Question: All problems are due in class next week. Be complete and succinct. Feel free to work together, but submit your own answers. 1. Identify the

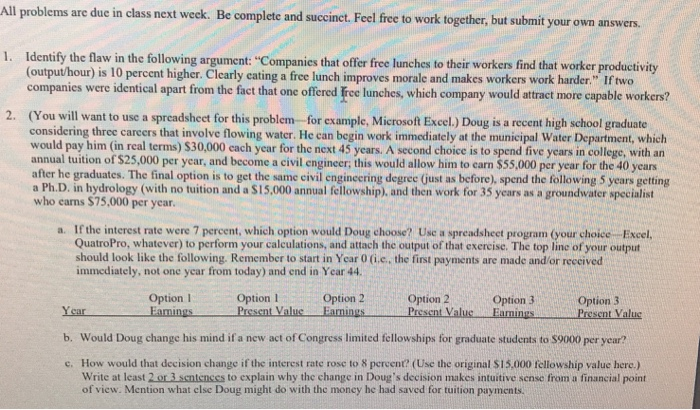

All problems are due in class next week. Be complete and succinct. Feel free to work together, but submit your own answers. 1. Identify the flaw in the following argument: "Companies that offer free lunches to their workers find that worker productivity (output/hour) is 10 percent higher. Clearly eating a free lunch improves morale and makes workers work harder." If two companies were identical apart from the fact that one offered Tree lunches, which company would attract more capable workers? (You will want to use a spreadsheet for this problem for example, Microsoft Excel.) Doug is a recent high school graduate. considering three careers that involve flowing water. He can begin work immediately at the municipal Water Department, which would pay him (in real terms) $30,000 cach year for the next 45 years. A second choice is to spend five years in college, with arn annual tuition of $25,000 per year, and become a civil engineer,; this would allow him to carn $55,000 per year for the 40 years after he graduates. The final option is to get the same civil engineering degree Gjust as before), spend the following 5 years getting a Ph.D. in hydrology (with no tuition and a S15,000 annual fellowship), and then work for 35 years as a groundwater specialist who earns $75,000 per year. a. If the interest rate were 7 percent, which option would Doug choose? Usc a spreadsheet program (your choice ." Excel, QuatroPro, whatever) to perform your calculations, and attach the output of that exercise. The top line of your output should look like the following. Remember to start in Year 0 (i.e, the first payments are made and/or reccived immediately, not one year from today) and end in Year 44 Option I Option l Present Value Eamings Option 2 Option 2 Option 3Option 3 Present Value Eamings Year b. Would Doug change his mind if a new act of Congress limited fellowships for graduate students to 59000 per year? c. How would that decision change if the interest rate rose to 8 percent? (Use the original $15,000 fellowship value here.) Write at least 2 or 3 sentenses to explain why the change in Doug's decision makes intuitive sense from a financial point of view. Mention what else Doug might do with the money he had saved for tuition payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts