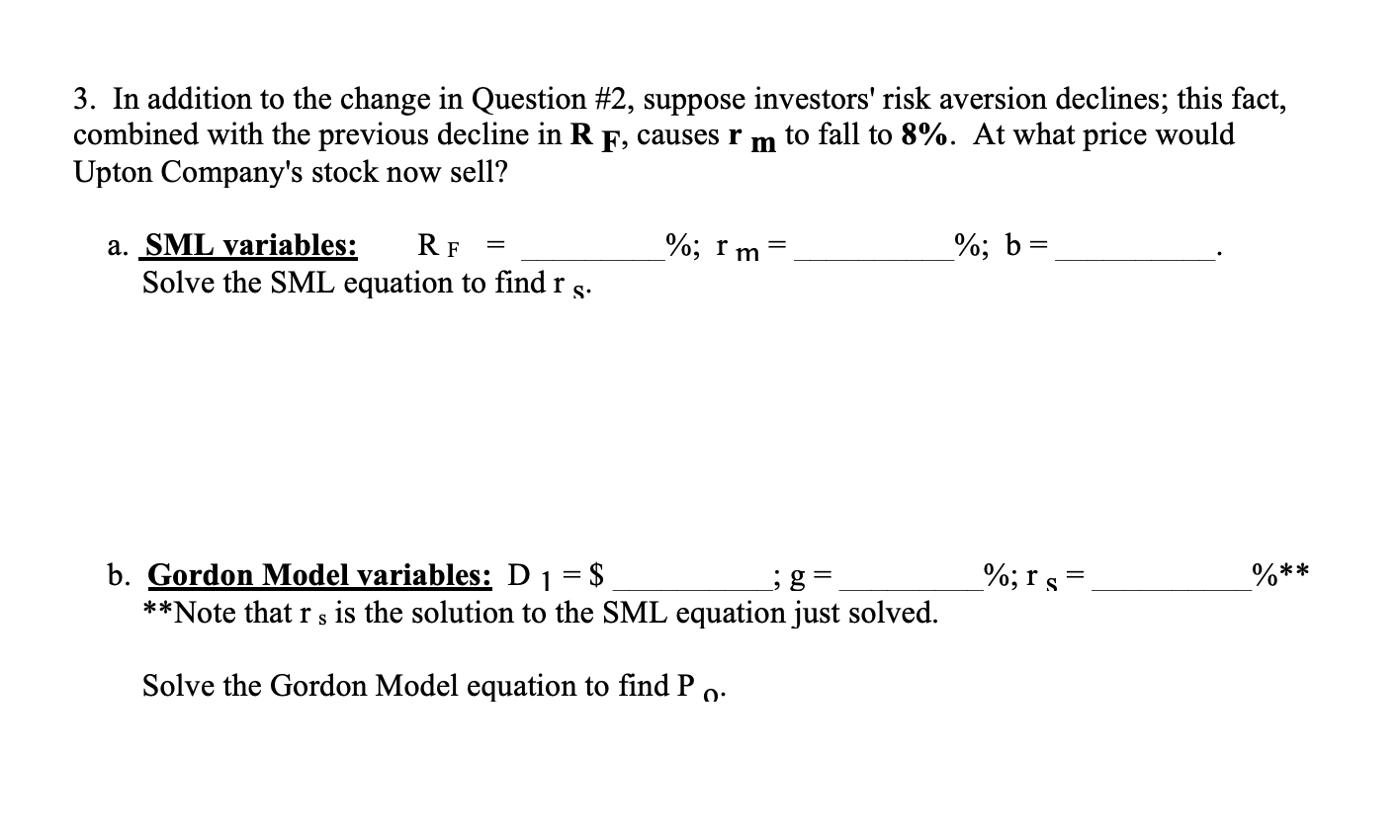

Upton Company is a technology firm engaged in the manufacture and sale of innovative computer hardware components. Assume the following: *The risk-free rate of return, RF, is 5%. *The required rate of return on the market, rm, is 12%. *The Upton Company's stock has a beta co-efficient of 1.2. HINT: For each of the problems listed below: First use the Security Market Line (SML) equation (top of page 353 in the text) to solve for the required rate of return, rs, on Upton Company's stock. Then, use the Gordon constant growth model (at the center of page 303) to solve for the expected stock price, Po. 1. If the dividend expected during the coming year, D1, is $2.00, and if g equals a constant 4%, at what price should Upton's stock sell? a. SML variables: RF=5%;rm=_12%;b=_1.2_. Solve the SML equation to find rs. 5%+1.2(12%5%)=0.1340=13.40% b. Gordon Model variables: D1=$2;g=4%;rs=13.40% Note that rs is the solution to the SML equation just solved. Solve the Gordon Model equation to find Pn. 2/(0.13400.04)=21.28 2. Now, suppose the Federal Reserve Board increases the money supply, causing the risk-free rate, RF, to drop to 3% and rm to fall to 10%. What would this do to the price of Upton Company's stock? a. SML variables: RF=%;rm=%; Solve the SML equation to find rs. b. Gordon Model variables: D1=$;g=%;rS=%0 **Note that rS is the solution to the SML equation just solved. Solve the Gordon Model equation to find Pn. 3. In addition to the change in Question \#2, suppose investors' risk aversion declines; this fact, combined with the previous decline in RF, causes rm to fall to 8%. At what price would Upton Company's stock now sell? a. SML variables: RF=%;rm=.%;b= Solve the SML equation to find rs. b. Gordon Model variables: D1=$;g=%;rs=% Note that rs is the solution to the SML equation just solved. Solve the Gordon Model equation to find Pn

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts