Question: All questions please Problem 9-9 Calculating Project OCF [LO 2] H. Cochran, Inc., is considering a new three-year expansion project that requires an initial fixed

![All questions please Problem 9-9 Calculating Project OCF [LO 2] H.](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66ff95a359f35_01866ff95a2b067b.jpg)

All questions please

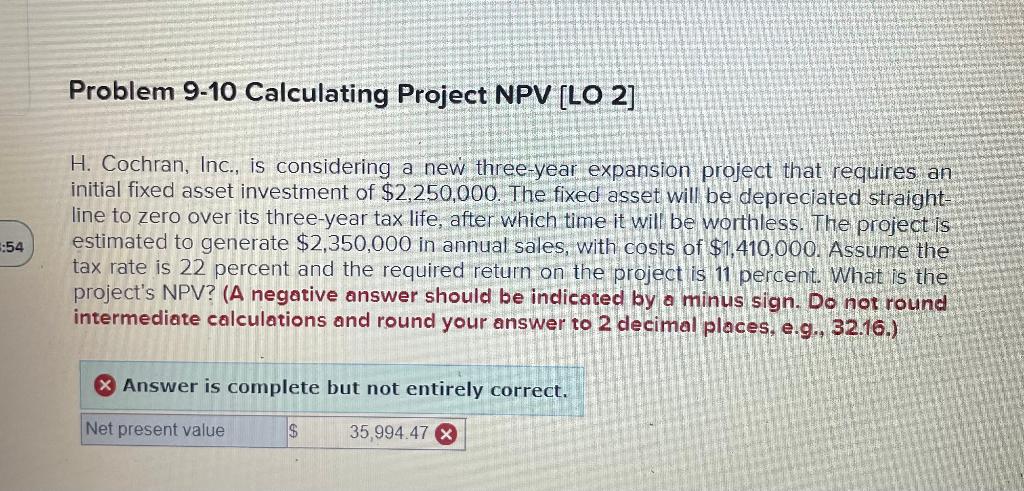

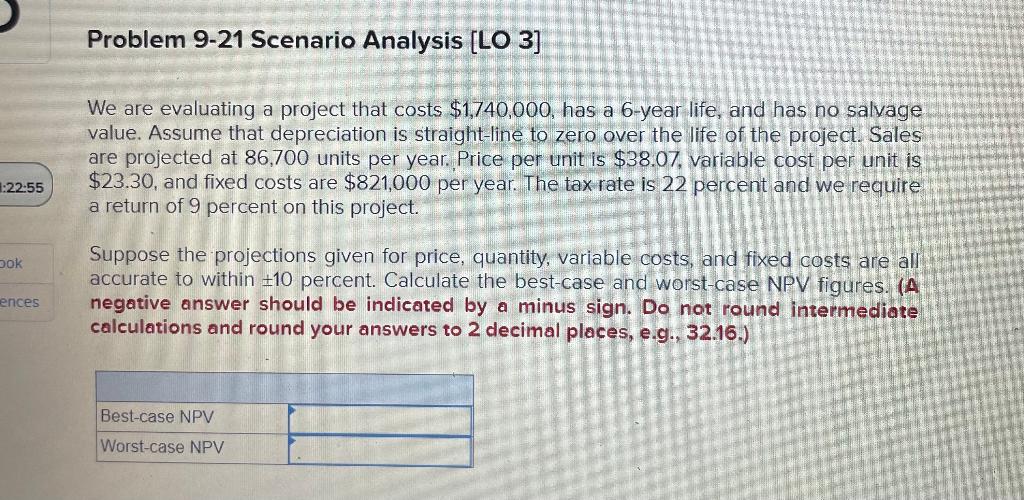

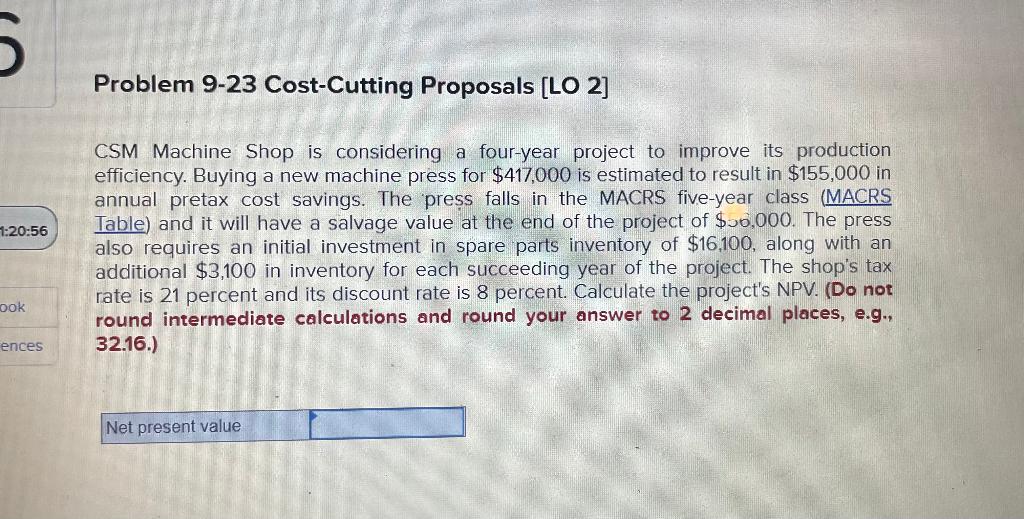

Problem 9-9 Calculating Project OCF [LO 2] H. Cochran, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $2,400,000. The fixed asset will be depreciated straight- line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $2,530,000 in annual sales, with costs of $1,550,000. If the tax rate is 25 percent, what is the OCF for this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) 01:24:16 X Answer is complete but not entirely correct. OCF $ 44,951.16 X Problem 9-10 Calculating Project NPV [LO 2] :54 H. Cochran, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $2,250,000. The fixed asset will be depreciated straight- line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $2,350,000 in annual sales, with costs of $1,410,000. Assume the tax rate is 22 percent and the required return on the project is 11 percent. What is the project's NPV? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. Net present value $ 35,994.47 5 Problem 9-23 Cost-Cutting Proposals [LO 2] 1:20:56 CSM Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $417,000 is estimated to result in $155,000 in annual pretax cost savings. The press falls in the MACRS five-year class (MACRS Table) and it will have a salvage value at the end of the project of $20,000. The press also requires an initial investment in spare parts inventory of $16,100, along with an additional $3,100 in inventory for each succeeding year of the project. The shop's tax rate is 21 percent and its discount rate is 8 percent. Calculate the project's NPV. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) ook ences Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts