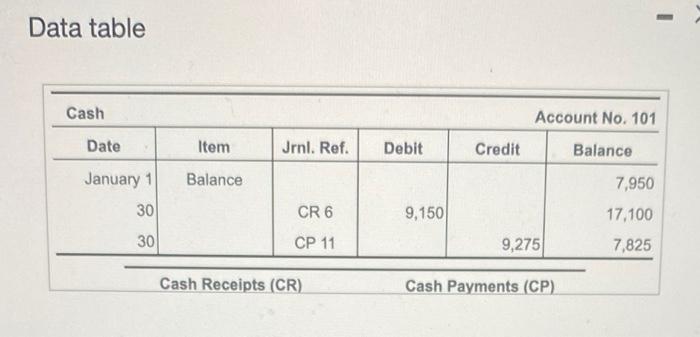

Question: all requirements please Data table Cash Date January 1 30 30 Item Balance Jrnl. Ref. CR 6 CP 11 Cash Receipts (CR) Debit 9,150 Credit

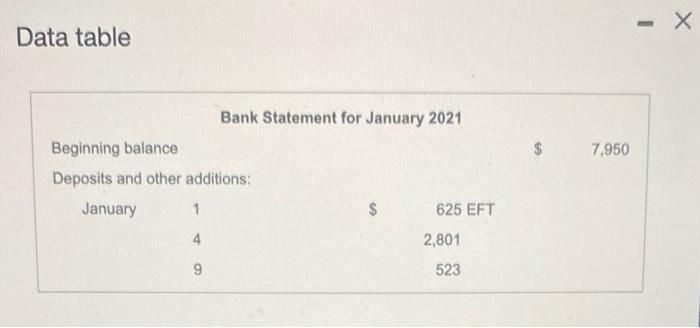

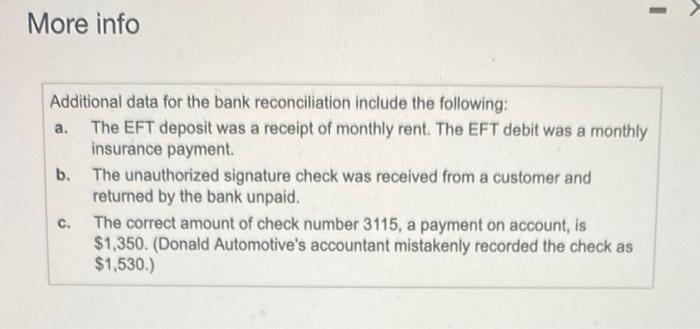

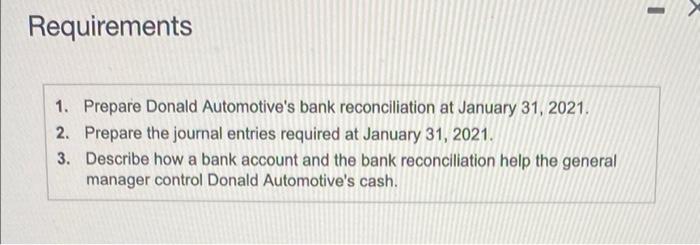

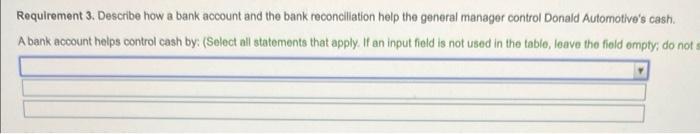

Data table Cash Date January 1 30 30 Item Balance Jrnl. Ref. CR 6 CP 11 Cash Receipts (CR) Debit 9,150 Credit Account No. 101 Balance 9,275 Cash Payments (CP) 7,950 17,100 7,825 Data table Bank Statement for January 2021 Beginning balance Deposits and other additions: January 1 4 9 625 EFT 2,801 523 7,950 X More info Additional data for the bank reconciliation include the following: The EFT deposit was a receipt of monthly rent. The EFT debit was a monthly insurance payment. a. b. The unauthorized signature check was received from a customer and returned by the bank unpaid. C. The correct amount of check number 3115, a payment on account, is $1,350. (Donald Automotive's accountant mistakenly recorded the check as $1,530.) Requirements 1. Prepare Donald Automotive's bank reconciliation at January 31, 2021. Prepare the journal entries required at January 31, 2021. 2. 3. Describe how a bank account and the bank reconciliation help the general manager control Donald Automotive's cash. Requirement 3. Describe how a bank account and the bank reconciliation help the general manager control Donald Automotive's cash. A bank account helps control cash by: (Select all statements that apply. If an input field is not used in the table, leave the field empty; do not s detecting all instances of theft. detecting errors in posting collections to accounts receivable. ensuring that the bank and book records of cash are correct. ensuring that the company accounts for all its cash transactions. providing a place for safekeeping. providing a detailed list of cash transactions that managers can compare to the books to correct book errors quickly. 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts