Question: All one tab please help! thank you in advance! Classifications A machine cost $400,000, has an estimated residual value of $40,000, and has an estimated

All one tab please help! thank you in advance!

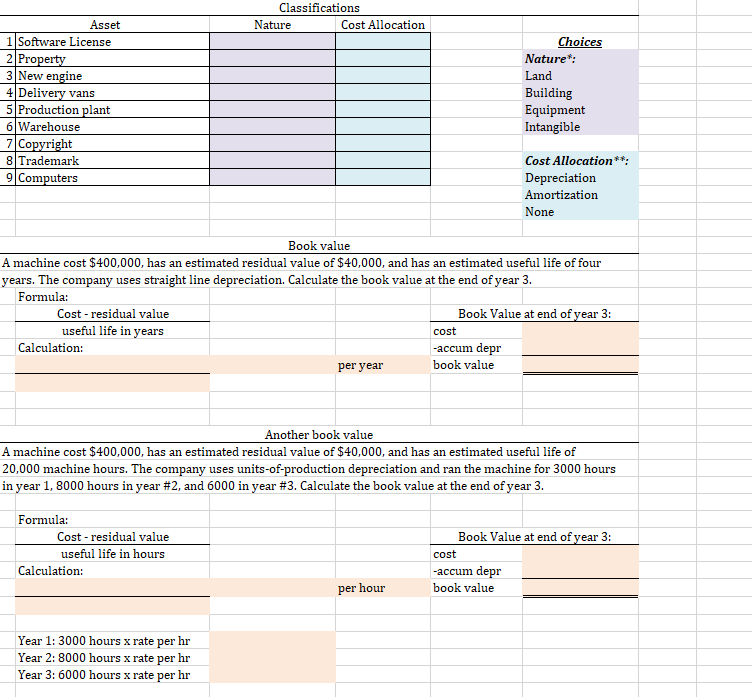

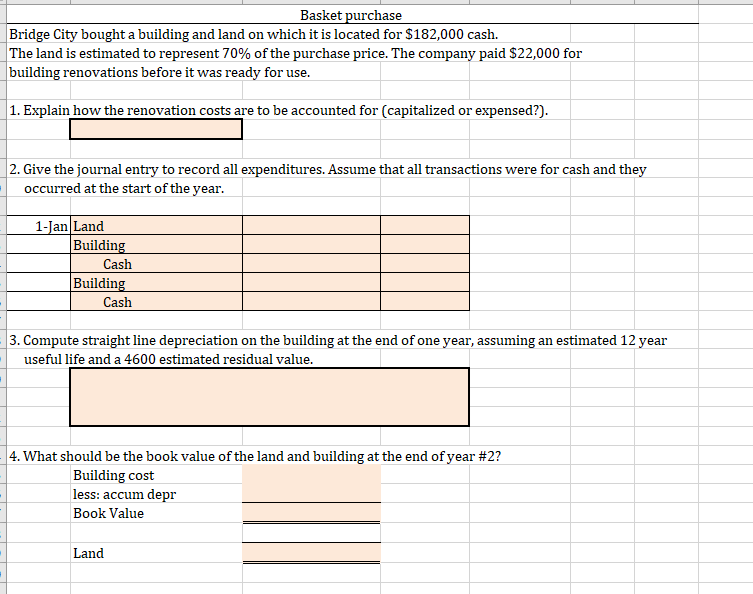

Classifications A machine cost $400,000, has an estimated residual value of $40,000, and has an estimated useful life of four years. The company uses straight line depreciation. Calculate the book value at the end of year 3. Formula: Another book value A machine cost $400,000, has an estimated residual value of $40,000, and has an estimated useful life of 20,000 machine hours. The company uses units-of-production depreciation and ran the machine for 3000 hours in year 1, 8000 hours in year \#2, and 6000 in year \#3. Calculate the book value at the end of year 3. Formula: \begin{tabular}{ll|l|l} \multicolumn{1}{c|}{ Cost - residual value } & & \multicolumn{2}{c|}{ Book Value at end of year 3: } \\ \hline \multicolumn{1}{c|}{ useful life in hours } & & cost \\ \hline Calculation: & & per hour & -accum depr \\ \hline & & book value \\ \hline \hline \end{tabular} Year 1: 3000 hours x rate per hr Year 2: 8000 hours x rate per hr Year 3: 6000 hours x rate per hr Basket purchase Bridge City bought a building and land on which it is located for $182,000 cash. The land is estimated to represent 70% of the purchase price. The company paid $22,000 for building renovations before it was ready for use. 1. Explain how the renovation costs are to be accounted for (capitalized or expensed?). 2. Give the journal entry to record all expenditures. Assume that all transactions were for cash and they occurred at the start of the year. \begin{tabular}{|c|l|l|l|} \hline 1-Jan & Land & & \\ \hline & Building & & \\ \hline & Cash & & \\ \hline & Building & & \\ \hline & Cash & & \\ \hline \end{tabular} 3. Compute straight line depreciation on the building at the end of one year, assuming an estimated 12 year useful life and a 4600 estimated residual value. 4. What should be the book value of the land and building at the end of year \#2? Building cost less: accum depr Book Value Land

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts