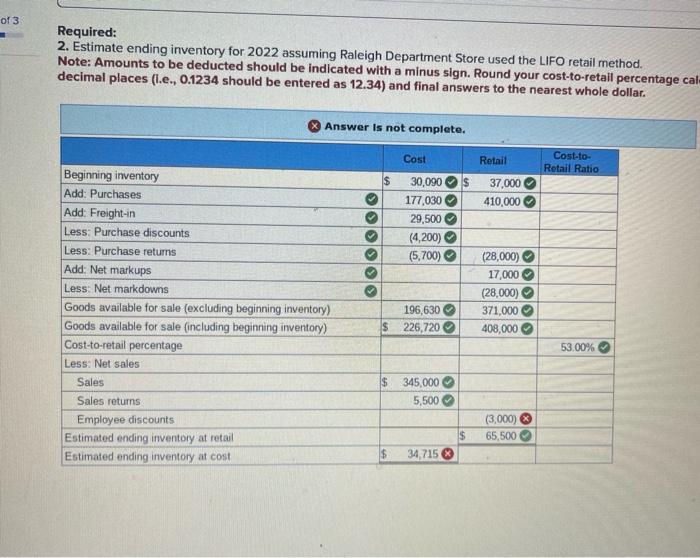

Question: all relate to the same question. Required: 2. Estimate ending inventory for 2022 assuming Raleigh Department Store used the LIFO retail method. Note: Amounts to

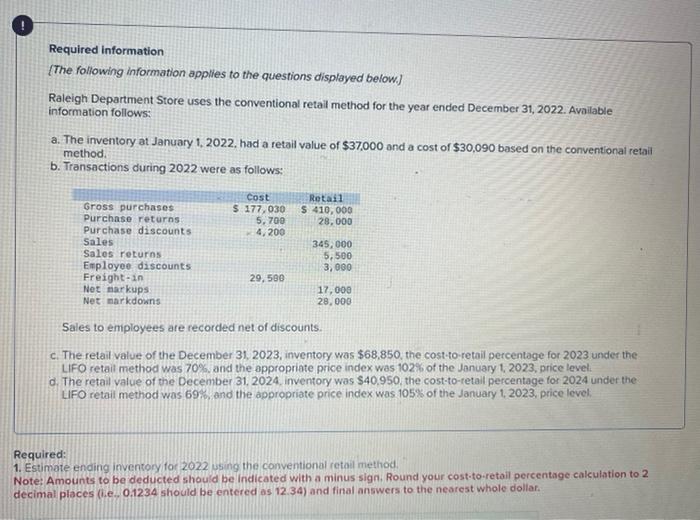

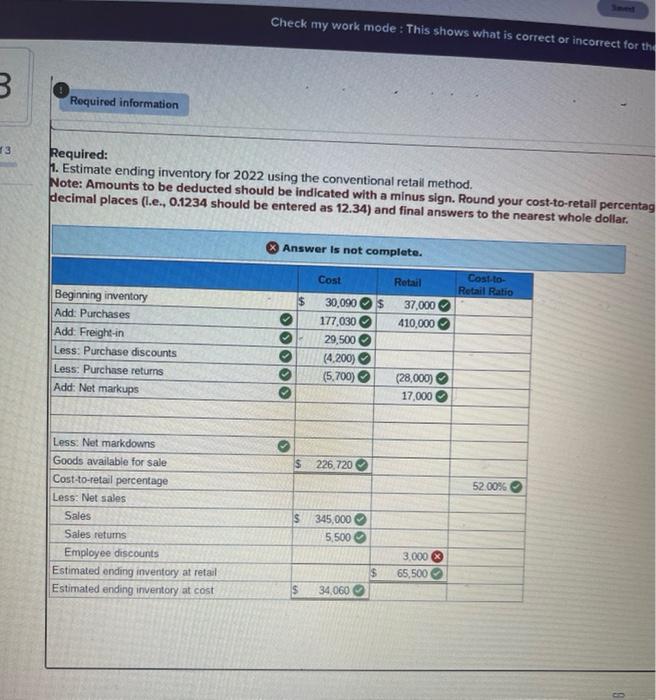

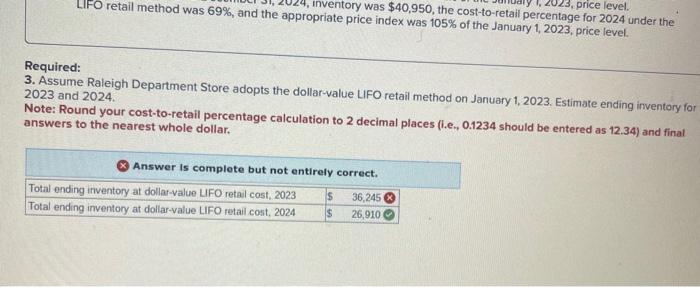

Required: 2. Estimate ending inventory for 2022 assuming Raleigh Department Store used the LIFO retail method. Note: Amounts to be deducted should be indicated with a minus sign. Round your cost-to-retail percentage cal decimal places (i.e., 0.1234 should be entered as 12.34 ) and final answers to the nearest whole dollar. Required information [The following information applies to the questions displayed below.] Raleigh Department Store uses the conventional retail method for the year ended December 31, 2022. Available information follows: a. The inventory at January 1,2022 , had a retail value of $37,000 and a cost of $30,090 based on the conventional retai method. b. Transactions during 2022 were as follows: Sales to employees are recorded net of discounts. c. The retail value of the December 31,2023 , inventory was $68,850, the cost-to-retail percentage for 2023 under the LIFO retait method was 70%, and the appropriate price index was 102% of the January 1, 2023, price level. d. The retail value of the December 31,2024 , inventory was $40,950, the cost-to-retail percentage for 2024 under the LIFO retail method was 69%, and the appropriate price index was 105% of the January 1,2023, price level: Required: 1. Estimate ending inventory tos2022 using the conventional retail method. Note: Amounts to be deducted should be indicated with a minus sign. Round your cost-to-retail percentage calculation to 2 decimal places (i.e. 0.1234 should be entered as 12.34 ) and final answers to the nearest whole dollar. LIFO retail method was 69%, and the apprinventory was $40,950, the cost-to-retail percentage for 2024 under the Required: 3. Assume Raleigh Department Store adopts the dollar-value LIFO retail method on January 1,2023. Estimate ending inventory for 2023 and 2024. Note: Round your cost-to-retail percentage calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34) and final answers to the nearest whole dollar. Required: 1. Estimate ending inventory for 2022 using the conventional retall method. Note: Amounts to be deducted should be indicated with a minus sign. Round your cost-to-retall percentas decimal places (l.e., 0.1234 should be entered as 12.34 ) and final answers to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts