Question: All Responses Must be contained within This Document and Additional T-Account Worksheet Alameda Products uses a job-order costing system. The companys inventory balances on April

All Responses Must be contained within This Document and Additional T-Account Worksheet Alameda Products uses a job-order costing system. The companys inventory balances on April 1, the start of its fiscal year, were as follows: Raw Materials: $41,000 Work-in-Progress: $73,000 Finished Goods: $58,500 Manufacturing Overhead: $0 During the year the following occurred: 1. Raw materials purchased on account: $186,000 2. Raw materials issued from the storeroom for use in production: $130,000 (80% direct materials and 20% indirect materials). 3. Employee salaries and wages paid in cash were as follows: Direct Labor (WIP): $183,000; Indirect Labor (Man OH): $68,000; Selling, General and Administrative Expenses (SG&A period cost) $110,000. 4. Utility Costs incurred in the factory and paid in cash (Man OH--indirect cost): $24,000. 5. Advertising Costs incurred and paid in cash (period cost): $132,000. 6. Depreciation: $80,000 (90% related to factory assets and considered manufacturing overhead; 10% related to corporate assets and considered a period type depreciation expense). 7. Estimated Manufacturing Overhead applied to jobs in W-I-P at a pre-determined overhead rate of $5.50 per unit produced. 35,000 units produced in the current year. 8. Costs of goods transferred from W-I-P to Finished Goods totaled $400,000. 9. Sales for the year totaled $1,512,000 and were all in cash. The total cost to produce these goods was $351,000 and were transferred from Finished Goods to Cost of Goods Sold. 10. Prepare the Journal Entry to clear out the Manufacturing Overhead Account (to be calculated) 11. Paid Income Tax Expense in cash totaling $225,000.

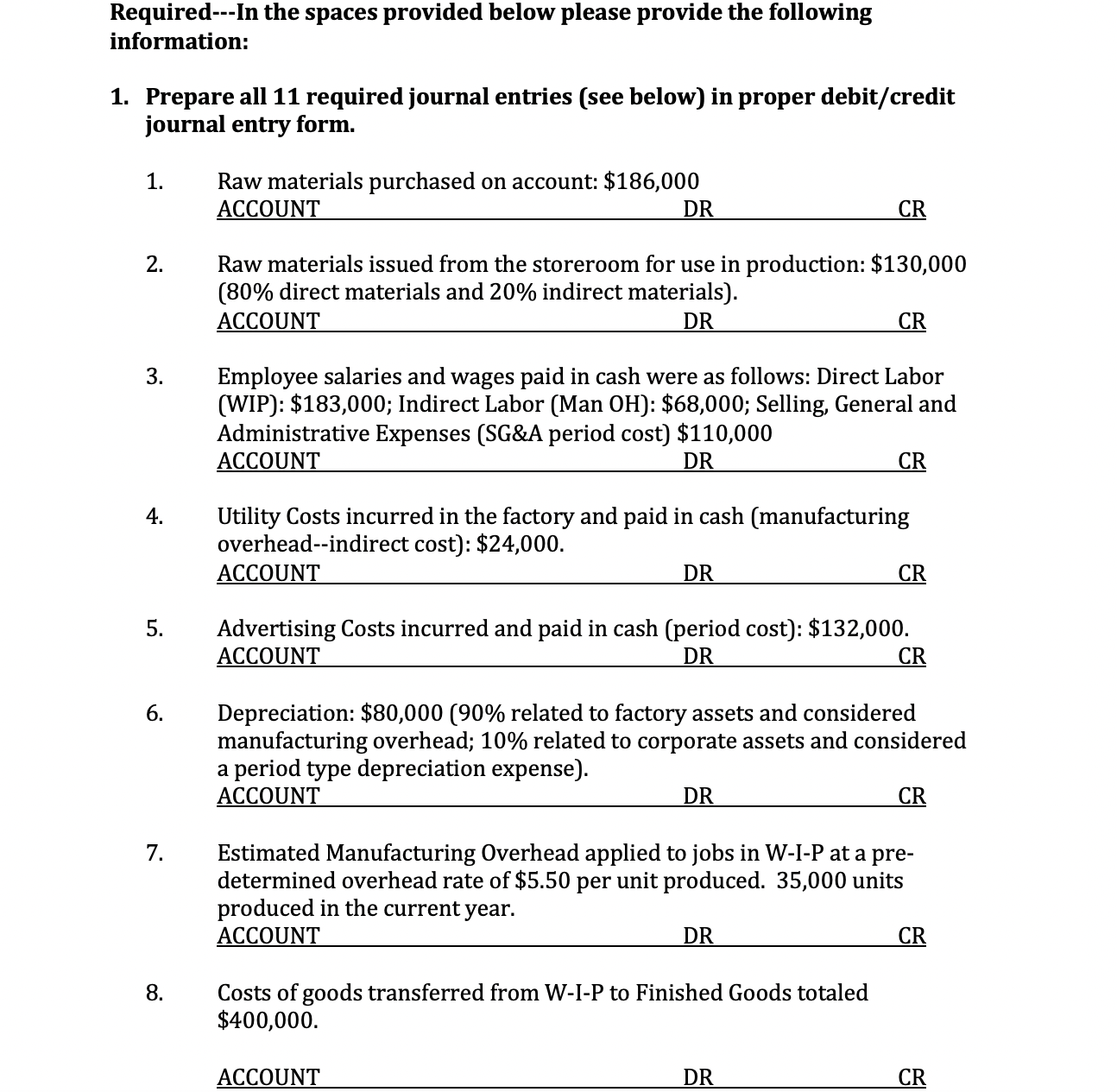

Required---In the spaces provided below please provide the following information: 1. Prepare all 11 required journal entries (see below) in proper debit/credit journal entry form. 1. Raw materials purchased on account: $186,000 ACCOUNT DR CR 2. Raw materials issued from the storeroom for use in production: $130,000 ( 80% direct materials and 20% indirect materials). ACCOUNT DR CR 3. Employee salaries and wages paid in cash were as follows: Direct Labor (WIP): \$183,000; Indirect Labor (Man 0H): \$68,000; Selling, General and Administrative Expenses (SG\&A period cost) $110,000 ACCOUNT DR CR 4. Utility Costs incurred in the factory and paid in cash (manufacturing overhead--indirect cost): $24,000. ACCOUNT DR CR 5. Advertising Costs incurred and paid in cash (period cost): $132,000. ACCOUNT DR CR 6. Depreciation: $80,000(90% related to factory assets and considered manufacturing overhead; 10% related to corporate assets and considered a period type depreciation expense). ACCOUNT DR CR 7. Estimated Manufacturing Overhead applied to jobs in W-I-P at a predetermined overhead rate of $5.50 per unit produced. 35,000 units produced in the current year. ACCOUNT DR CR 8. Costs of goods transferred from W-I-P to Finished Goods totaled $400,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts