Question: All parts need to be done. GL0402- Based on Problem 4-1A LO C3, P2, P3 On April 1, 2017, Carolyn Collins created a new travel

All parts need to be done.

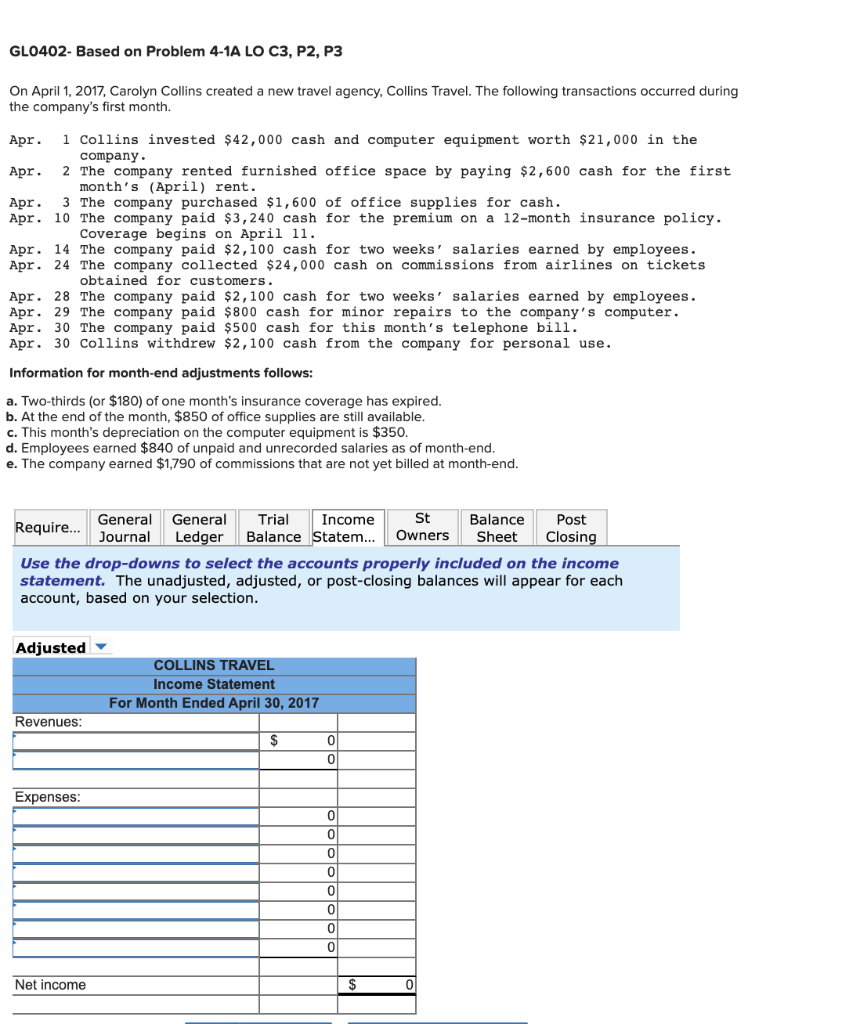

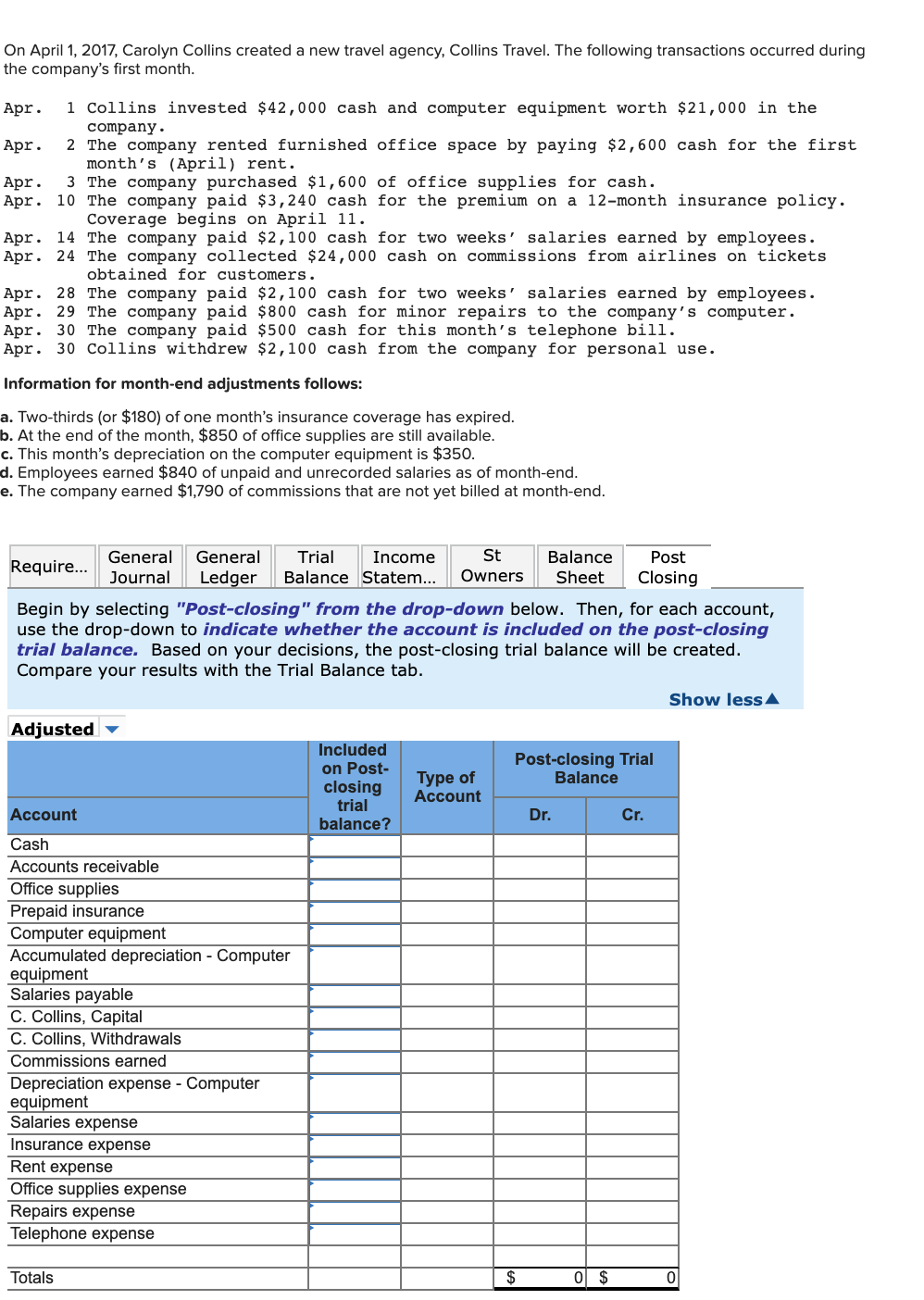

GL0402- Based on Problem 4-1A LO C3, P2, P3 On April 1, 2017, Carolyn Collins created a new travel agency, Collins Travel. The following transactions occurred during the company's first month. Apr. 1 Collins invested $42,000 cash and computer equipment worth $21,000 in the company. Apr. 2 The company rented furnished office space by paying $2,600 cash for the first month's (April) rent. Apr. 3 The company purchased $1,600 of office supplies for cash. Apr. 10 The company paid $3,240 cash for the premium on a 12-month insurance policy. Coverage begins on April 11. Apr. 14 The company paid $2,100 cash for two weeks' salaries earned by employees. Apr. 24 The company collected $24,000 cash on commissions from airlines on tickets obtained for customers. Apr. 28 The company paid $2,100 cash for two weeks' salaries earned by employees. Apr. 29 The company paid $800 cash for minor repairs to the company's computer. Apr. 30 The company paid $500 cash for this month's telephone bill. Apr. 30 Collins withdrew $2,100 cash from the company for personal use. Information for month-end adjustments follows: a. Two-thirds (or $180) of one month's insurance coverage has expired. b. At the end of the month, $850 of office supplies are still available. c. This month's depreciation on the computer equipment is $350. d. Employees earned $840 of unpaid and unrecorded salaries as of month-end. e. The company earned $1,790 of commissions that are not yet billed at month-end. General General Trial Income St Balance Require... Post Journal Ledger Balance Statem... Owners Sheet Closing Use the drop-downs to select the accounts properly included on the income statement. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Adjusted COLLINS TRAVEL Income Statement For Month Ended April 30, 2017 Revenues: 0 Expenses: ooooooooo Net income On April 1, 2017, Carolyn Collins created a new travel agency, Collins Travel. The following transactions occurred during the company's first month. Apr. 1 Collins invested $42,000 cash and computer equipment worth $21,000 in the company. Apr. 2 The company rented furnished office space by paying $2,600 cash for the first month's (April) rent. Apr. 3 The company purchased $1,600 of office supplies for cash. Apr. 10 The company paid $3,240 cash for the premium on a 12-month insurance policy. Coverage begins on April 11. Apr. 14 The company paid $2,100 cash for two weeks' salaries earned by employees. Apr. 24 The company collected $24,000 cash on commissions from airlines on tickets obtained for customers. Apr. 28 The company paid $2,100 cash for two weeks' salaries earned by employees. Apr. 29 The company paid $800 cash for minor repairs to the company's computer. Apr. 30 The company paid $500 cash for this month's telephone bill. Apr. 30 Collins withdrew $2,100 cash from the company for personal use. Information for month-end adjustments follows: a. Two-thirds (or $180) of one month's insurance coverage has expired. b. At the end of the month, $850 of office supplies are still available. c. This month's depreciation on the computer equipment is $350. d. Employees earned $840 of unpaid and unrecorded salaries as of month-end. e. The company earned $1,790 of commissions that are not yet billed at month-end. General General Require... " | Journal || Ledger Trial Income Balance Statem... St Balance Owners || Sheet Post Closing Begin by selecting "Post-closing" from the drop-down below. Then, for each account, use the drop-down to indicate whether the account is included on the post-closing trial balance. Based on your decisions, the post-closing trial balance will be created. Compare your results with the Trial Balance tab. Show less Adjusted Included Post-closing Trial on Post- Type of Balance closing Account trial Account Dr. Cr. balance? Cash Accounts receivable Office supplies Prepaid insurance Computer equipment Accumulated depreciation - Computer equipment Salaries payable C. Collins, Capital C. Collins, Withdrawals Commissions earned Depreciation expense - Computer equipment Salaries expense Insurance expense Rent expense Office supplies expense Repairs expense Telephone expense Totals $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts