Question: All of problem 1 please Date a) b) General Journal Particulars Debit Page Credit 1. Ahmed and Ali are partners in a small business. Their

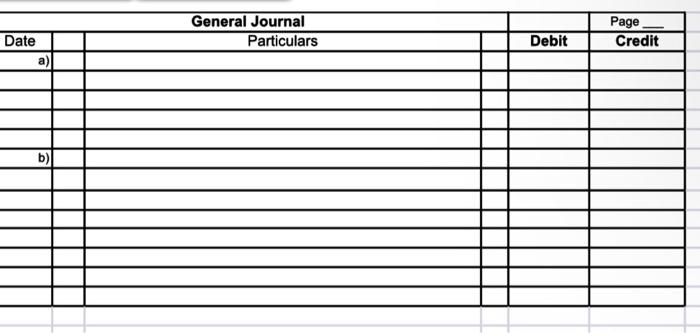

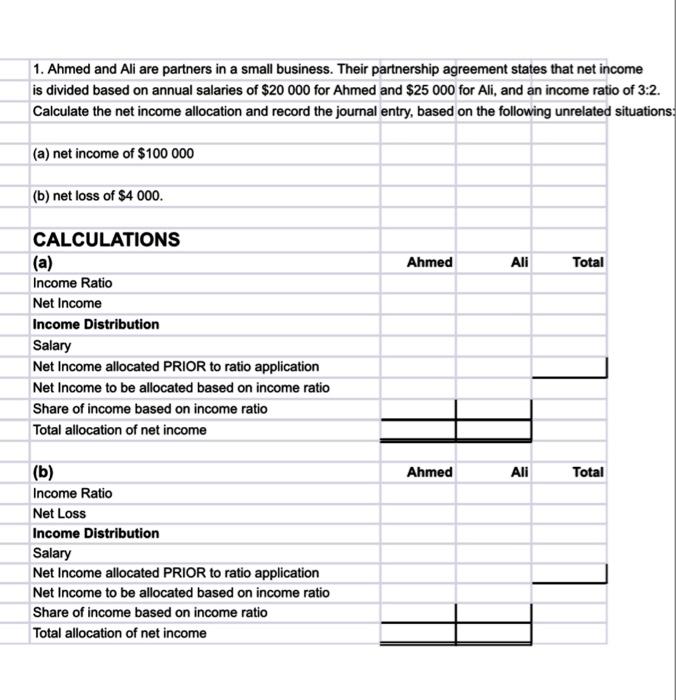

Date a) b) General Journal Particulars Debit Page Credit 1. Ahmed and Ali are partners in a small business. Their partnership agreement states that net income is divided based on annual salaries of $20 000 for Ahmed and $25 000 for Ali, and an income ratio of 3:2. Calculate the net income allocation and record the journal entry, based on the following unrelated situations: (a) net income of $100 000 (b) net loss of $4 000. CALCULATIONS Ahmed Ali Total (a) Income Ratio Net Income Income Distribution Salary Net Income allocated PRIOR to ratio application Net Income to be allocated based on income ratio Share of income based on income ratio Total allocation of net income (b) Ahmed Total Income Ratio Net Loss Income Distribution Salary Net Income allocated PRIOR to ratio application Net Income to be allocated based on income ratio Share of income based on income ratio Total allocation of net income Ali

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts