Question: All information is provided below. Please answer with explanations, I have no idea how to get these answers. Thank you. Here are the options for

All information is provided below. Please answer with explanations, I have no idea how to get these answers. Thank you.

Here are the options for the one I had wrong:

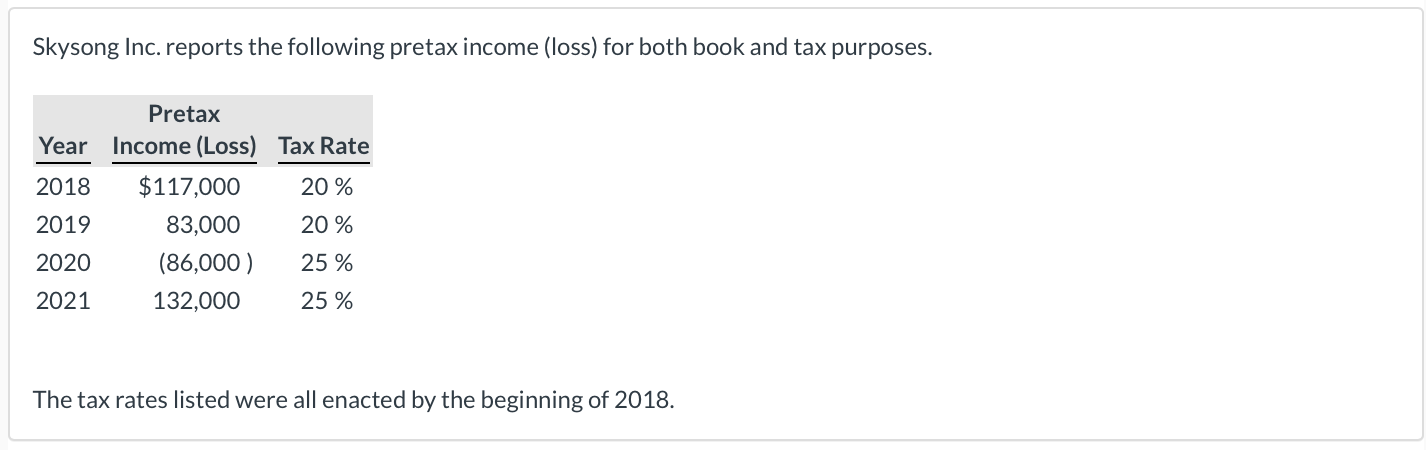

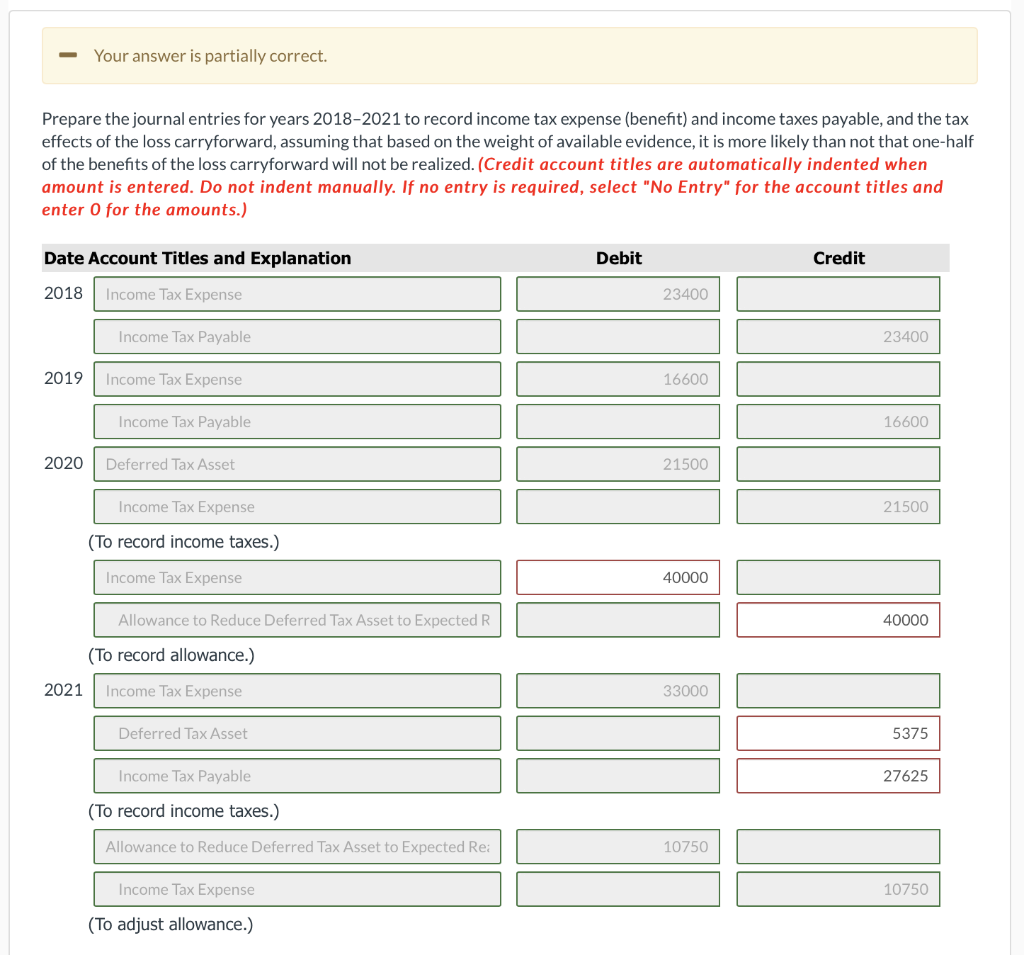

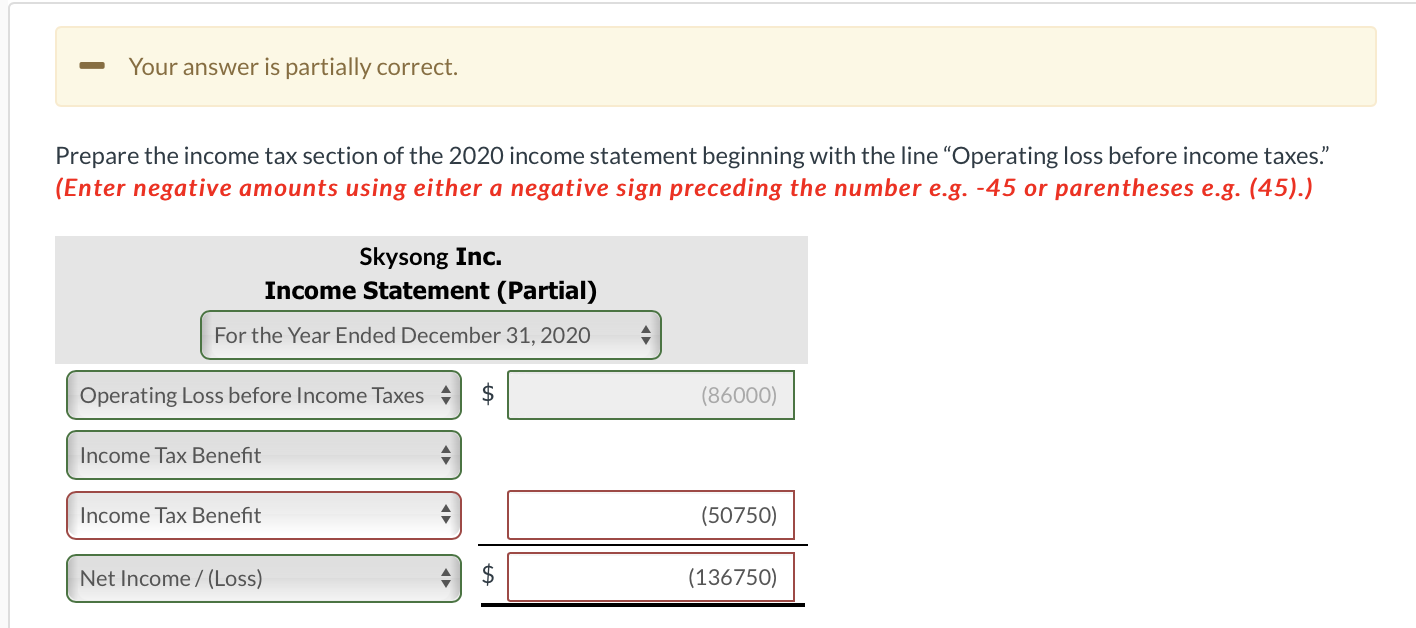

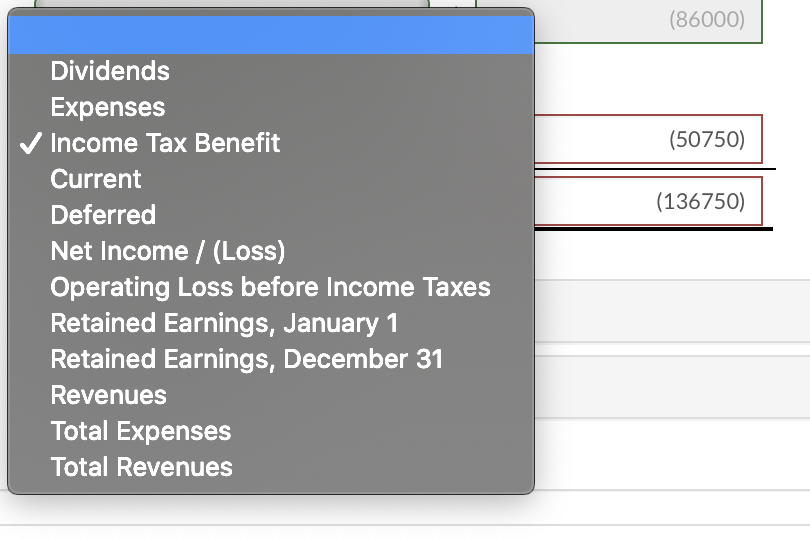

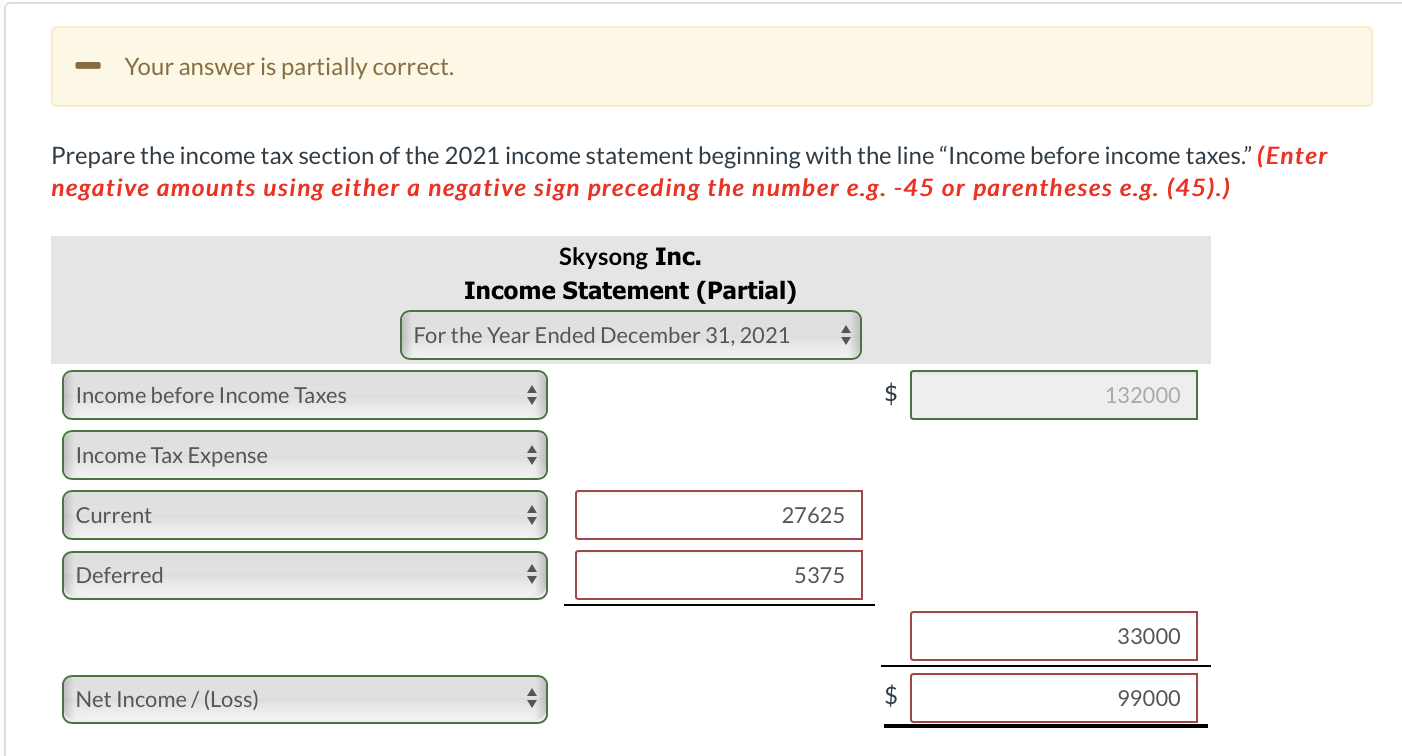

Skysong Inc. reports the following pretax income (loss) for both book and tax purposes. Pretax Year Income (Loss) Tax Rate 2018 $117,000 20% 2019 83,000 20% 2020 (86,000) 25 % 2021 132,000 25 % The tax rates listed were all enacted by the beginning of 2018. Your answer is partially correct. Prepare the journal entries for years 2018-2021 to record income tax expense (benefit) and income taxes payable, and the tax effects of the loss carryforward, assuming that based on the weight of available evidence, it is more likely than not that one-half of the benefits of the loss carryforward will not be realized. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit 2018 Income Tax Expense 23400 Income Tax Payable 23400 2019 Income Tax Expense 16600 Income Tax Payable 16600 2020 Deferred Tax Asset 21500 Income Tax Expense 21500 (To record income taxes.) Income Tax Expense 40000 Allowance to Reduce Deferred Tax Asset to Expected R 40000 (To record allowance.) 2021 Income Tax Expense 33000 Deferred Tax Asset 5375 Income Tax Payable 27625 (To record income taxes.) Allowance to Reduce Deferred Tax Asset to Expected Re: 10750 Income Tax Expense 10750 (To adjust allowance.) Your answer is partially correct. Prepare the income tax section of the 2020 income statement beginning with the line "Operating loss before income taxes (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Skysong Inc. Income Statement (Partial) For the Year Ended December 31, 2020 Operating Loss before Income Taxes A $ (86000) Income Tax Benefit Income Tax Benefit (50750) Net Income /(Loss) $ (136750) (86000) (50750) (136750) Dividends Expenses Income Tax Benefit Current Deferred Net Income /(Loss) Operating Loss before Income Taxes Retained Earnings, January 1 Retained Earnings, December 31 Revenues Total Expenses Total Revenues Your answer is partially correct. Prepare the income tax section of the 2021 income statement beginning with the line Income before income taxes. (Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) Skysong Inc. Income Statement (Partial) For the Year Ended December 31, 2021 Income before Income Taxes $ 132000 Income Tax Expense Current 27625 Deferred 5375 33000 Net Income /(Loss) $ 99000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts