Question: All numbers are the same for each question. Question 1 Assets 2012 2013 Cash 45 50 AR 331 111 Inventory 197 255 Total 573 416

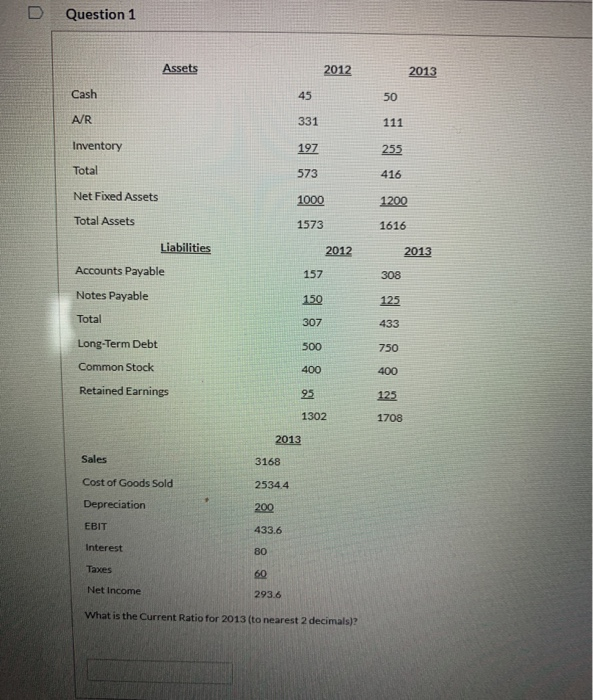

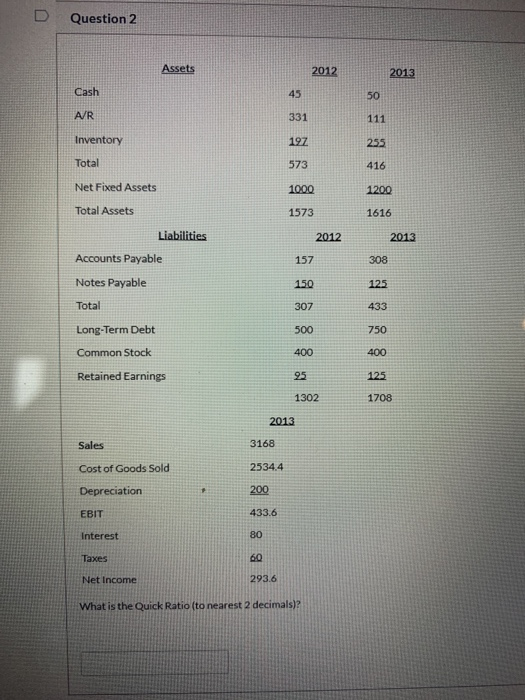

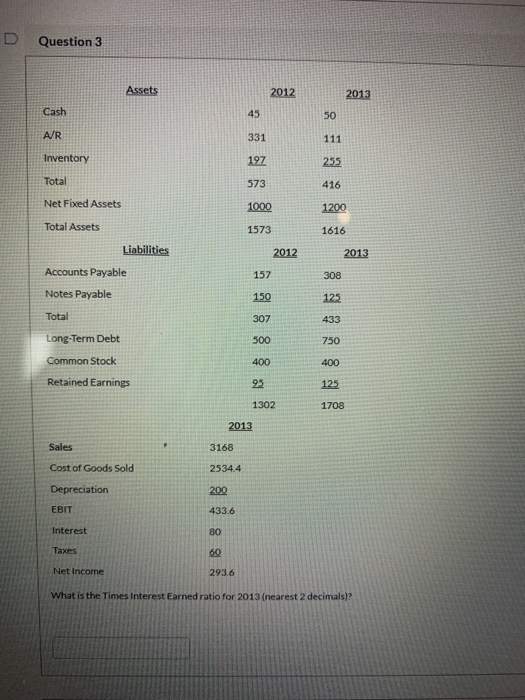

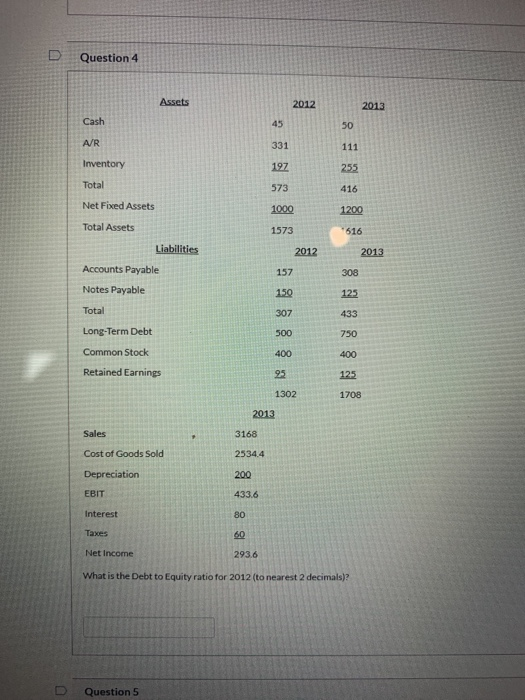

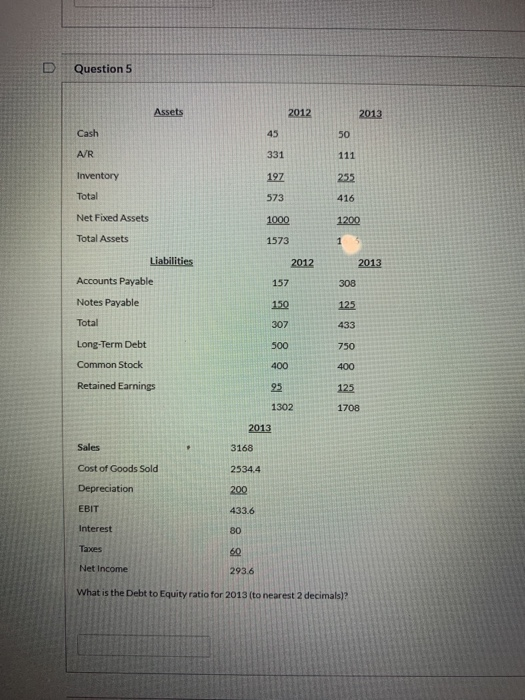

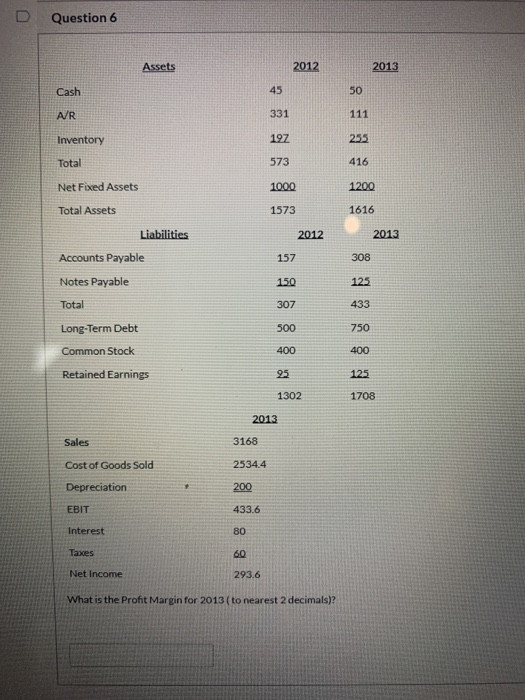

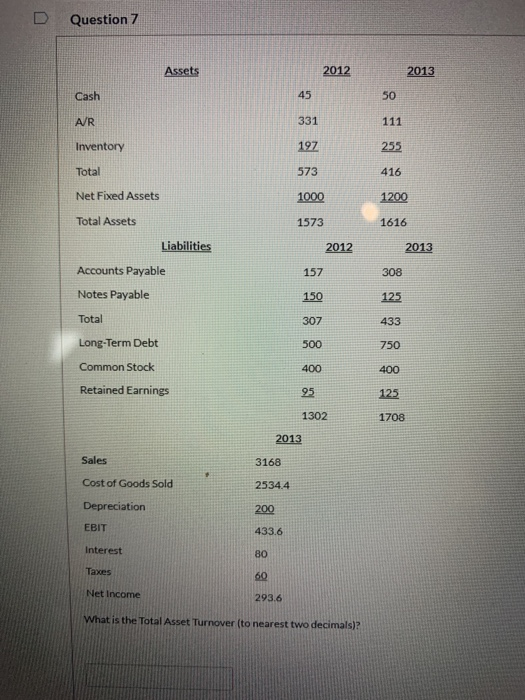

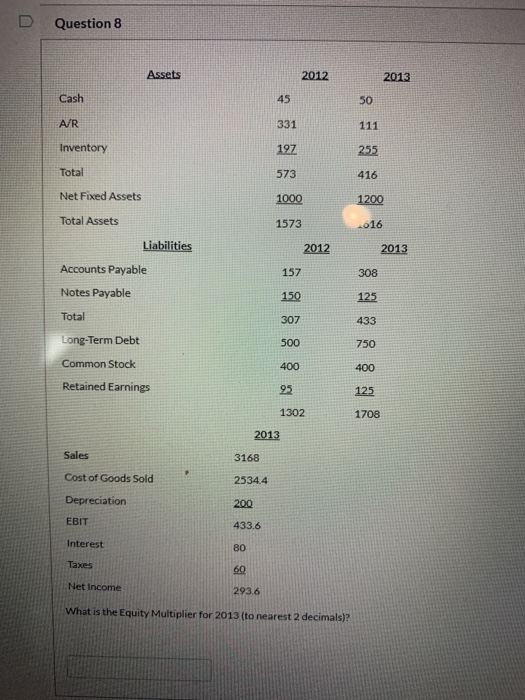

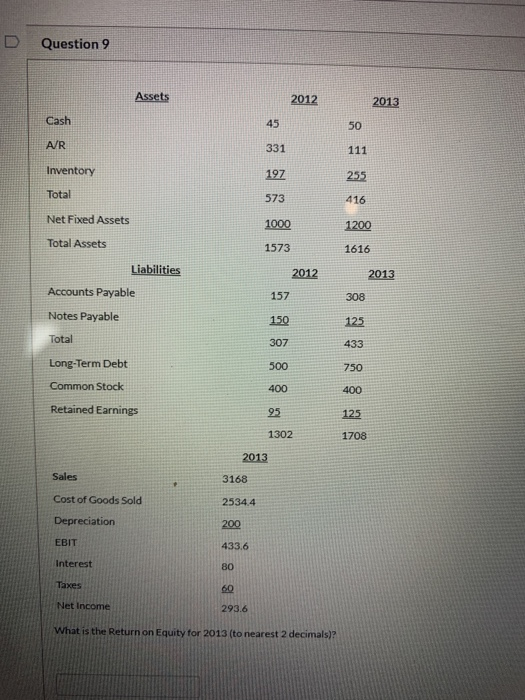

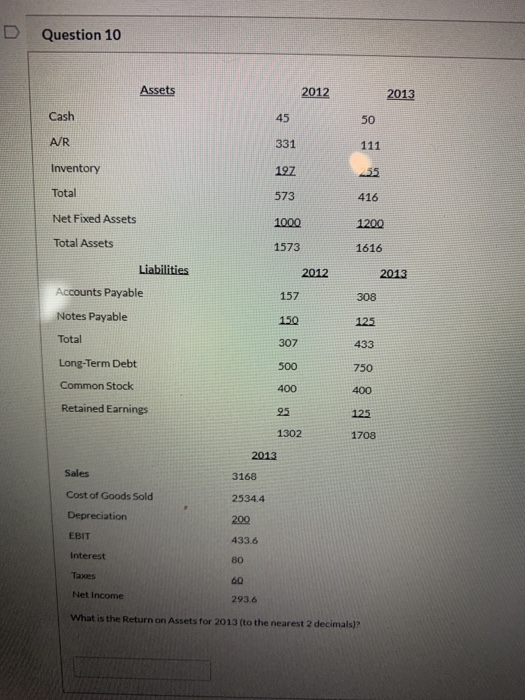

Question 1 Assets 2012 2013 Cash 45 50 AR 331 111 Inventory 197 255 Total 573 416 Net Fixed Assets 1000 1200 Total Assets 1573 1616 Liabilities 2012 2013 157 308 Accounts Payable Notes Payable 150 125 Total 307 433 Long-Term Debt 500 750 Common Stock 400 400 Retained Earnings 95 125 1302 1708 2013 Sales 3168 Cost of Goods Sold 2534.4 Depreciation 200 EBIT 433.6 Interest 80 Taxes 60 Net Income 293.6 What is the Current Ratio for 2013 (to nearest 2 decimals)? D Question 2 Assets 2012 2013 Cash 45 50 A/R 331 111 Inventory 197 255 Total 573 416 Net Fixed Assets 1000 1200 Total Assets 1573 1616 Liabilities 2012 2013 157 308 150 125 Accounts Payable Notes Payable Total Long-Term Debt Common Stock 307 433 500 750 400 400 Retained Earnings 25 125 1302 1708 2013 Sales 3168 Cost of Goods Sold 2534.4 Depreciation 200 EBIT 433.6 Interest 80 Taxes 60 Net Income 293.6 What is the Quick Ratio (to nearest 2 decimals)? D Question 3 Assets 2012 2013 Cash 45 50 ASR 331 111 Inventory 197 255 Total 573 416 Net Fixed Assets 1000 1200 Total Assets 1573 1616 2012 2013 Liabilities Accounts Payable Notes Payable 157 308 150 125 Total 307 433 500 750 Long-Term Debt Common Stock Retained Earnings 400 400 95 125 1302 1708 2013 Sales + 3168 Cost of Goods Sold 2534.4 Depreciation 200 EBIT 433.6 Interest 80 Taxes 60 Net Income 2936 What is the Times Interest Earned ratio for 2013 (nearest 2 decimals)? Question 4 Assets 2012 2013 Cash 50 A/R 331 111 Inventory 197 255 Total 573 416 Net Fixed Assets 1000 1200 Total Assets 1573 516 Liabilities 2012 2013 157 308 Accounts Payable Notes Payable 150 125 Total 307 433 Long-Term Debt 500 750 Common Stock 400 400 Retained Earnings 25 125 1302 1708 2013 Sales 3168 Cost of Goods Sold 2534.4 Depreciation 200 EBIT 433.6 Interest 80 Taxes 60 Net Income 293.6 What is the Debt to Equity ratio for 2012 (to nearest 2 decimals)? Question 5 D Question 5 Assets 2012 2013 Cash 45 50 A/R 331 111 Inventory 197 255 Total 573 416 Net Fixed Assets 1000 1200 Total Assets 1573 1 3 Liabilities 2012 2013 157 308 Accounts Payable Notes Payable Total 150 125 307 433 Long-Term Debt 500 750 Common Stock 400 400 Retained Earnings 95 125 1302 1708 2013 Sales 3168 2534.4 Cost of Goods Sold Depreciation 200 EBIT 433.6 Interest 80 Taxes 60 Net Income 293.6 What is the Debt to Equity ratio for 2013 (to nearest 2 decimals)? Question 6 Assets 2012 2013 Cash 45 50 A/R 331 111 Inventory 197 255 Total 573 416 Net Fixed Assets 1000 1200 Total Assets 1573 1616 2012 2013 157 308 Liabilities Accounts Payable Notes Payable Total Long-Term Debt 150 125 307 433 500 750 Common Stock 400 400 Retained Earnings 25 125 1302 1708 2013 Sales 3168 Cost of Goods Sold 2534.4 Depreciation 200 EBIT 433.6 Interest 80 Taxes 60 Net Income 293.6 What is the Profit Margin for 2013 (to nearest 2 decimals)? Question 7 Assets 2012 2013 Cash 45 50 A/R 331 111 Inventory 197 255 Total 573 416 Net Fixed Assets 1000 1200 Total Assets 1573 1616 Liabilities 2012 2013 157 308 Accounts Payable Notes Payable 150 125 Total 307 433 Long-Term Debt 500 750 Common Stock 400 400 Retained Earnings 95 125 1302 1708 2013 Sales 3168 Cost of Goods Sold 2534.4 Depreciation 200 EBIT 433.6 Interest 80 Taxes 60 Net Income 293.6 What is the Total Asset Turnover (to nearest two decimals)? Question 8 Assets 2012 2013 Cash 45 50 A/R 331 111 Inventory 197 255 Total 573 416 Net Fixed Assets 1000 1200 Total Assets 1573 016 Liabilities 2012 2013 157 308 Accounts Payable Notes Payable 150 125 Total 307 433 Long-Term Debt 500 750 Common Stock 400 400 Retained Earnings 95 125 1302 1708 2013 Sales 3168 Cost of Goods Sold 2534.4 Depreciation 200 EBIT 433.6 Interest 80 Taxes 60 Net Income 293.6 What is the Equity Multiplier for 2013 (to nearest 2 decimals)? Question 9 Assets 2012 2013 Cash 45 50 A/R 331 111 Inventory 197 255 Total 573 416 Net Fixed Assets 1000 1200 1573 1616 2012 Total Assets Liabilities Accounts Payable Notes Payable 2013 157 308 150 125 Total 307 433 500 750 Long-Term Debt Common Stock 400 400 Retained Earnings 95 125 1302 1708 2013 Sales 3168 Cost of Goods Sold 2534.4 Depreciation 200 EBIT 433.6 Interest 80 Taxes 60 Net Income 293.6 What is the Return on Equity for 2013 (to nearest 2 decimals)? Question 10 Assets 2012 2013 Cash 45 50 AR 331 111 Inventory 197 255 Total 573 416 Net Fixed Assets 1000 1200 Total Assets 1573 1616 Liabilities 2012 2013 Accounts Payable 157 308 Notes Payable 150 125 Total 307 433 Long-Term Debt 500 750 Common Stock 400 400 Retained Earnings 25 125 1302 1708 2013 Sales 3168 Cost of Goods Sold 2534.4 Depreciation 200 EBIT 433.6 Interest 80 Taxes 60 Net Income 293.6 What is the Return on Assets for 2013 (to the nearest 2 decimals)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts