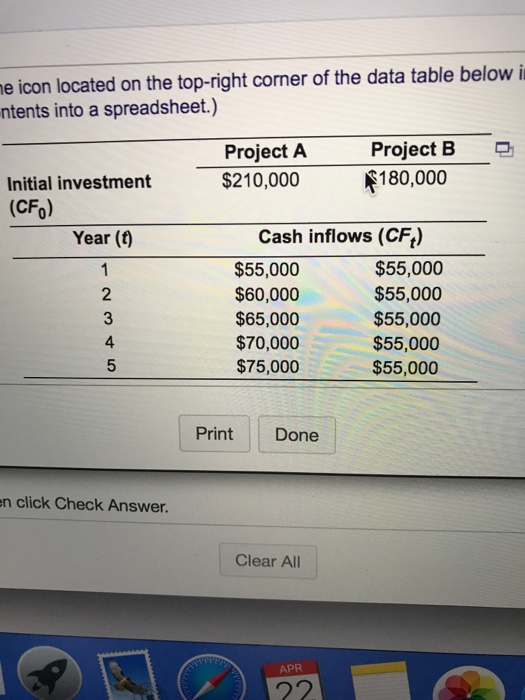

Question: All techniques with NPV profileMutually exclusive projects Projects A and B, of equal risk, are alternatives for expanding Rosa Company's capacity. The firm's cost of

e icon located on the top-right corner of the data table below i ntents into a spreadsheet.) Project A Project B Initial investment $210,000 180,000 (CFo) Cash inflows (CF) $55,000 $60,000 $65,000 $70,000 $75,000 Year (t) $55,000 $55,000 $55,000 $55,000 $55,000 2 4 Print Done n click Check Answer. Clear All APR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts