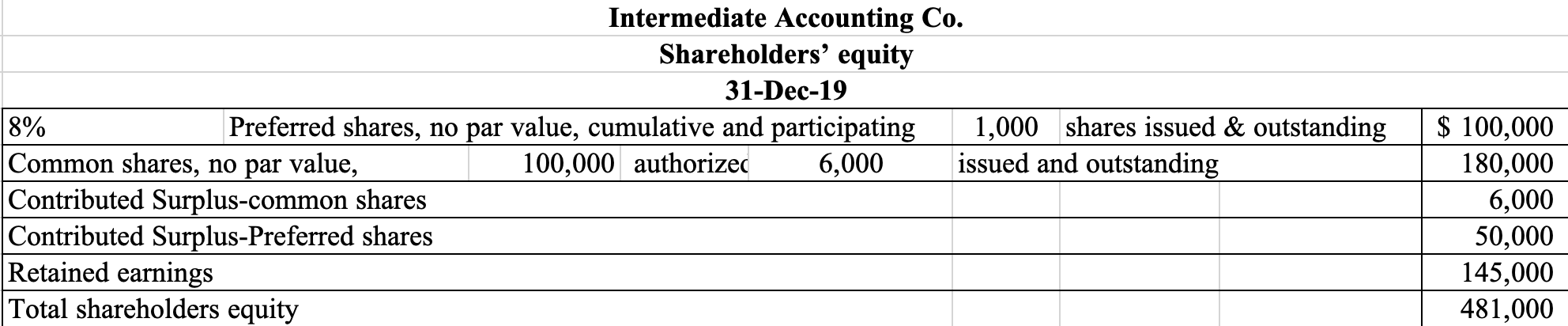

Question: All one question Please show your work Thanks! 8% Intermediate Accounting Co. Shareholders' equity 31-Dec-19 Preferred shares, no par value, cumulative and participating 1,000 shares

All one question

Please show your work Thanks!

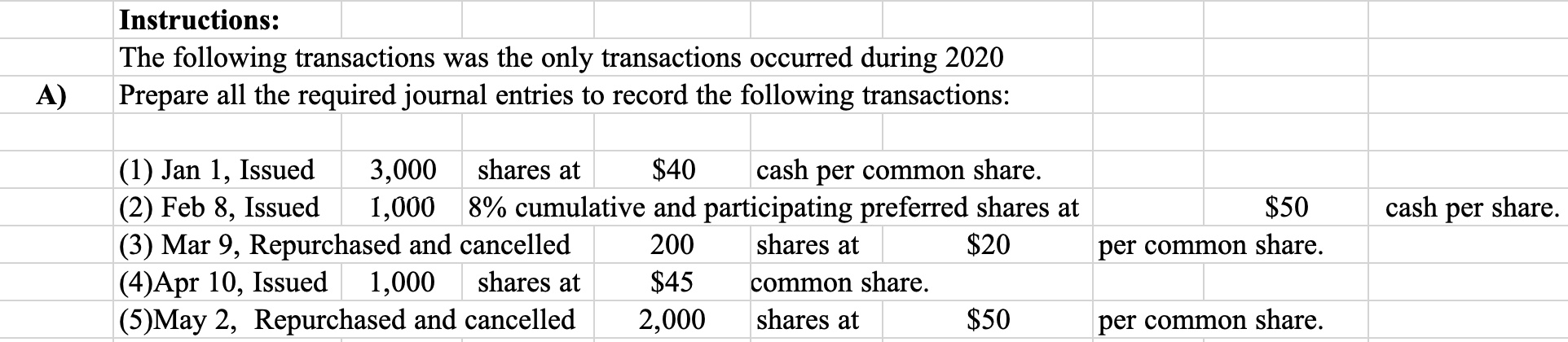

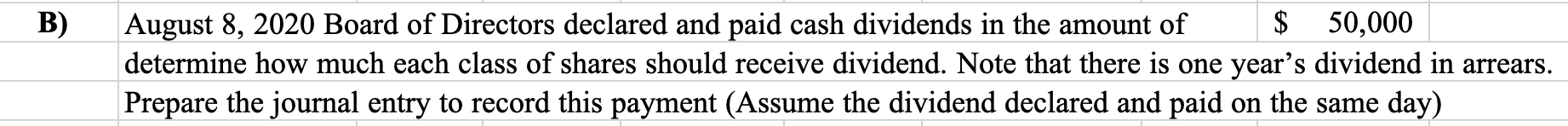

8% Intermediate Accounting Co. Shareholders' equity 31-Dec-19 Preferred shares, no par value, cumulative and participating 1,000 shares issued & outstanding Common shares, no par value, 100,000 authorized 6,000 issued and outstanding Contributed Surplus-common shares Contributed Surplus-Preferred shares Retained earnings Total shareholders equity $ 100,000 180,000 6,000 50,000 145,000 481,000 Instructions: The following transactions was the only transactions occurred during 2020 Prepare all the required journal entries to record the following transactions: A) cash per share. (1) Jan 1, Issued 3,000 shares at $40 cash per common share. (2) Feb 8, Issued 1,000 8% cumulative and participating preferred shares at (3) Mar 9, Repurchased and cancelled 200 shares at $20 (4)Apr 10, Issued 1,000 shares at $45 common share. (5)May 2, Repurchased and cancelled 2,000 shares at $50 $50 per common share. per common share. B) August 8, 2020 Board of Directors declared and paid cash dividends in the amount of $ 50,000 determine how much each class of shares should receive dividend. Note that there is one year's dividend in arrears. Prepare the journal entry to record this payment (Assume the dividend declared and paid on the same day) C) Show the proper B/S (SFP) presentation for the shareholders equity at dec 31 2020 Notes: To proceed, you first need to preapre all the journal entries. When ever there is a repurchase you need to calculate the book value (BV) per common share You might prepare "T" accounts to keep track of the number, the value of each class of shares and the contributed surpls as well (then you know your numbers are good). However, for the solutions you need to link the original amounts given in each transaction (for example, RE final balance will be = Beg. Balance - dividends- or + any other numbers appear in your journal entries Finally, to prepare the partial B/S (SFP), use the original balances as beginning balances then add/deduct based on your transactions (Journal entries) above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts