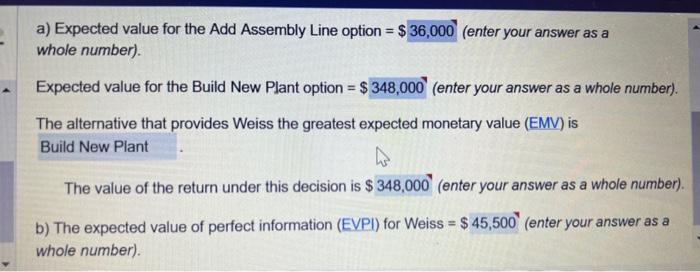

Question: *all shown answers are incorrect* a) Expected value for the Add Assembly Line option =$ (enter your answer as a whole number). Expected value for

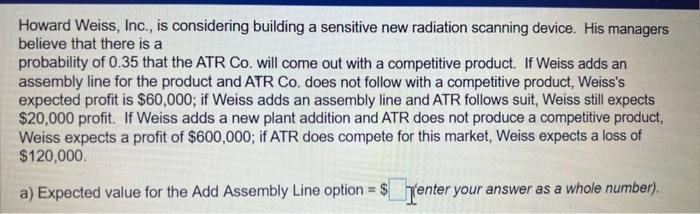

a) Expected value for the Add Assembly Line option =$ (enter your answer as a whole number). Expected value for the Build New Plant option =$ (enter your answer as a whole number). The alternative that provides Weiss the greatest expected monetary value (EMV) is The value of the return under this decision is $ (enter your answer as a whole number). b) The expected value of perfect information (EVPI) for Weiss =$45,500 (enter your answer as a whole number). Howard Weiss, Inc., is considering building a sensitive new radiation scanning device. His managers believe that there is a probability of 0.35 that the ATR Co. will come out with a competitive product. If Weiss adds an assembly line for the product and ATR Co. does not follow with a competitive product, Weiss's expected profit is $60,000; if Weiss adds an assembly line and ATR follows suit, Weiss still expects $20,000 profit. If Weiss adds a new plant addition and ATR does not produce a competitive product, Weiss expects a profit of $600,000; if ATR does compete for this market, Weiss expects a loss of $120,000. a) Expected value for the Add Assembly Line option =$ (enter your answer as a whole number)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts