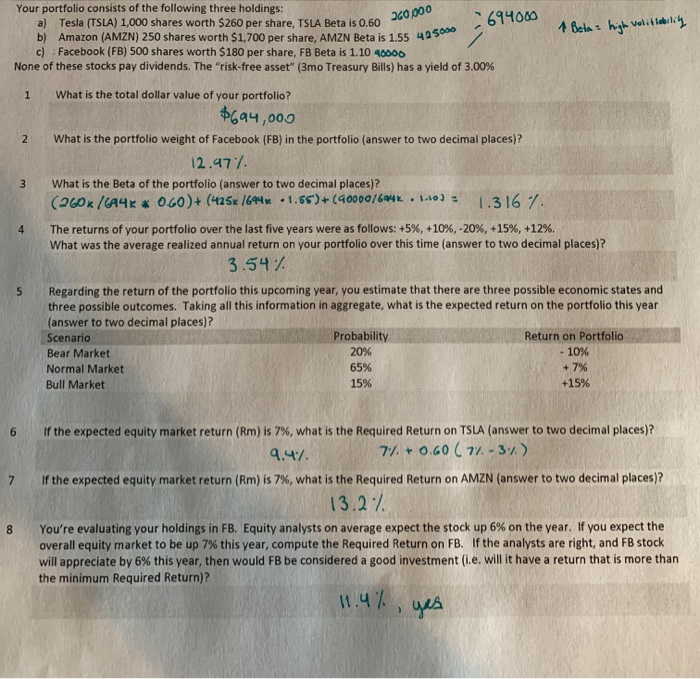

Question: All questions are wromg except #4. Please help! 660,000 - 694000 4 Betas high volite Beta : high volit tebalking Your portfolio consists of the

660,000 - 694000 4 Betas high volite Beta : high volit tebalking Your portfolio consists of the following three holdings: a) Tesla (TSLA) 1,000 shares worth $260 per share, TSLA Beta is 0.60 b) Amazon (AMZN) 250 shares worth $1,700 per share, AMZN Beta is 1.55 4950 55 425000 c) Facebook (FB) 500 shares worth $180 per share, FB Beta is 1.10 46000 None of these stocks pay dividends. The "risk-free asset" (3mo Treasury Bills) has a yield of 3.00% 1 What is the total dollar value of your portfolio? $694,000 2 What is the portfolio weight of Facebook (FB) in the portfolio (answer to two decimal places)? 12.97% 3 What is the Beta of the portfolio (answer to two decimal places)? (260k/A4K * O.GO)+ (4256 1694 . 1.65)+(40000/6242 . H) 1316 / The returns of your portfolio over the last five years were as follows: +5%, +10%, -20%, +15%, +12%. What was the average realized annual return on your portfolio over this time (answer to two decimal places)? 3.54% Regarding the return of the portfolio this upcoming year, you estimate that there are three possible economic states and three possible outcomes. Taking all this information in aggregate, what is the expected return on the portfolio this year (answer to two decimal places)? Scenario Probability Return on Portfolio Bear Market 20% - 10% Normal Market 65% + 7% Bull Market 15% +15% 6 7 if the expected equity market return (Rm) is 7%, what is the Required Return on TSLA (answer to two decimal places)? 9.47 7%. + 0.60 ( 77 - 37.) If the expected equity market return (Rm) is 7%, what is the Required Return on AMZN (answer to two decimal places)? 13.2%. You're evaluating your holdings in FB. Equity analysts on average expect the stock up 6% on the year. If you expect the overall equity market to be up 7% this year, compute the Required Return on FB. If the analysts are right, and FB stock will appreciate by 6% this year, then would FB be considered a good investment (i.e. will it have a return that is more than the minimum Required Return)? 8 11.4%, yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts