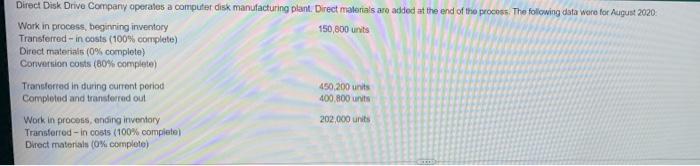

Question: all one question!!!! Direct Disk Drive Company operates a computer disk manufacturing plant Direct materials are added at the end of the process. The following

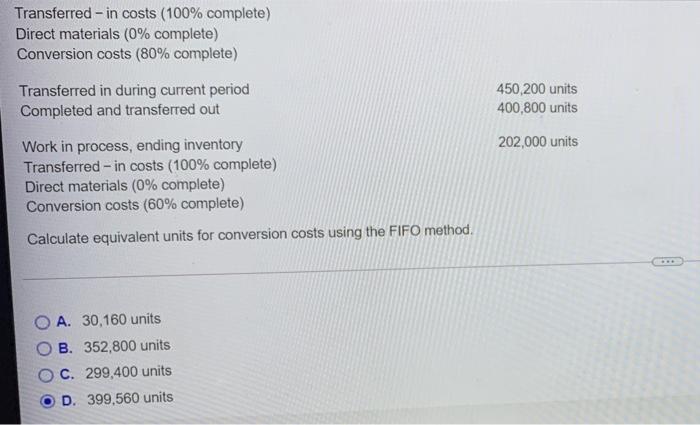

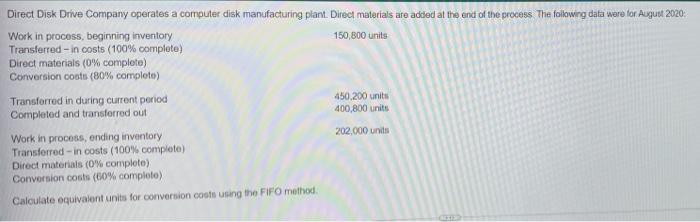

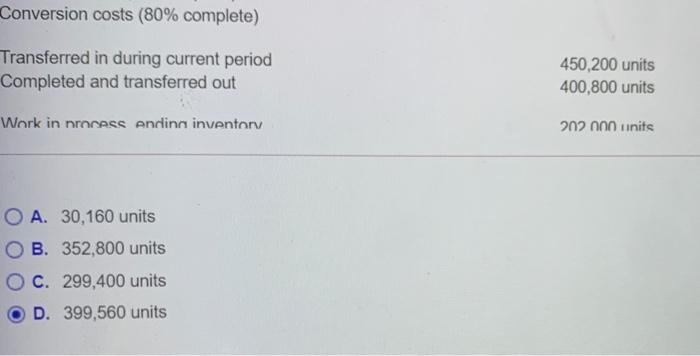

Direct Disk Drive Company operates a computer disk manufacturing plant Direct materials are added at the end of the process. The following data were for August 2020 Work in process, beginning inventory 150,800 units Transferred - in costs (100% complete) Direct materials (0% complete) Conversion costs (80% complete) Transferred in during current period Completed and transferred out 450,200 units 400,800 units 202,000 units Work in process, ending inventory Transferred - in Costs (100% complete) Direct materials (0% complete) Transferred - in costs (100% complete) Direct materials (0% complete) Conversion costs (80% complete) 450,200 units 400,800 units 202,000 units Transferred in during current period Completed and transferred out Work in process, ending inventory Transferred - in costs (100% complete) Direct materials (0% complete) Conversion costs (60% complete) Calculate equivalent units for conversion costs using the FIFO method. A. 30,160 units B. 352,800 units C. 299,400 units D. 399,560 units Direct Disk Drive Company operates a computer disk manufacturing plant. Direct materials are added at the end of the process The following data were for August 2020 Work in process, beginning inventory 150,800 units Transferred - in costs (100% complete) Direct materials (0% complete) Conversion costo (80% completo) Transforred in during current period 450,200 units Completed and transferred out 400,800 units Work in process, ending inventory 202.000 units Transferred -in costs (100% complete) Direct materials (0 complote) Conversion couts (60% complote) Calculate equivalent units for conversion costs using the FIFO method Conversion costs (80% complete) Transferred in during current period Completed and transferred out 450,200 units 400,800 units 202.000 units Work in process andina inventorv A. 30,160 units B. 352,800 units C. 299,400 units D. 399,560 units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts