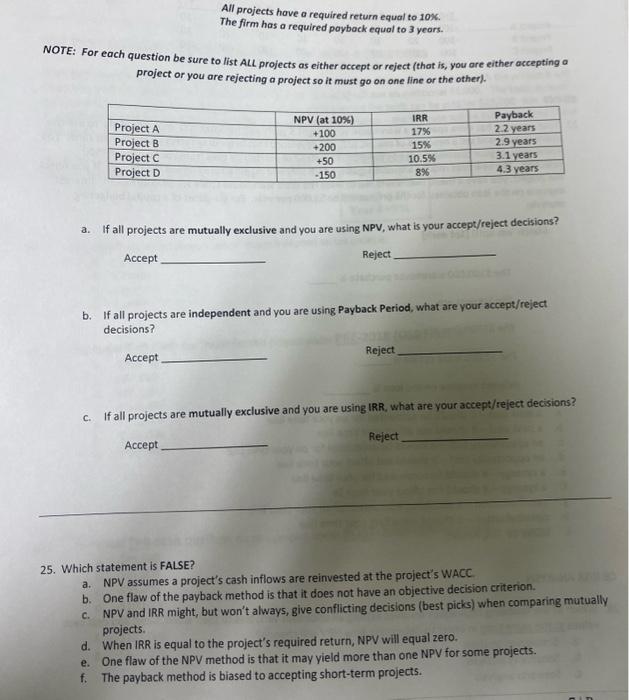

Question: All projects have a required return equal to 10K. The firm has a required payback equal to 3 years. NOTE: For each question be sure

All projects have a required return equal to 10K. The firm has a required payback equal to 3 years. NOTE: For each question be sure to list All projects as either accept or reject (that is, you are either accepting a project or you are rejecting a project so it must go on one line or the other). a. If all projects are mutually exclusive and you are using NPV, what is your accept/reject decisions? Accept Reject b. If all projects are independent and you are using Payback Period, what are your accept/reject decisions? Accept Reject c. If all projects are mutually exclusive and you are using IRR, what are your accept/reject decisions? Reject Accept 25. Which statement is FALSE? a. NPV assumes a project's cash inflow5 are reinvested at the project's WACC. b. One flaw of the payback method is that it does not have an objective decision criterion. c. NPV and IRR might, but won't always, give conflicting decisions (best picks) when comparing mutually projects. d. When IRR is equal to the project's required return, NPV will equal zero. e. One flaw of the NPV method is that it may yield more than one NPV for some projects. f. The payback method is biased to accepting short-term projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts