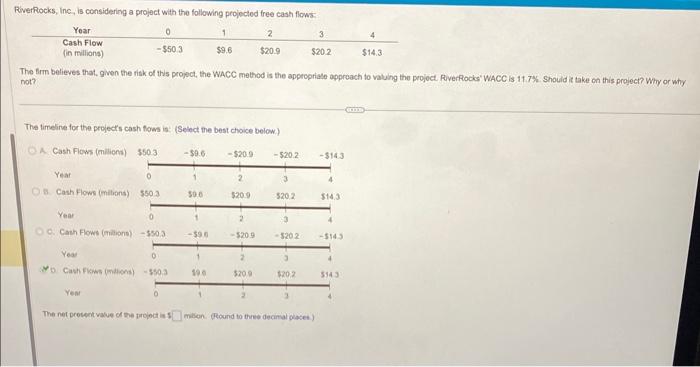

Question: *All thats needed is NPV and whether or not they should take on the project* RoverRocks, Inc, is considering a project with the following projected

*All thats needed is NPV and whether or not they should take on the project*

RoverRocks, Inc, is considering a project with the following projected free cash flows: The firm believes that, given the risk of this propect, the WACC method is the appropriale approach to valuing the project. Riverfiocks' WiacC is 11.7%. Should it take on this project? Why or why. not? The timeline for the projects cash fows is: (Sehect the best choice below.) A. Cash Flows (milions) Year 8. Cash Hows (milions) Year Cach Flows (milions) Year Yo Cash Flaws (ondions Year The net procent vave of the yroped is 1 Fillan. Ground to three decinal plases)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock