Question: All projects (A to G ) are 7 -year projects. NPV = Net present value. IRR = internal rate of return. MIRR = modified internal

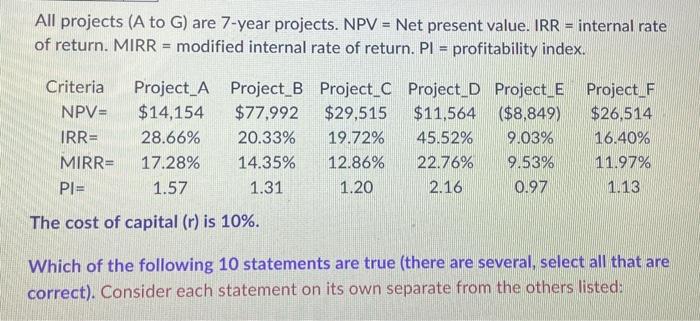

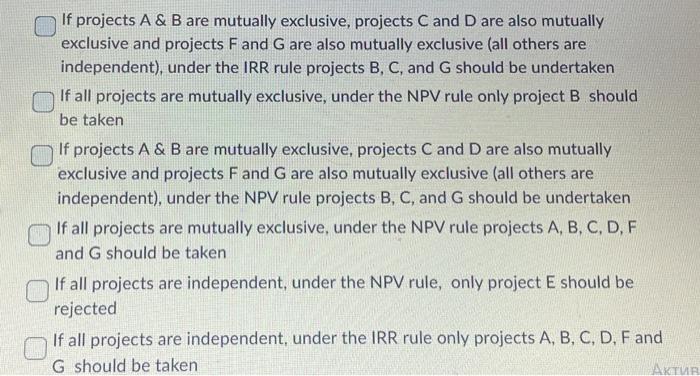

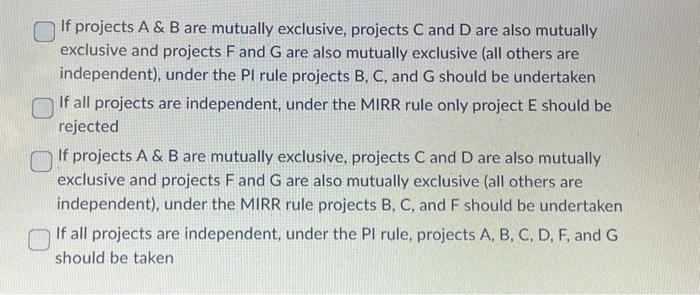

All projects (A to G ) are 7 -year projects. NPV = Net present value. IRR = internal rate of return. MIRR = modified internal rate of return. PI= profitability index. The cost of capital ( r ) is 10% Which of the following 10 statements are true (there are several, select all that are correct). Consider each statement on its own separate from the others listed: If projects A&B are mutually exclusive, projects C and D are also mutually exclusive and projects F and G are also mutually exclusive (all others are independent), under the IRR rule projects B,C, and G should be undertaken If all projects are mutually exclusive, under the NPV rule only project B should be taken If projects A&B are mutually exclusive, projects C and D are also mutually exclusive and projects F and G are also mutually exclusive (all others are independent), under the NPV rule projects B,C, and G should be undertaken If all projects are mutually exclusive, under the NPV rule projects A,B,C,D,F and G should be taken If all projects are independent, under the NPV rule, only project E should be rejected If all projects are independent, under the IRR rule only projects A,B,C,D,F and If projects A&B are mutually exclusive, projects C and D are also mutually exclusive and projects F and G are also mutually exclusive (all others are independent), under the PI rule projects B, C, and G should be undertaken If all projects are independent, under the MIRR rule only project E should be rejected If projects A&B are mutually exclusive, projects C and D are also mutually exclusive and projects F and G are also mutually exclusive (all others are independent), under the MIRR rule projects B,C, and F should be undertaken If all projects are independent, under the PI rule, projects A, B, C, D, F, and G should be taken All projects (A to G ) are 7 -year projects. NPV = Net present value. IRR = internal rate of return. MIRR = modified internal rate of return. PI= profitability index. The cost of capital ( r ) is 10% Which of the following 10 statements are true (there are several, select all that are correct). Consider each statement on its own separate from the others listed: If projects A&B are mutually exclusive, projects C and D are also mutually exclusive and projects F and G are also mutually exclusive (all others are independent), under the IRR rule projects B,C, and G should be undertaken If all projects are mutually exclusive, under the NPV rule only project B should be taken If projects A&B are mutually exclusive, projects C and D are also mutually exclusive and projects F and G are also mutually exclusive (all others are independent), under the NPV rule projects B,C, and G should be undertaken If all projects are mutually exclusive, under the NPV rule projects A,B,C,D,F and G should be taken If all projects are independent, under the NPV rule, only project E should be rejected If all projects are independent, under the IRR rule only projects A,B,C,D,F and If projects A&B are mutually exclusive, projects C and D are also mutually exclusive and projects F and G are also mutually exclusive (all others are independent), under the PI rule projects B, C, and G should be undertaken If all projects are independent, under the MIRR rule only project E should be rejected If projects A&B are mutually exclusive, projects C and D are also mutually exclusive and projects F and G are also mutually exclusive (all others are independent), under the MIRR rule projects B,C, and F should be undertaken If all projects are independent, under the PI rule, projects A, B, C, D, F, and G should be taken

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts