Question: all one question!!! answer all requirements correctly for a thumbs up! Requirements - X 1. Allocate 2020 fixed corporate-overhead costs to the three divisions using

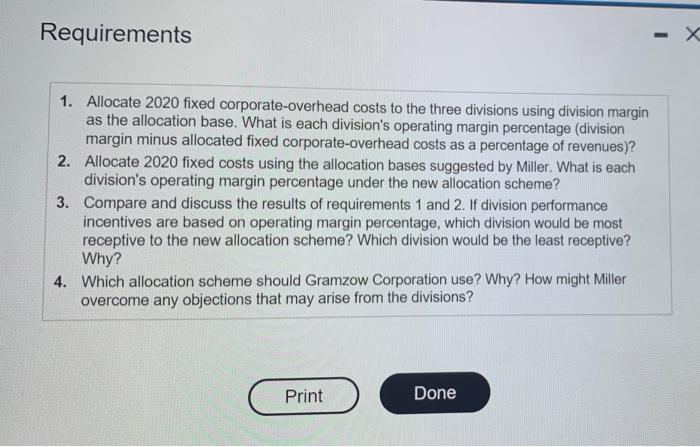

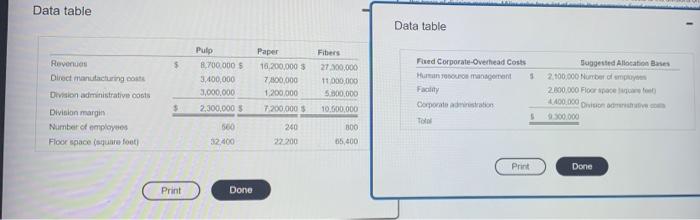

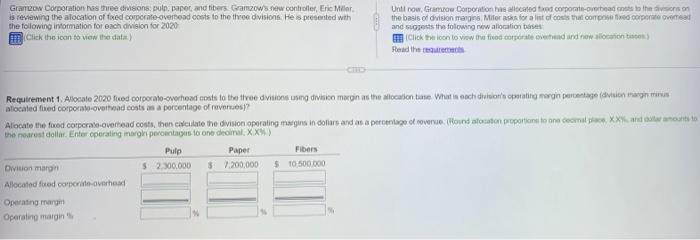

Requirements - X 1. Allocate 2020 fixed corporate-overhead costs to the three divisions using division margin as the allocation base. What is each division's operating margin percentage (division margin minus allocated fixed corporate-overhead costs as a percentage of revenues)? 2. Allocate 2020 fixed costs using the allocation bases suggested by Miller. What is each division's operating margin percentage under the new allocation scheme? 3. Compare and discuss the results of requirements 1 and 2. If division performance incentives are based on operating margin percentage, which division would be most receptive to the new allocation scheme? Which division would be the least receptive? Why? 4. Which allocation scheme should Gramzow Corporation use? Why? How might Miller overcome any objections that may arise from the divisions? Print Done Data table Data table 5 Revenues Direct manufacturing costs Division administrative costs Division margin Number of employees Floor space square foot Pulp 8.700.000 5 3.400,000 3.000.000 2,300,000 $ Paper 16,200,000 $ 7,800,000 1.200.000 7.200.000 Fiters 2700,000 11 000 000 5.800.000 10.600.000 Feed Corporate-Overhead Costs Hur management 5 Facility Corporationstration Toto 5 Suggested Allocation Bases 2.100.000 Number of my 2.800,000 Floor 400.000 9.300.000 $ 500 32.400 240 22 200 300 65.400 Print Done Print Done Gracow Corporation has three divisions, pul, paper and fibers Gramzow new controller, Erie Miler is reviewing the location of fred corporate overtad costs to the three divisions. He is presented with the following information for each division for 2020 Click the icon to view the data) Untlow, Gramrow Corporation has allocated in corporated intes to the son the basis of division margins Mifer ask for a list of costs that comprovat and suggests the following new allocations Click the loon to row the food corporated and now location Read the reques Requirement 1. Allocate 2020 fluod corporato-overhead cents to the three ding division megin as the allocation time What is each diutwon's operating margin percentage van argintiu allocated fred corporate overtad costs as a porcentage of revenues)? Alocate the fived corporate-overhead cout, then contenuto the division operating maging in colors and as a percentage of overwe. (Hound Baston proportions to one cecmate XXX and not to the nearest dollar. Enter operating margiperontagestone deal. XX) Pulp Paper Fibers Division margin $ 210.000 $7.200.000 $ 10.500.000 Allocated fed corporate-overhead Operating marum Operating margin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts