Question: all one problem Sharon Incorporated is headquartered in State X and owns 100 percent of Carol Corporation, Josey Corporation, and Janice Corporation, which form a

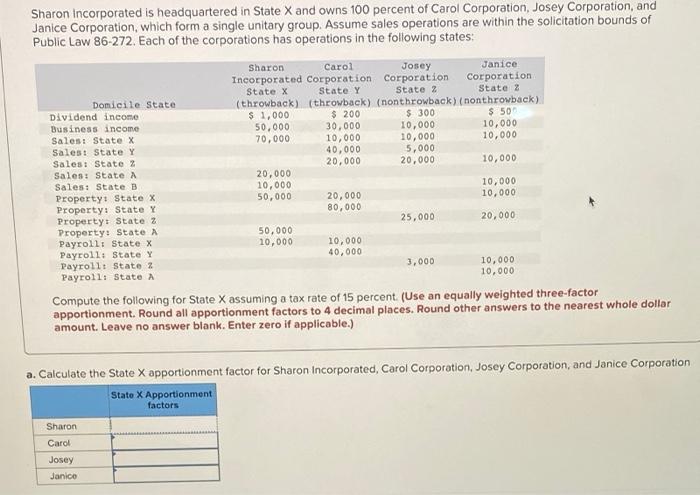

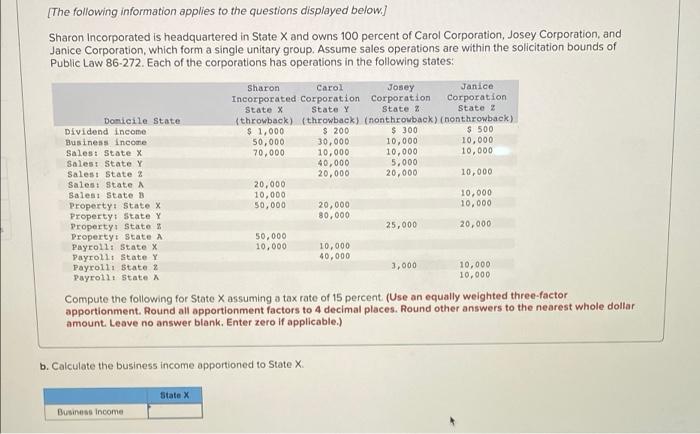

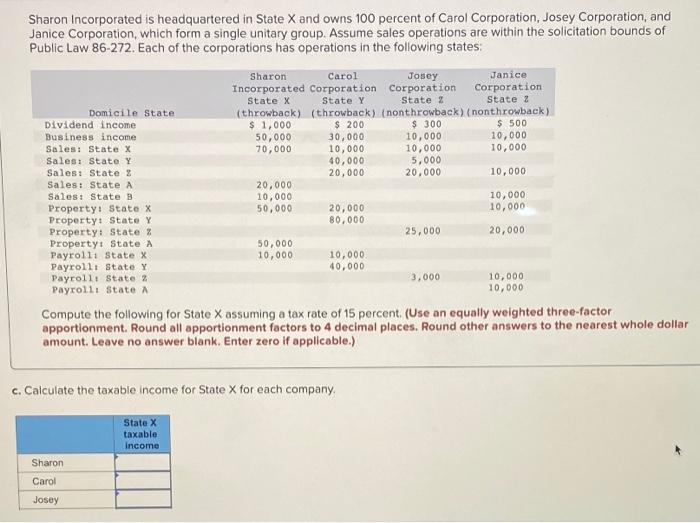

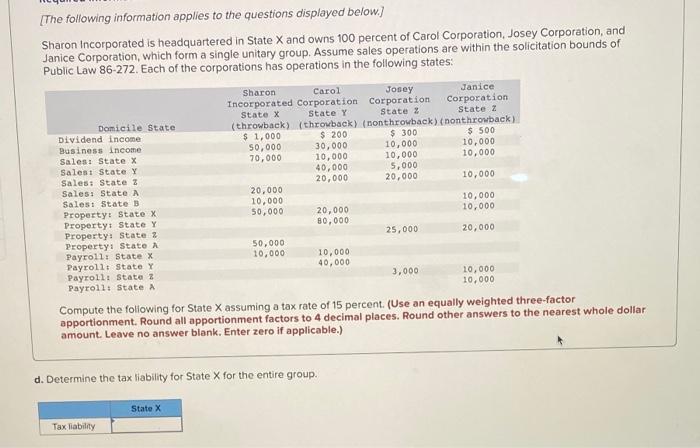

Sharon Incorporated is headquartered in State X and owns 100 percent of Carol Corporation, Josey Corporation, and Janice Corporation, which form a single unitary group. Assume sales operations are within the solicitation bounds of Public Law 86-272. Each of the corporations has operations in the following states: Sharon Carol Josey Janice Incorporated Corporation Corporation Corporation State x State Y State 2 State 2 Domicile State (throwback) (throwback) (nonthrowback) (nonthrowback) Dividend income $1,000 $ 200 $ 300 $ 500 Business income 50,000 30,000 10,000 10,000 Sales: State X 70,000 10,000 10,000 10,000 Sales: State Y 40,000 5,000 Sales: State 2 20.000 20,000 10,000 Sales State A 20,000 Salesi State B 10,000 10,000 Property: State X 50,000 20,000 10,000 Property: State Y 80,000 Property State z 25,000 20,000 Property: State A 50,000 Payroll: State x 10,000 10,000 Payroll: State Y 40,000 Payrollt State 3,000 10,000 Payroll: State a 10,000 Compute the following for State X assuming a tax rate of 15 percent (Use an equally weighted three-factor apportionment. Round all apportionment factors to 4 decimal places. Round other answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.) a. Calculate the State X apportionment factor for Sharon Incorporated, Carol Corporation, Josey Corporation, and Janice Corporation State X Apportionment factors Sharon Carol Josey Janico [The following information applies to the questions displayed below) Sharon Incorporated is headquartered in State X and owns 100 percent of Carol Corporation, Josey Corporation, and Janice Corporation, which form a single unitary group. Assume sales operations are within the solicitation bounds of Public Law 86-272. Each of the corporations has operations in the following states: Sharon Carol Joney Janice Incorporated Corporation Corporation Corporation State x State Y State State 2 Domicile State (throwback) (throwback) (nonthrowback) (nonthrowback) Dividend income $1,000 $ 200 $ 300 $ 500 Business income 50,000 30,000 10,000 10,000 Salest State X 70,000 10,000 10,000 10,000 Sales: State Y 40,000 5.000 Salesi State % 20,000 20,000 10,000 Sales: State A 20,000 Salesi State B 10,000 10,000 Property State X 50,000 20,000 10,000 Property: State Y 80,000 Property State % 25,000 20,000 Property State A 50,000 Payrollt State X 10,000 10,000 Payroll State Y 40,000 Payrolli State 2 3,000 10,000 Payroll: State 10,000 Compute the following for State X assuming a tax rate of 15 percent (Use an equally weighted three-factor apportionment. Round all apportionment factors to 4 decimal places. Round other answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.) b. Calculate the business income opportioned to State X State X Business Income Sharon Incorporated is headquartered in State X and owns 100 percent of Carol Corporation, Josey Corporation, and Janice Corporation, which form a single unitary group. Assume sales operations are within the solicitation bounds of Public Law 86-272. Each of the corporations has operations in the following states: Sharon Carol Josey Janice Incorporated Corporation Corporation Corporation State X State y State % State 2 Domicile State (throwback) (throwback) (nonthrowback) (nonthrowback) Dividend income $1,000 $ 200 $ 300 $ 500 Business income 50,000 30,000 10,000 10,000 Sales: State X 70,000 10,000 10,000 10,000 Salesi State Y 40,000 5,000 Sales: State ? 20,000 20,000 10,000 Sales: State A 20,000 Salesi State B 10,000 10,000 Property State X 50,000 20,000 10,000 Property: State Y 80,000 Property: State % 25,000 20,000 Property State A 50,000 Payrolli State X 10,000 10,000 Payroll State Y 40,000 Payroll: State z 3.000 10,000 Payrolli State A 10,000 Compute the following for State X assuming a tax rate of 15 percent. (Use an equally weighted three-factor apportionment. Round all apportionment factors to 4 decimal places. Round other answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.) c. Calculate the taxable income for State for each company State X taxable Income Sharon Carol Josey [The following information applies to the questions displayed below.) Sharon Incorporated is headquartered in State X and owns 100 percent of Carol Corporation, Josey Corporation, and Janice Corporation, which form a single unitary group. Assume sales operations are within the solicitation bounds of Public Law 86-272. Each of the corporations has operations in the following states: Domicile State Dividend income Business Income Salent State X Sales State Y Sales State z Sales: State A Sales: State B Property State X Property State Y Property: State ? Property: State A Payroll: State x Payroll: State Y Payroll: State 2 Payroll: State A Sharon Carol Josey Janice Incorporated Corporation Corporation Corporation Statex State Y State 2 State z (throwback) (throwback) (nonthrowback) (nonthrowback) $ 1,000 $ 200 $ 300 $ 500 50,000 30,000 10,000 10,000 70,000 10,000 10,000 10,000 40,000 5,000 20.000 20,000 10,000 20,000 10,000 10,000 50,000 20,000 10,000 80,000 25,000 20,000 50,000 10,000 10,000 40,000 3,000 10,000 10,000 Compute the following for State X assuming a tax rate of 15 percent. (Use an equally weighted three-factor apportionment. Round all apportionment factors to 4 decimal places. Round other answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.) d. Determine the tax liability for State X for the entire group. State X Tax liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts