Question: ALL INFORMATION IS SHOW. MAKE SURE YOUR ANSWER IS CORRECT Burtman Electronics has only two retail and two wholesale customers. Information relating to each customer

ALL INFORMATION IS SHOW. MAKE SURE YOUR ANSWER IS CORRECT

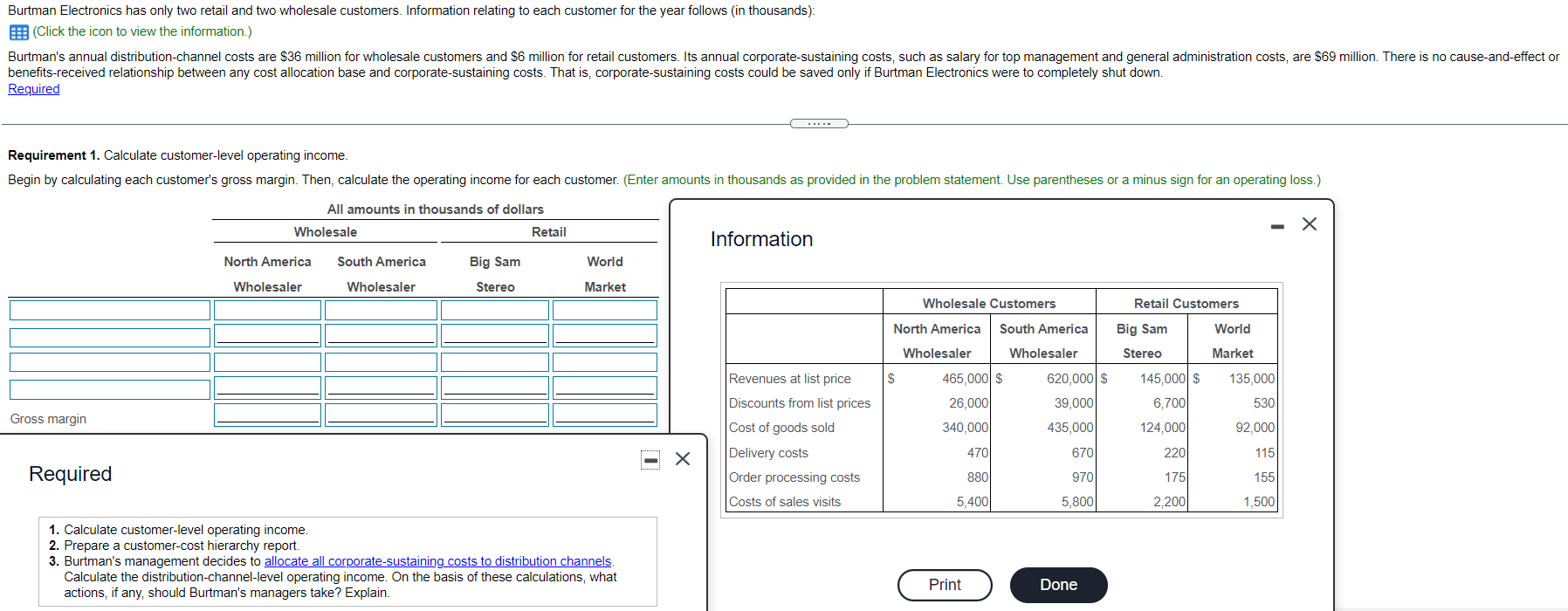

Burtman Electronics has only two retail and two wholesale customers. Information relating to each customer for the year follows (in thousands): E: (Click the icon to view the information.) Burtman's annual distribution-channel costs are $36 million for wholesale customers and $6 million for retail customers. Its annual corporate-sustaining costs, such as salary for top management and general administration costs, are $69 million. There is no cause-and-effect or benefits-received relationship between any cost allocation base and corporate-sustaining costs. That is, corporate-sustaining costs could be saved only if Burtman Electronics were to completely shut down. Required C. Requirement 1. Calculate customer-level operating income. Begin by calculating each customer's gross margin. Then, calculate the operating income for each customer. (Enter amounts in thousands as provided in the problem statement. Use parentheses or a minus sign for an operating loss.) All amounts in thousands of dollars Wholesale Retail Information North America South America Big Sam World Wholesaler Wholesaler Stereo Market Wholesale Customers Retail Customers North America South America World Big Sam Stereo Wholesaler Wholesaler Market Revenues at list price $ 620,000 $ 135,000 465,000 $ 26,000 340.0001 145,000 $ 6,700 39,000 530 Gross margin 435,000 124,000 92.000 Discounts from list prices Cost of goods sold Delivery costs Order processing costs Costs of sales visits 470 670 220 115 Required 8801 970 175 155 5,400 5,800 2,200 1,500 1. Calculate customer-level operating income. 2. Prepare a customer-cost hierarchy report. 3. Burtman's management decides to allocate all corporate-sustaining costs to distribution channels. Calculate the distribution-channel-level operating income. On the basis of these calculations, what actions, if any, should Burtman's managers take? Explain. Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts