Question: All note payments include interest. Requirements: A. Record the 1/1/14 transaction for Fishbone Corporation and all necessary entries from 2014-2016. B. Record the 1/1/14 transaction

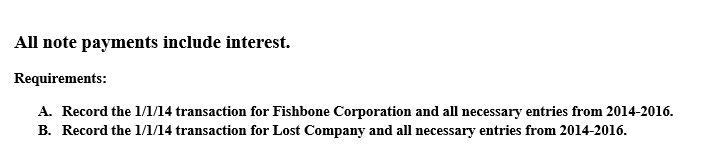

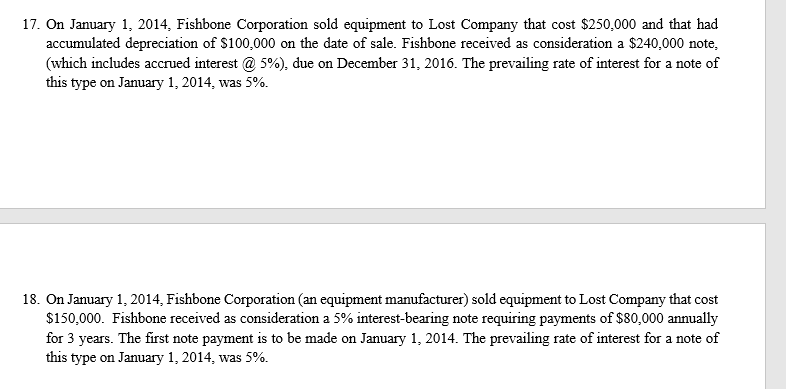

All note payments include interest. Requirements: A. Record the 1/1/14 transaction for Fishbone Corporation and all necessary entries from 2014-2016. B. Record the 1/1/14 transaction for Lost Company and all necessary entries from 2014-2016. 17. On January 1, 2014, Fishbone Corporation sold equipment to Lost Company that cost $250,000 and that had accumulated depreciation of $100,000 on the date of sale. Fishbone received as consideration a $240.000 note, (which includes accrued interest @ 5%), due on December 31, 2016. The prevailing rate of interest for a note of this type on January 1, 2014, was 5%. 18. On January 1, 2014, Fishbone Corporation (an equipment manufacturer) sold equipment to Lost Company that cost $150,000. Fishbone received as consideration a 5% interest-bearing note requiring payments of $80,000 annually for 3 years. The first note payment is to be made on January 1, 2014. The prevailing rate of interest for a note of this type on January 1, 2014, was 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts