Question: All questions answer.. A to E .. to simple answers.. Jack and Jane are married and own a home insured for $150,000 under an unendorsed

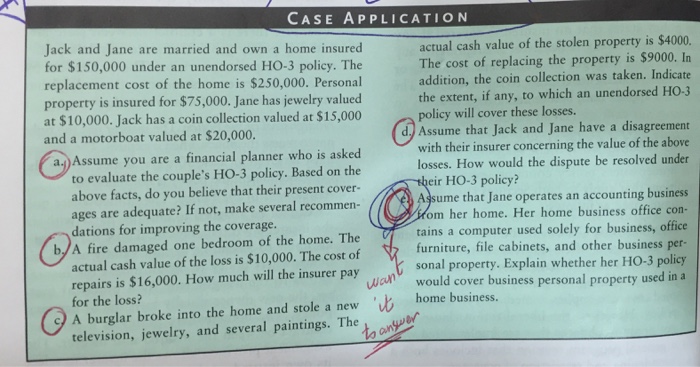

Jack and Jane are married and own a home insured for $150,000 under an unendorsed HO-3 policy. The replacement cost of the home is $250,000. Personal property is insured for $75,000. Jane has jewelry valued at $10,000. Jack has a coin collection valued at $15,000 and a motorboat valued at $20,000. Assume you are a financial planner who is asKea to evaluate the couple's HO-3 policy. Based on the above facts, do you believe that their present coverages arc adequate? If not, make several recommendations for improving the coverage. A fire damaged one bedroom of the home. The actual cash value of the loss is $10,000. The cost o repairs is $16,000. How much will the insurer pay for the loss? A burglar broke into the home and stole a new television, jewelry, and several paintings. The actual cash value of the stolen property is The cost of replacing the property is $9000. In addition, the coin collection was taken. Indicate the extent, if any, to which an unendorsed HO-3 policy will cover these losses. Assume that Jack and Jane have a disagreement with their insurer concerning the value of the above losses. How would the dispute be resolved under their HO-3 policy? Assume that Jane operates an accounting business from her home. Her home business office contains a computer used solely for business, office furniture, file cabinets, and other business personal property. Kxplain whether her HO-3 policy would cover business personal property used in a home business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts