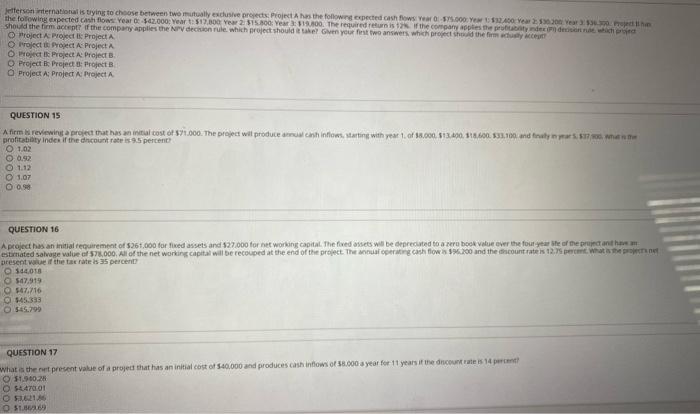

Question: all please! Q .16 A project has an initial requirement of $261,000 for fixed assets and $27,000 for network and capital. The fixed assets will

Jefferson international is trying to choose between two mutually exclusive projects Project has the following expected cash flow Year 5.000 Yew Year 20 Yearth the following expected cash flows Year 502.000: Year: 517.000 Y 2 315.00 Year: 19.00. The required return is the company ople the probate decent which should the firmat if the company applies the decision rule, which project should take? Give your first two answers which projects the firme Me O Project Project Project Project Progect As Project A Optik Project Projects O Project Project Project Project A: Project Project QUESTION 15 A firm reviewing a project that has an initial cost of $1.000. The project will produce al cash inflows starting with year 1.0 18.000, 513.670.116.60033.100 and try nyarwan profitabity index if the countrate is 95 percent 01.02 0.92 01.12 1.07 O 0.90 QUESTION 16 A project has an initial requirement of 5261,000 for fixed assets and $27.000 for working capital. The feed assets will be deprecated to a robook value over the four years of the prantham estimated salvare value of 78.000. All of the networking capital will be recouped at the end of the project. The operating cash flow 4.200 and the countrates 12.7 per What is the present at the tax rates 35 percent 304,018 57,919 O $47.716 $45.333 QUESTION 17 What is the represent value of a project that has an initial cost of $40.000 and produces cash intows of 58.000 a year for 11 years it the countrate is 14 percent O 31.900.28 O $47001 O 621 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts