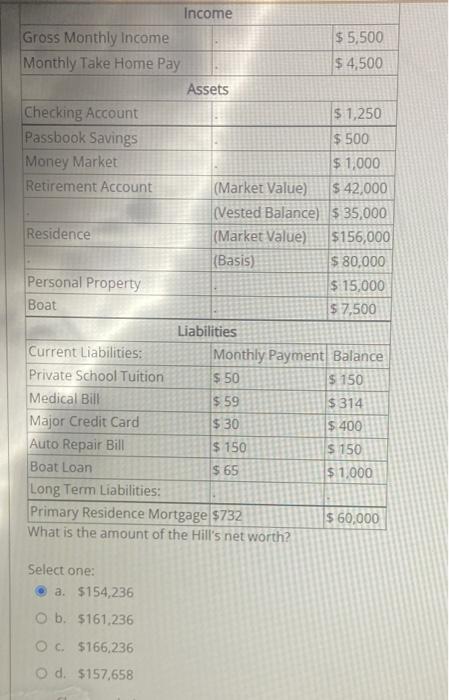

Question: All part of one question using the chart from part A. Thank you!! Income Gross Monthly Income $ 5,500 Monthly Take Home Pay $ 4,500

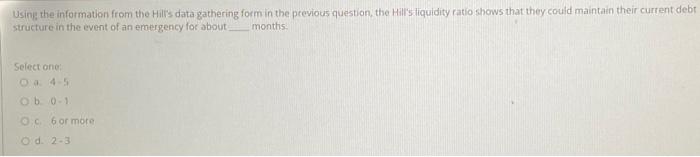

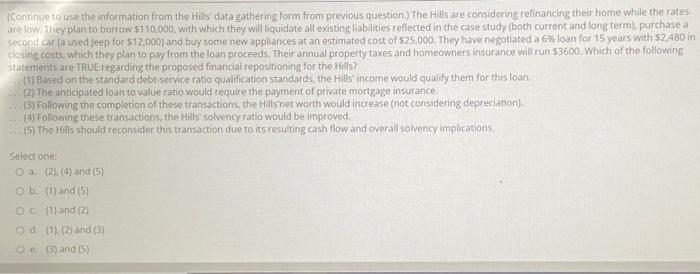

Income Gross Monthly Income $ 5,500 Monthly Take Home Pay $ 4,500 Assets Checking Account $ 1,250 Passbook Savings $ 500 Money Market $ 1,000 Retirement Account (Market Value) $ 42,000 (Vested Balance) $ 35,000 Residence (Market Value) $156,000 (Basis) $ 80,000 Personal Property $ 15,000 Boat $ 7,500 Liabilities Current Liabilities: Monthly Payment Balance Private School Tuition $50 $ 150 Medical Bill $ 59 $ 314 Major Credit Card $ 30 $.400 Auto Repair Bill $ 150 $ 150 Boat Loan $ 65 $1,000 Long Term Liabilities: Primary Residence Mortgage $732 $ 60,000 What is the amount of the Hill's net worth? Select one: a $154,236 O b. $161.236 OC. $166,236 Od $157,658 Using the information from the Hill's data gathering form in the previous question the Hill's liquidity ratio shows that they could maintain their current debt structure in the event of an emergency for about months Select one 45 ob 0.1 Oc6 or more Od 2-3 (Continue to use the information from the Hills data gathering form from previous question.) The Hills are considering refinancing their home while the rates are low. They plan to borrow $110,000, with which they will liquidate all existing liabilities reflected in the case study (both current and long term purchase a second cara used Jeep for $12,000) and buy some new appliances at an estimated cost of $25.000. They have negotiated a 6% loan for 15 years with 52.480 in closing costs, which they plan to pay from the loan proceeds. Their annual property taxes and homeowners insurance will run 53600. Which of the following Statements are TRUE regarding the proposed financial repositioning for the Hills? (1) Based on the standard debt service ratio qualification standards, the Hills income would qualify them for this loan. 2) The anticipated loan to value ratio would require the payment of private mortgage insurance (3) Following the completion of these transactions, the Hills net worth would increase (not considering depreciation) (4) Following these transactions, the Hills solvency ratio would be improved. ... (5) The Hills should reconsider this transaction due to its resulting cash flow and overall solvency implications Select one Oa (21 (4) and (5) b. (1) and (5) OC (1) and (2) Od (1). 12 and (3) De 3) and (5) Income Gross Monthly Income $ 5,500 Monthly Take Home Pay $ 4,500 Assets Checking Account $ 1,250 Passbook Savings $ 500 Money Market $ 1,000 Retirement Account (Market Value) $ 42,000 (Vested Balance) $ 35,000 Residence (Market Value) $156,000 (Basis) $ 80,000 Personal Property $ 15,000 Boat $ 7,500 Liabilities Current Liabilities: Monthly Payment Balance Private School Tuition $50 $ 150 Medical Bill $ 59 $ 314 Major Credit Card $ 30 $.400 Auto Repair Bill $ 150 $ 150 Boat Loan $ 65 $1,000 Long Term Liabilities: Primary Residence Mortgage $732 $ 60,000 What is the amount of the Hill's net worth? Select one: a $154,236 O b. $161.236 OC. $166,236 Od $157,658 Using the information from the Hill's data gathering form in the previous question the Hill's liquidity ratio shows that they could maintain their current debt structure in the event of an emergency for about months Select one 45 ob 0.1 Oc6 or more Od 2-3 (Continue to use the information from the Hills data gathering form from previous question.) The Hills are considering refinancing their home while the rates are low. They plan to borrow $110,000, with which they will liquidate all existing liabilities reflected in the case study (both current and long term purchase a second cara used Jeep for $12,000) and buy some new appliances at an estimated cost of $25.000. They have negotiated a 6% loan for 15 years with 52.480 in closing costs, which they plan to pay from the loan proceeds. Their annual property taxes and homeowners insurance will run 53600. Which of the following Statements are TRUE regarding the proposed financial repositioning for the Hills? (1) Based on the standard debt service ratio qualification standards, the Hills income would qualify them for this loan. 2) The anticipated loan to value ratio would require the payment of private mortgage insurance (3) Following the completion of these transactions, the Hills net worth would increase (not considering depreciation) (4) Following these transactions, the Hills solvency ratio would be improved. ... (5) The Hills should reconsider this transaction due to its resulting cash flow and overall solvency implications Select one Oa (21 (4) and (5) b. (1) and (5) OC (1) and (2) Od (1). 12 and (3) De 3) and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts