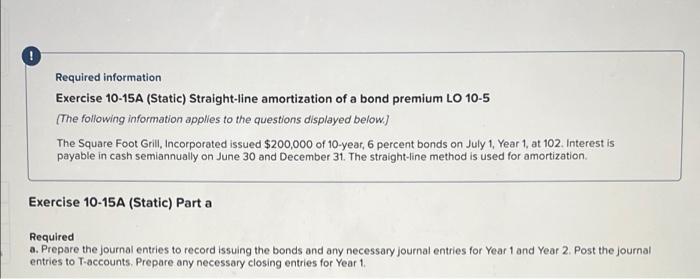

Question: all one question Required information. Exercise 10-15A (Static) Straight-line amortization of a bond premium LO 10-5 (The following information applies to the questions displayed below.)

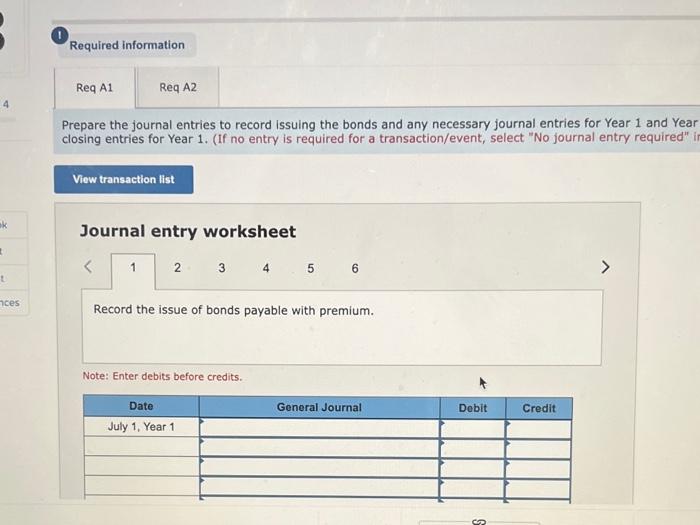

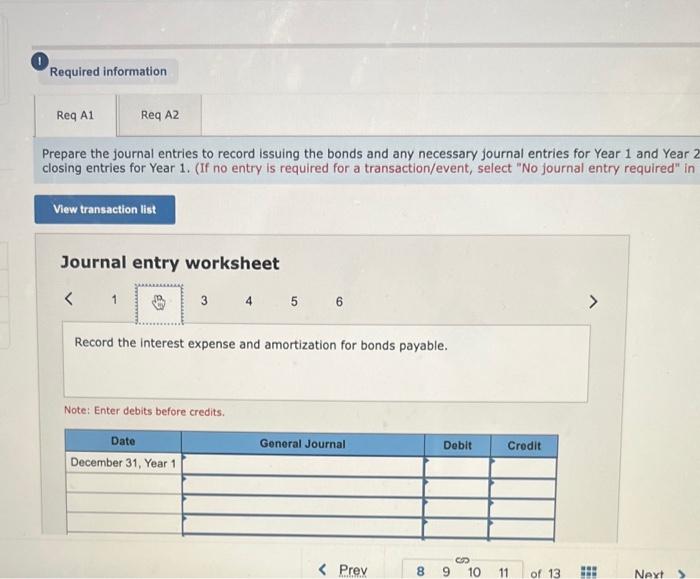

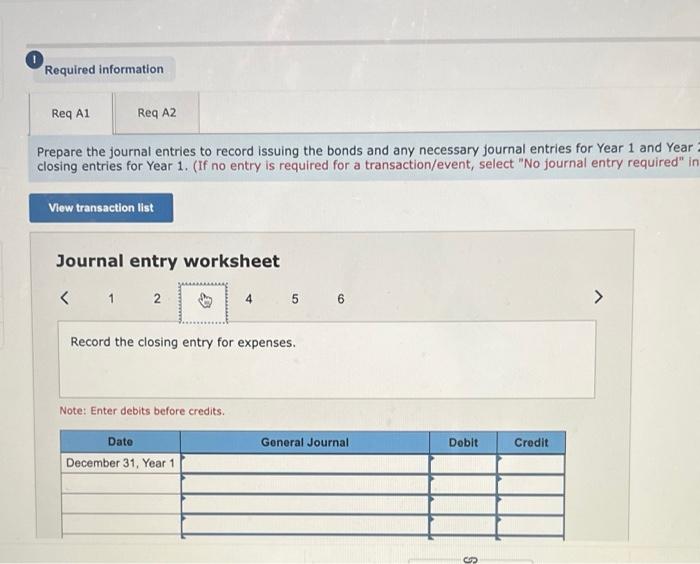

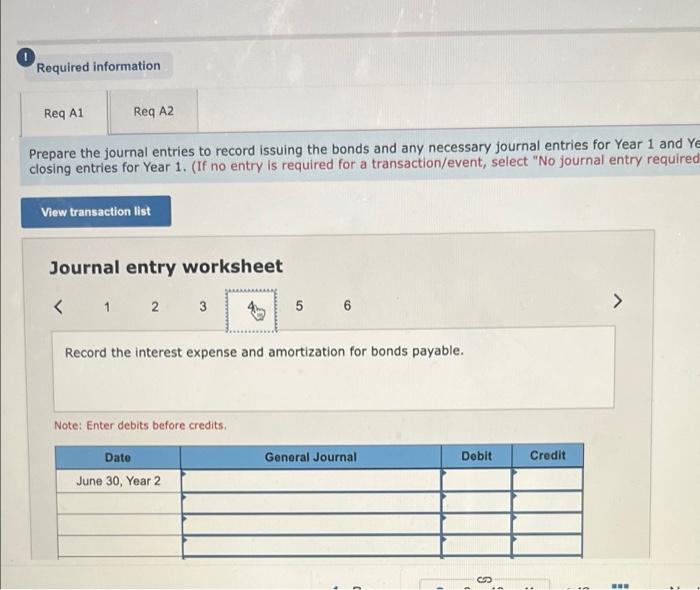

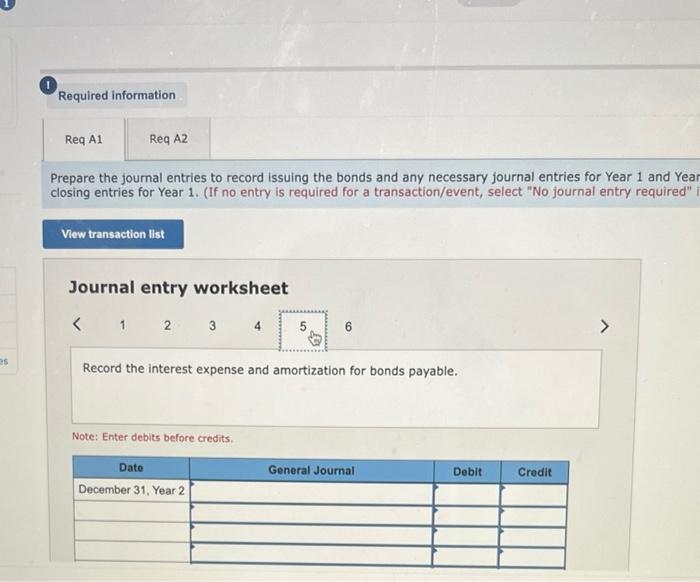

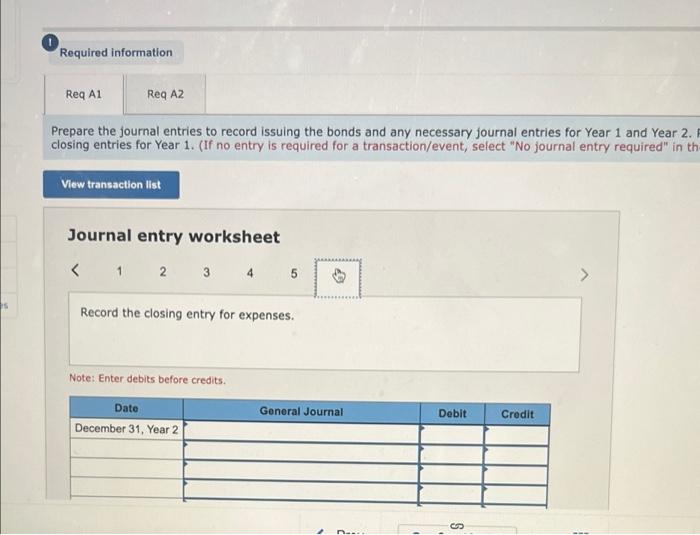

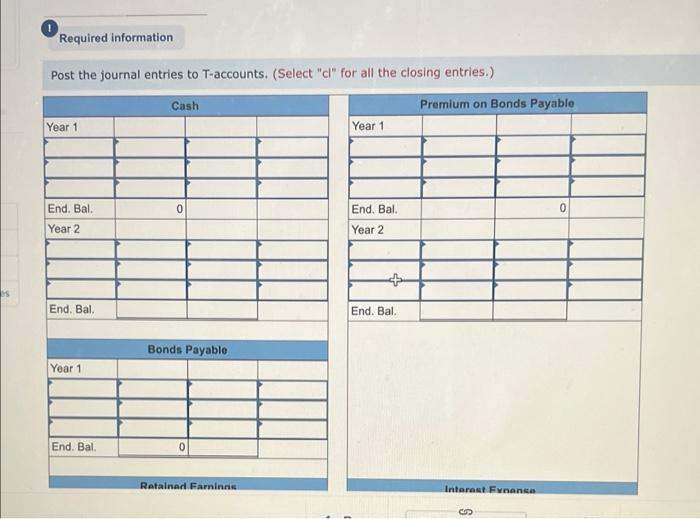

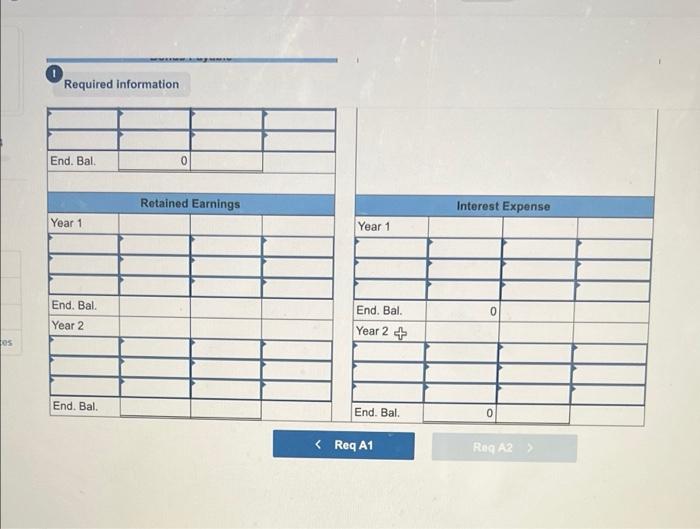

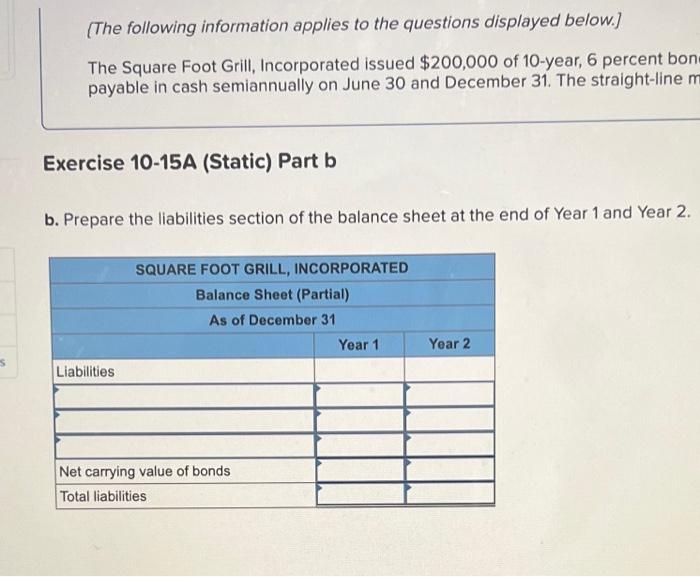

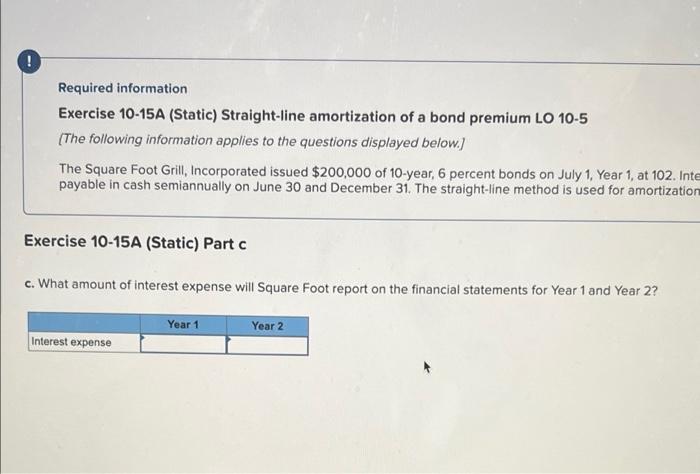

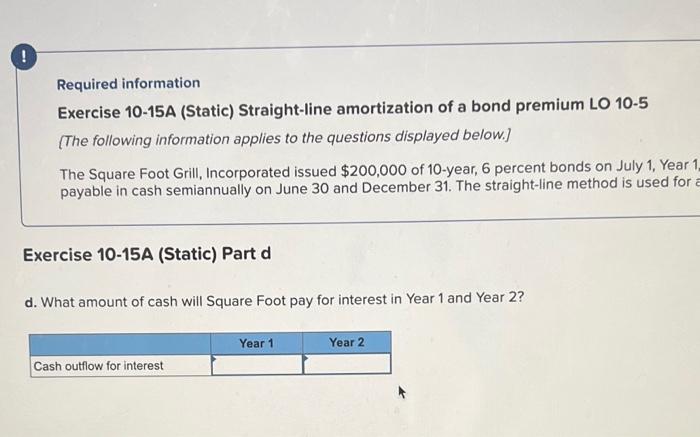

Required information. Exercise 10-15A (Static) Straight-line amortization of a bond premium LO 10-5 (The following information applies to the questions displayed below.) The Square Foot Grill, Incorporated issued $200,000 of 10-year, 6 percent bonds on July 1, Year 1, at 102. Interest is payable in cash semiannually on June 30 and December 31. The straight-line method is used for amortization. Exercise 10-15A (Static) Part a Required a. Prepare the journal entries to record issuing the bonds and any necessary journal entries for Year 1 and Year 2. Post the journal entries to T-accounts. Prepare any necessary closing entries for Year 1. k t L ces Required information Req A1 Req A2 Prepare the journal entries to record issuing the bonds and any necessary journal entries for Year 1 and Year closing entries for Year 1. (If no entry is required for a transaction/event, select "No journal entry required" in View transaction list Journal entry worksheet Required information Req A1 Req A2 Prepare the journal entries to record issuing the bonds and any necessary journal entries for Year 1 and Year 2 closing entries for Year 1. (If no entry is required for a transaction/event, select "No journal entry required" in View transaction list Journal entry worksheet Record the closing entry for expenses. Note: Enter debits before credits. Date December 31, Year 1 General Journal, Dobit $ Credit Required information Req A1 Req A2 Prepare the journal entries to record issuing the bonds and any necessary journal entries for Year 1 and Ye closing entries for Year 1. (If no entry is required for a transaction/event, select "No journal entry required View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts