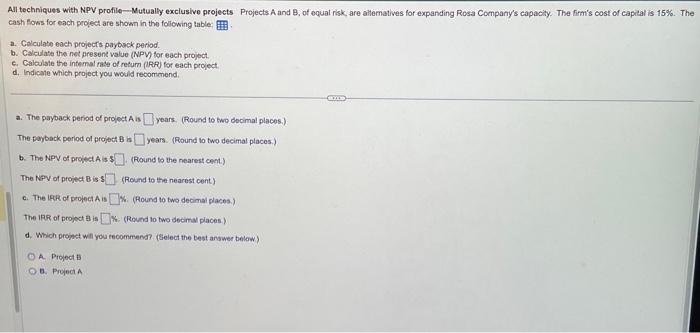

Question: All techniques with NPV profile-Mutually exclusive projects Projects A and B, of equal risk are altematives for expanding Rosa Company's capacity. The firm's cost of

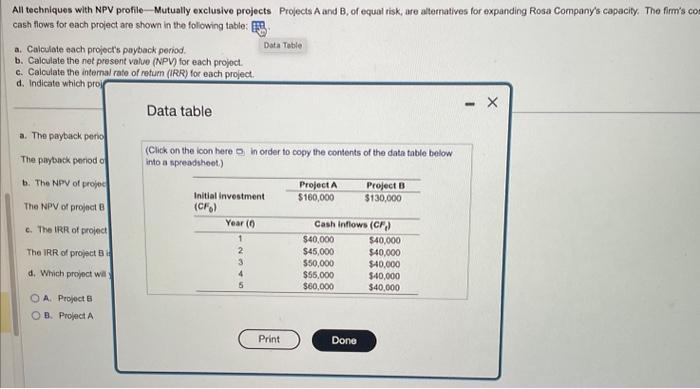

All techniques with NPV profile-Mutually exclusive projects Projects A and B, of equal risk are altematives for expanding Rosa Company's capacity. The firm's cost of capitat is 15%. The cash fows for each project are shown in the following table: a. Golculate each projects paytack period. b. Calculate the net present value (NPV) for each projoct. c. Calculate the intemal rate of retum (RRP) for each project. d. Indicale which project you wosild recommend. a. The payback period of project A is years. (Round to two decimal places.) The payback period of project B is years. (Round to two decimal places.) b. The NPV of profect A is s (Round to the nearest cent.) The NFY of project B is 5 (Roind to the nearest cont) c. The LPR of proiect A is \&. (Round to two decimal places.) The 1PR of propoct B is : (Reucd to two decimal places.) d. Which projact wil you tecommend? (Eielect the best answer below) A. Project Es B. Proped A All techniques with NPV profile-Mutually exclusive projects Projects A and B, of equal risk, are altematives for expanding Rosa Company's capacity, The firm's cash flows for each project are shown in the following table: a. Calculate each projects payback period. b. Calculate the net present value (NPV) for each projoct. c. Calculate the internal rate of retum (IRR) for each project. d. Indicate which proj Data table a. The paytack perio (Click on the icon here o in order to copy the contents of the data table below The paytanck period of into a spreadshoot)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts