Question: all multiple choice ! answer all questions please Question 15 (2.5 points) According to the pecking order theory of capital structure, firms will usually go

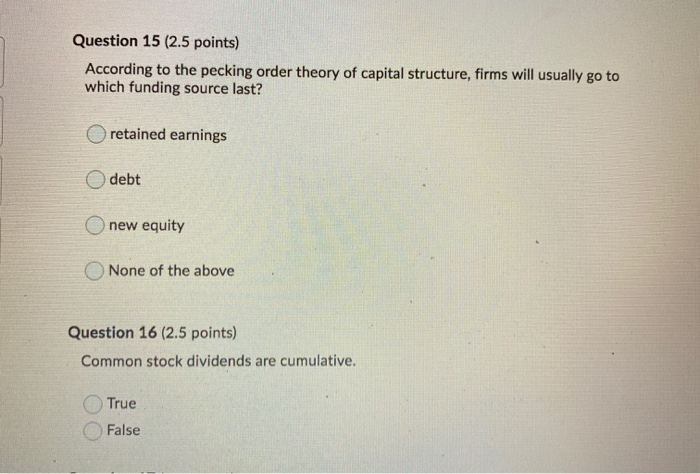

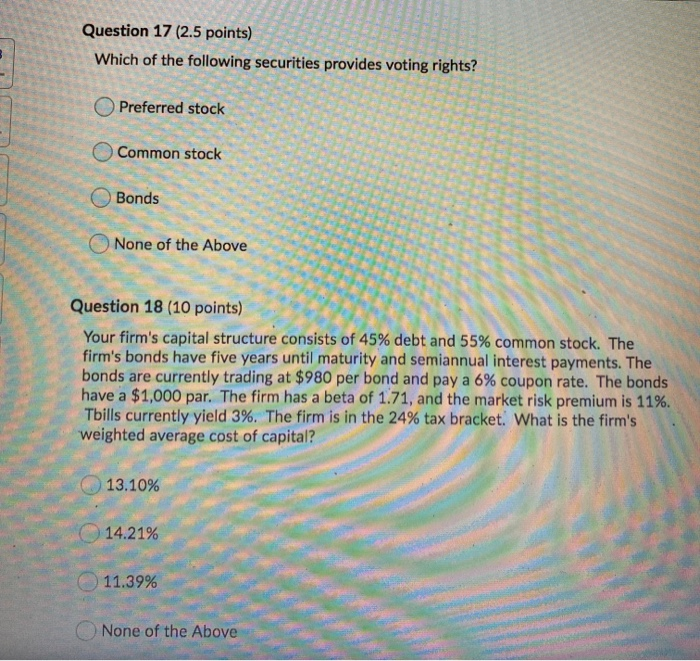

Question 15 (2.5 points) According to the pecking order theory of capital structure, firms will usually go to which funding source last? retained earnings debt new equity None of the above Question 16 (2.5 points) Common stock dividends are cumulative. True False Question 17 (2.5 points) Which of the following securities provides voting rights? Preferred stock Common stock Bonds None of the Above Question 18 (10 points) Your firm's capital structure consists of 45% debt and 55% common stock. The firm's bonds have five years until maturity and semiannual interest payments. The bonds are currently trading at $980 per bond and pay a 6% coupon rate. The bonds have a $1,000 par. The firm has a beta of 1.71, and the market risk premium is 11%. Tbills currently yield 3%. The firm is in the 24% tax bracket. What is the firm's weighted average cost of capital?! 13.10% 14.21% 11.39% None of the Above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts