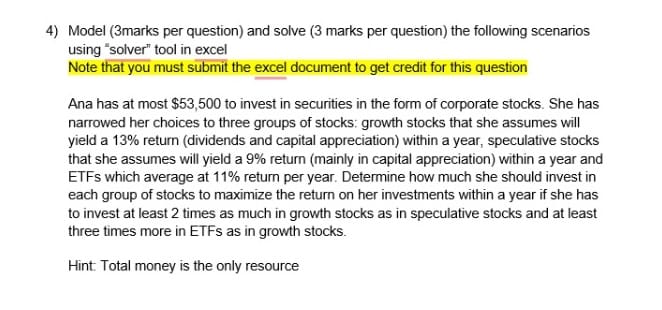

Question: All questions need to be solved in excelModel ( 3 marks per question ) and solve ( 3 marks per question ) the following scenarios

All questions need to be solved in excelModel marks per question and solve marks per question the following scenarios

using "solver" tool in excel

Note that you must submit the excel document to get credit for this question

Ana has at most $ to invest in securities in the form of corporate stocks. She has

narrowed her choices to three groups of stocks: growth stocks that she assumes will

yield a return dividends and capital appreciation within a year, speculative stocks

that she assumes will yield a return mainly in capital appreciation within a year and

ETFs which average at return per year. Determine how much she should invest in

each group of stocks to maximize the return on her investments within a year if she has

to invest at least times as much in growth stocks as in speculative stocks and at least

three times more in ETFs as in growth stocks.

Hint: Total money is the only resource

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock