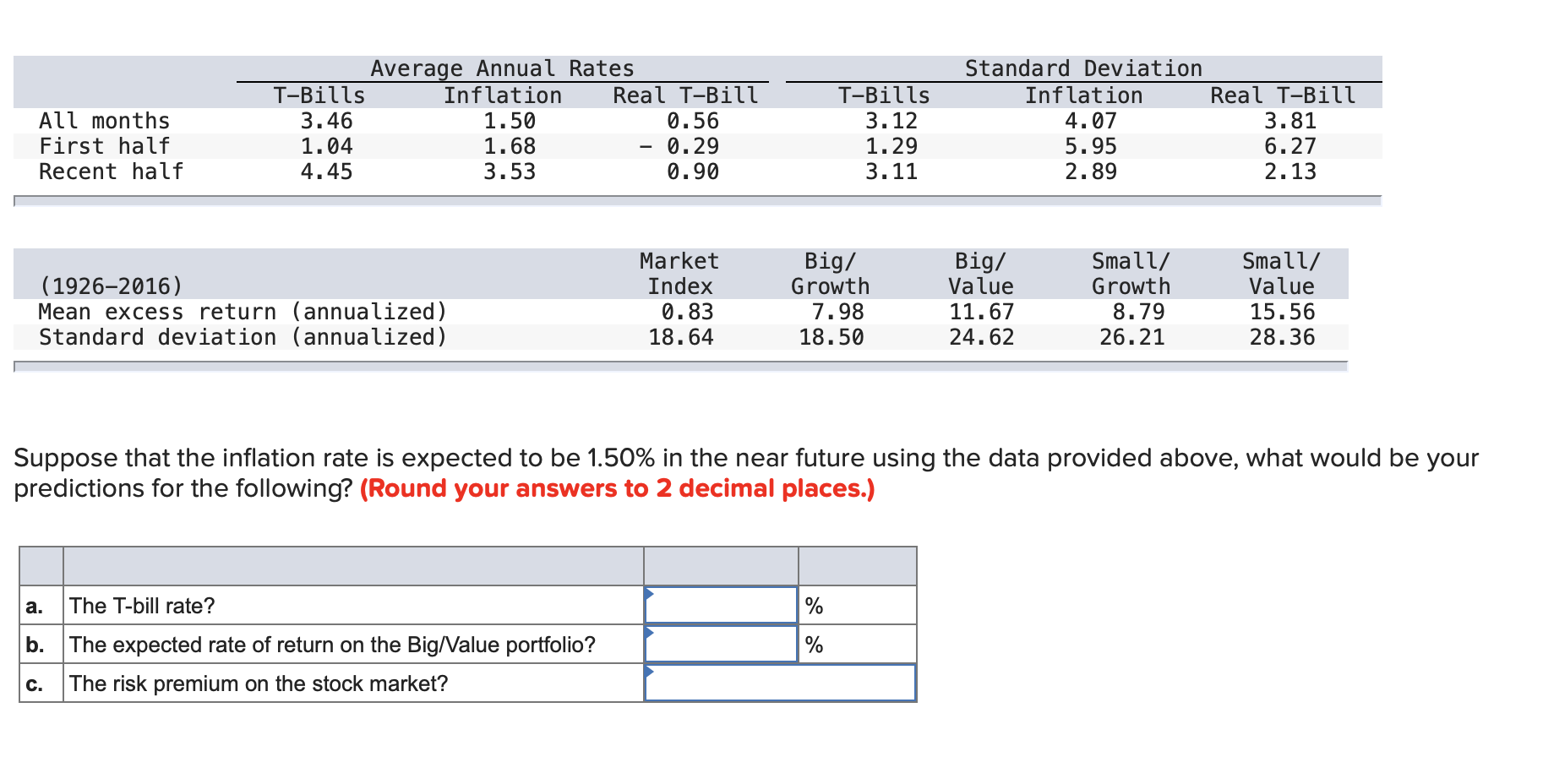

Question: All months First half Recent half Average Annual Rates T-Bills Inflation Real T-Bill 3.46 1.50 0.56 1.04 1.68 - 0.29 4.45 3.53 0.90 T-Bills 3.12

All months First half Recent half Average Annual Rates T-Bills Inflation Real T-Bill 3.46 1.50 0.56 1.04 1.68 - 0.29 4.45 3.53 0.90 T-Bills 3.12 1.29 3.11 Standard Deviation Inflation Real T-Bill 4.07 3.81 5.95 6.27 2.89 2.13 (19262016) Mean excess return (annualized) Standard deviation (annualized) Market Index 0.83 18.64 Big/ Growth 7.98 18.50 Big/ Value 11.67 24.62 Small/ Growth 8.79 26.21 Small/ Value 15.56 28.36 Suppose that the inflation rate is expected to be 1.50% in the near future using the data provided above, what would be your predictions for the following? (Round your answers to 2 decimal places.) a. The T-bill rate? b. The expected rate of return on the Big/Value portfolio? c. The risk premium on the stock market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts