Question: All problems are sequenced by 1-2-3-4-5-6-7. If u want to know anything, please ask. Use the following table: Case X Case Y Case 2 Cash

All problems are sequenced by 1-2-3-4-5-6-7. If u want to know anything, please ask.

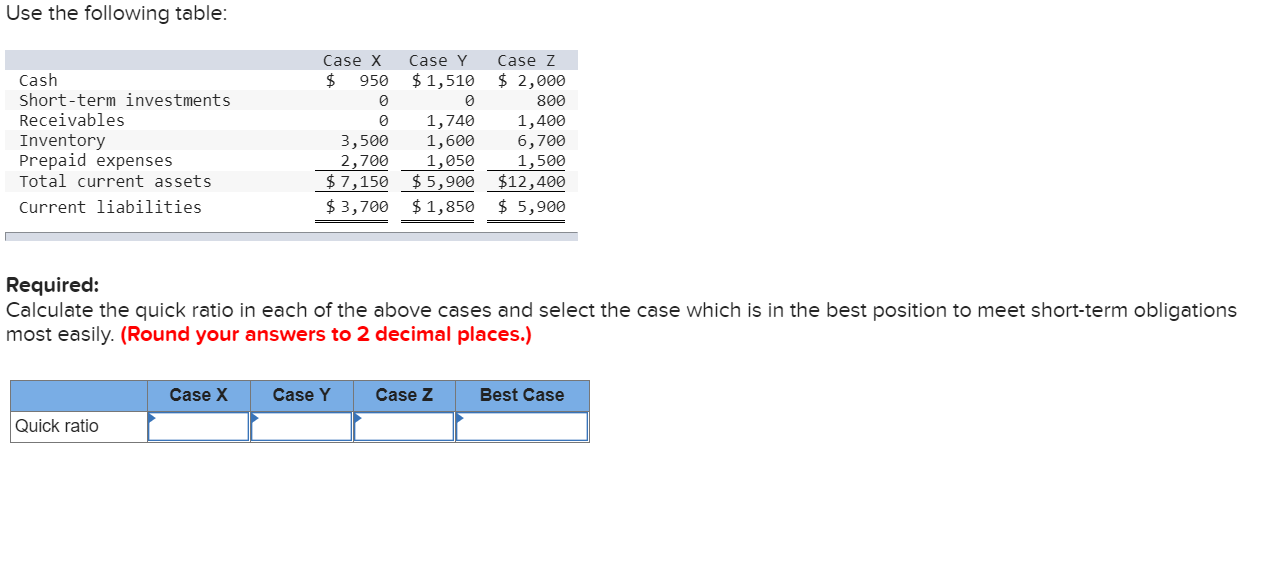

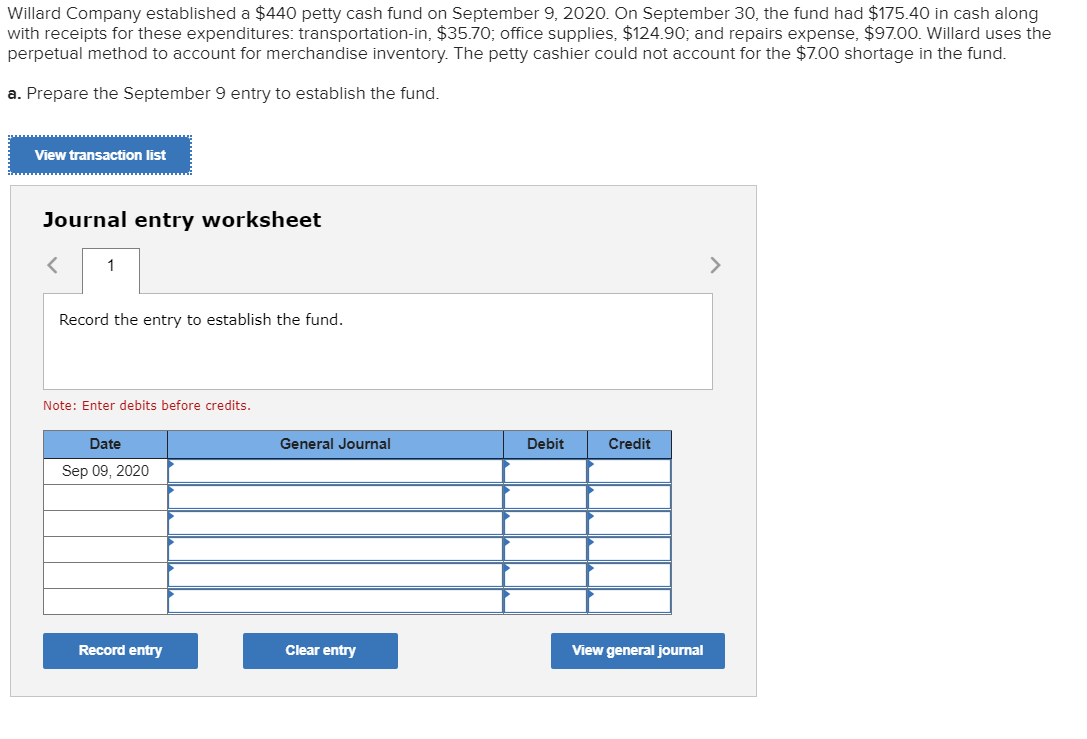

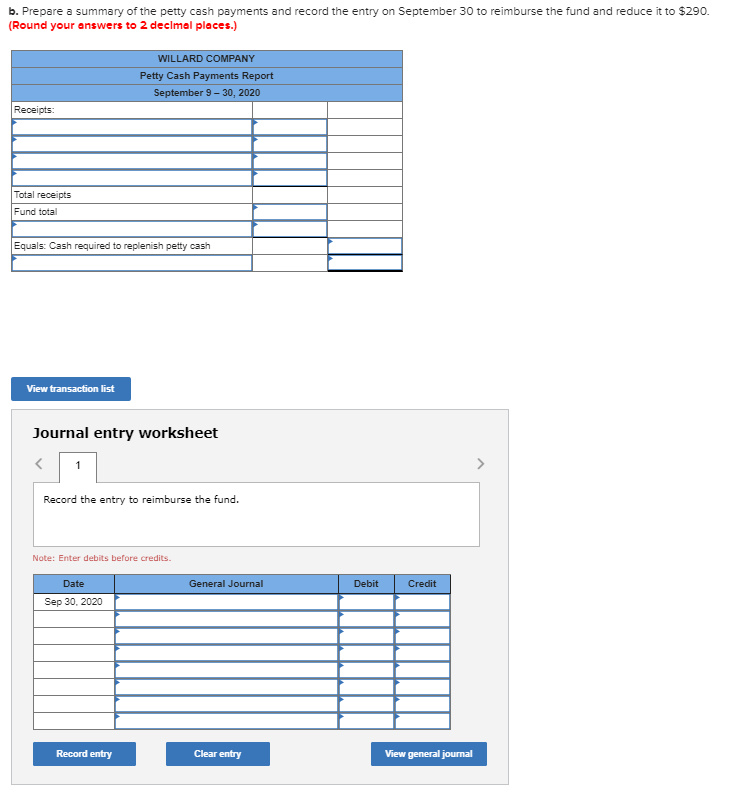

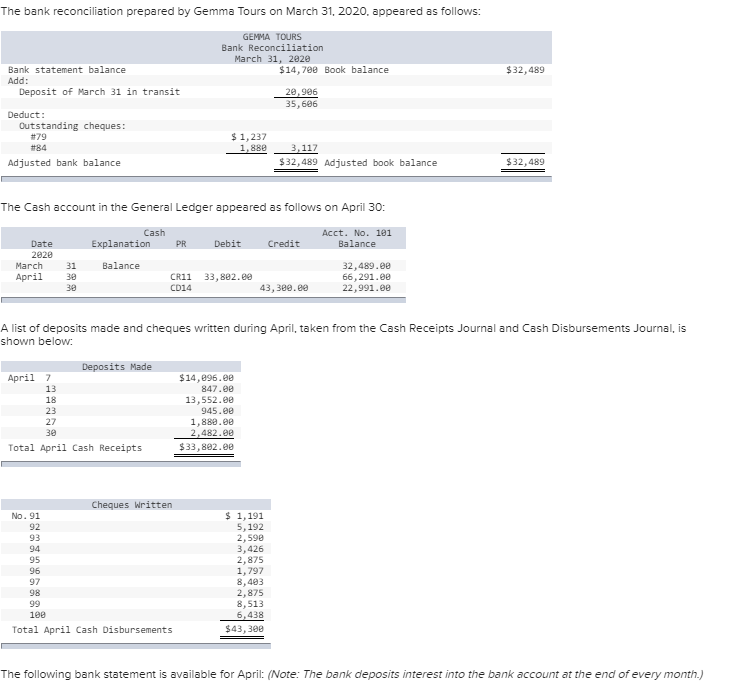

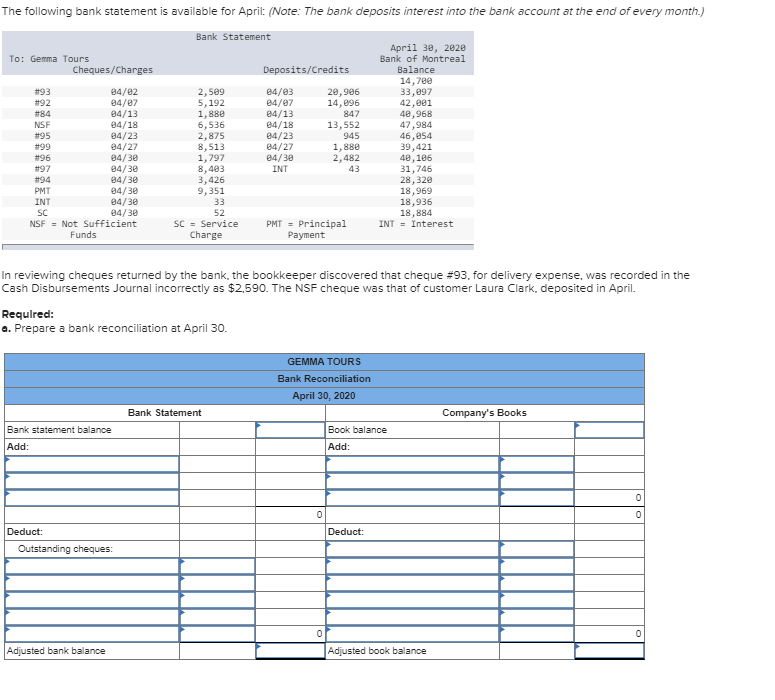

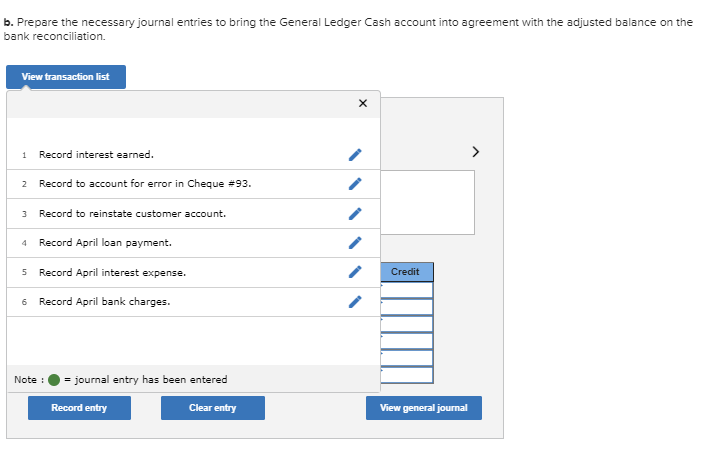

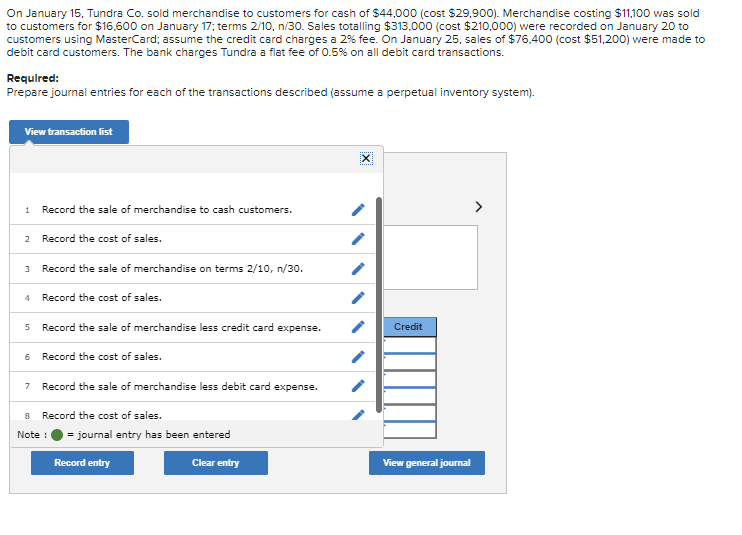

Use the following table: Case X Case Y Case 2 Cash 1; 959 $ 1,519 $ 2,999 Shortterm investments 9 9 899 Receivables 9 1,749 1,499 Inventory 3,599 1,699 6,799 Prepaid expenses 2,799 1,959 1,599 Total current assets $7,159 $ 5,999 $12,499 Current liabilities $ 3,799 $ 1,859 $ 5,999 l Required: Calculate the quick ratio in each of the above cases and select the case which is in the best position to meet short-term obligations most easily. (Round your answers to 2 decimal places.) _!l!l!l!l Willard Company established a $440 petty cash fund on September 9, 2020. On September 30, the fund had $175.40 in cash along with receipts for these expenditures: transportation-in, $35.70; office supplies, $124.90; and repairs expense, $97.00. Willard uses the perpetual method to account for merchandise inventory. The petty cashier could not account for the $7.00 shortage in the fund. a. Prepare the September 9 entry to establish the fund. View transaction list Journal entry worksheet Record the entry to establish the fund. Note: Enter debits before credits. Date General Journal Debit Credit Sep 09, 2020 Record entry Clear entry View general journalb. Prepare a summary of the petty cash payments and record the entry on September 30 to reimburse the fund and reduce it to $290. (Round your answers to 2 decimal places.) WILLARD COMPANY Petty Cash Payments Report September 9 - 30, 2020 Receipts: Total receipts Fund tote Equals: Cash required to replenish petty cash View transaction list Journal entry worksheet Record the entry to reimburse the fund. Note: Enter debits before credits. Date General Journal Debit Credit Bep 30. 2020 Record entry Clear entry View general journalThe bank reconciliation prepared by Gemma Tours on March 31, 2020, appeared as follows: GEMMA TOURS Bank Reconciliation March 31, 2929 Bank statement balance $14,708 Book balance $32, 489 Add: Deposit of March 31 in transit 28, 906 35,696 Deduct : Outstanding cheques: #79 $ 1, 237 #84 1, 880 3,117 Adjusted bank balance $32, 489 Adjusted book balance $32,489 The Cash account in the General Ledger appeared as follows on April 30: Cash Acct. No. 191 Date Explanation PR Debit Credit Balance 2028 March 31 Balance 32, 489.90 April 38 CR11 33, 802.80 66,291.98 CD14 43,309.89 22,991. 98 A list of deposits made and cheques written during April, taken from the Cash Receipts Journal and Cash Disbursements Journal, is shown below: Deposits Made April 7 $14,896.98 13 847.90 18 13, 552.98 23 945.98 27 1, 889.98 2, 482.08 Total April Cash Receipts $33, 802.09 Cheques Written No . 91 $ 1, 191 92 5,192 93 2.598 94 3,426 95 2,875 96 1,797 97 8, 493 98 2,875 99 B, 513 190 6,438 Total April Cash Disbursements $437308 The following bank statement is available for April: (Note: The bank deposits interest into the bank account at the end of every month.)The following bank statement is available for April: (Note: The bank deposits interest into the bank account at the end of every month.) Bank Statement April 30, 2028 To: Gemma Tours Bank of Montreal Cheques/Charges Deposits/Credits Balance 14,790 #93 34/82 2,509 84/93 29,906 33, 097 #92 94/87 5, 192 84/97 14, 896 42,091 #84 34/13 1 , 8 80 04/13 847 40 ,968 NSF 94/18 6,536 04/18 13,552 47,984 #95 04/23 2,875 04/23 945 46,954 #99 94/27 8,513 84/27 1, 889 39, 421 #96 94/30 1, 797 04/38 2,482 40, 196 #97 94/30 8,493 INT 43 31, 746 #94 94/30 3, 426 28,328 PMT 94/30 9,351 18,969 INT 94/30 33 18,936 SC 94/30 52 18 , 884 NSF = Not Sufficient SC = Service PMT = Principal INT = Interest Funds Charge Payment In reviewing cheques returned by the bank, the bookkeeper discovered that cheque #93. for delivery expense, was recorded in the Cash Disbursements Journal incorrectly as $2,590. The NSF cheque was that of customer Laura Clark, deposited in April. Required: a. Prepare a bank reconciliation at April 30. GEMMA TOURS Bank Reconciliation April 30, 2020 Bank Statement Company's Books Bank statement balance Book balance Add Add: Deduct Deduct: Outstanding cheques: 0 |Adjusted bank balance Adjusted book balanceb. Prepare the necessary journal entries to bring the General Ledger Cash account into agreement with the adjusted balance on the bank reconciliation. View transaction list X Record interest earned. 2 Record to account for error in Cheque #93. 3 Record to reinstate customer account. 4 Record April loan payment. 5 Record April interest expense. Credit 6 Record April bank charges. Note : = journal entry has been entered Record entry Clear entry View general journalOn January 15, Tundra Co. sold merchandise to customers for cash of $44,000 (cost $29,900). Merchandise costing $11,100 was sold to customers for $16,600 on January 17; terms 2/10, n/30. Sales totalling $313,000 (cost $210,000) were recorded on January 20 to customers using MasterCard; assume the credit card charges a 2% fee. On January 25, sales of $76,400 (cost $51,200) were made to debit card customers. The bank charges Tundra a flat fee of 0.5% on all debit card transactions. Required: Prepare journal entries for each of the transactions described (assume a perpetual inventory system). View transaction list 1 Record the sale of merchandise to cash customers. > 2 Record the cost of sales. 3 Record the sale of merchandise on terms 2/10, n/30. 4 Record the cost of sales. 5 Record the sale of merchandise less credit card expense. Credit 6 Record the cost of sales. 7 Record the sale of merchandise less debit card expense. 8 Record the cost of sales. Note : = journal entry has been entered Record entry Clear entry View general journal