Question: (All the data and table required has been attached below. Thank you!) Bombardier's Beta was 2.35 and the Market Risk Premium was 5.23 per cent.

(All the data and table required has been attached below. Thank you!)

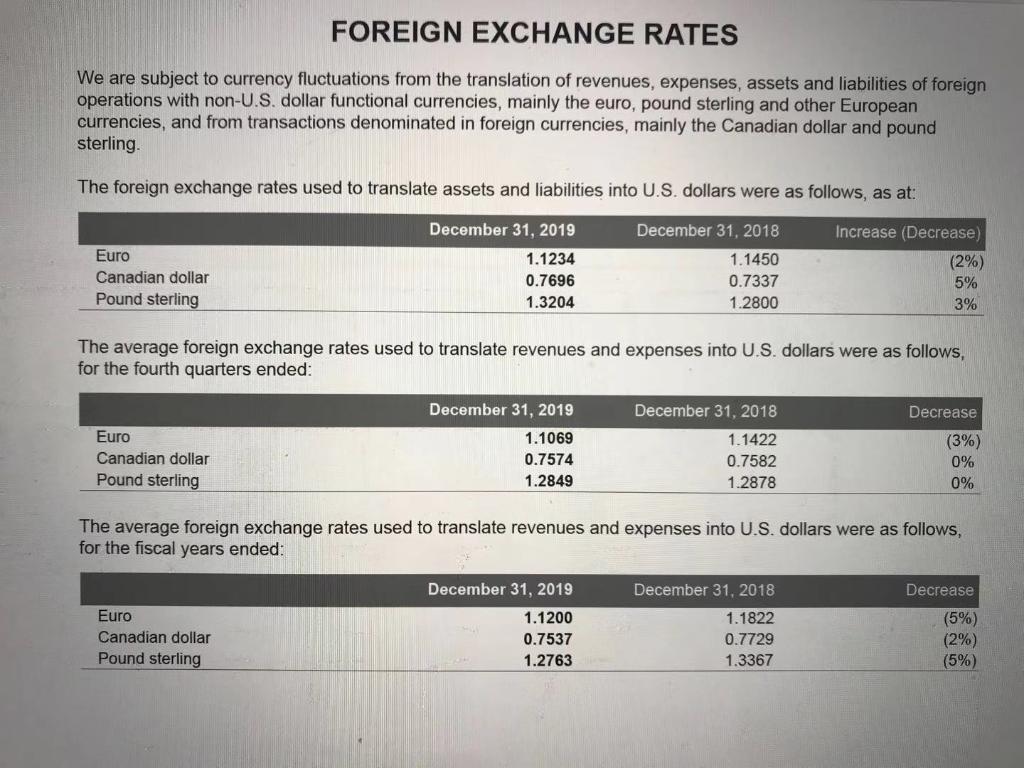

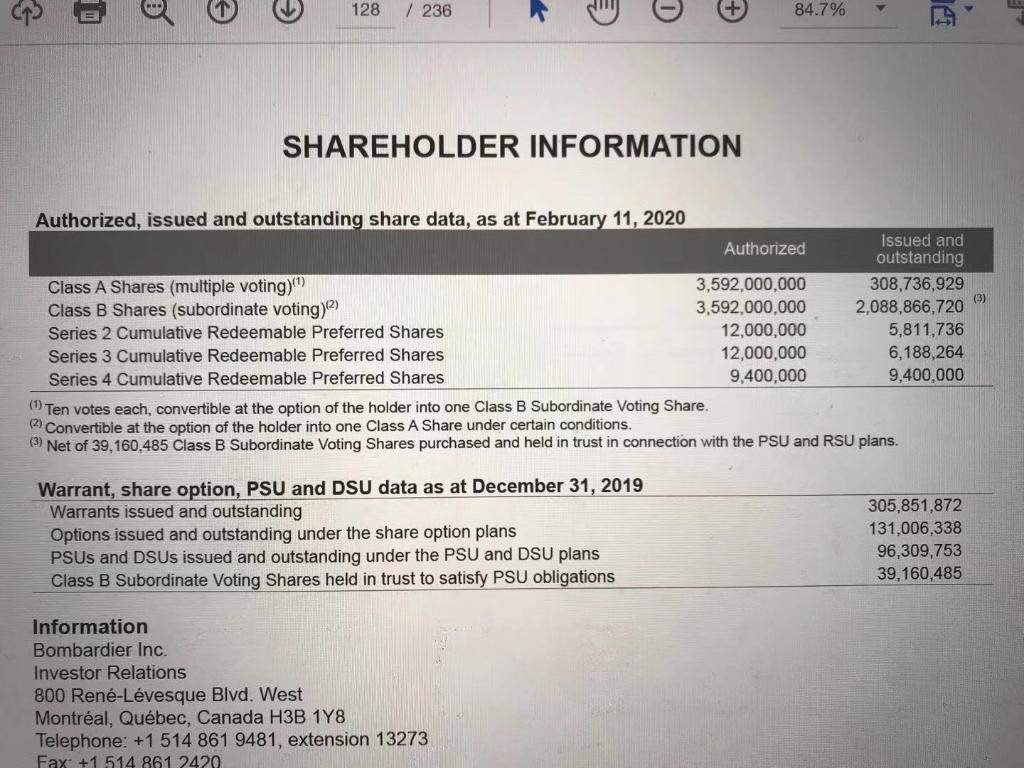

Bombardier's Beta was 2.35 and the Market Risk Premium was 5.23 per cent. He set out to calculate the weight of all the equity and preferred securities for Bombardier based on the closing share price as of November 10, 2020. Share price information is available at Bombardier Investor Relations. By looking at the 2019 Annual Report (available as an Additional Resource), Lee could determine the number of shares outstanding of both preferred and common shares (see p. 126 of the Annual Report) and exchange rates (see p. 125 of the Annual Report). He decided to ignore warrants, share options, PSUs and DSUs. The exchange rate is important because the values in the Annual Report are in USD whereas the share prices are in CAD. He will need then to convert the USD values to CAD (please do so using the rates in the annual report). He assumed the company's effective tax rate was 17.88 per cent (an average of the last 4 years that Bombardier had a positive tax rate). Lee researched the Canadian 10-year bond yield at the Bank of Canada, which would be necessary in calculating the cost of equity for Bombardier. He found that this yield was 1.25%. [Kindly note that we are using Bombardiers latest annual report and then using more recent market pricing for illustrative teaching purposes. Normally one would use the most recent publicly available financial statement data (i.e. quarterly statements) but we will use the annual report for this Case as it has the most disclosure and thus provides the best opportunity to get familiar with more detailed financial statements].

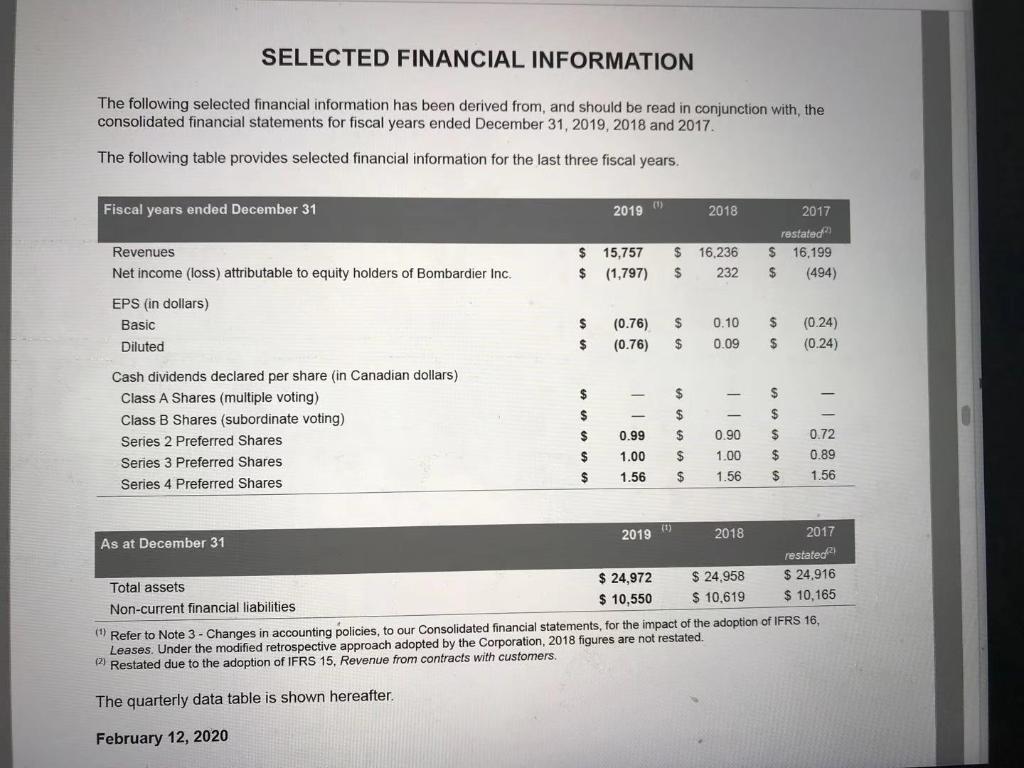

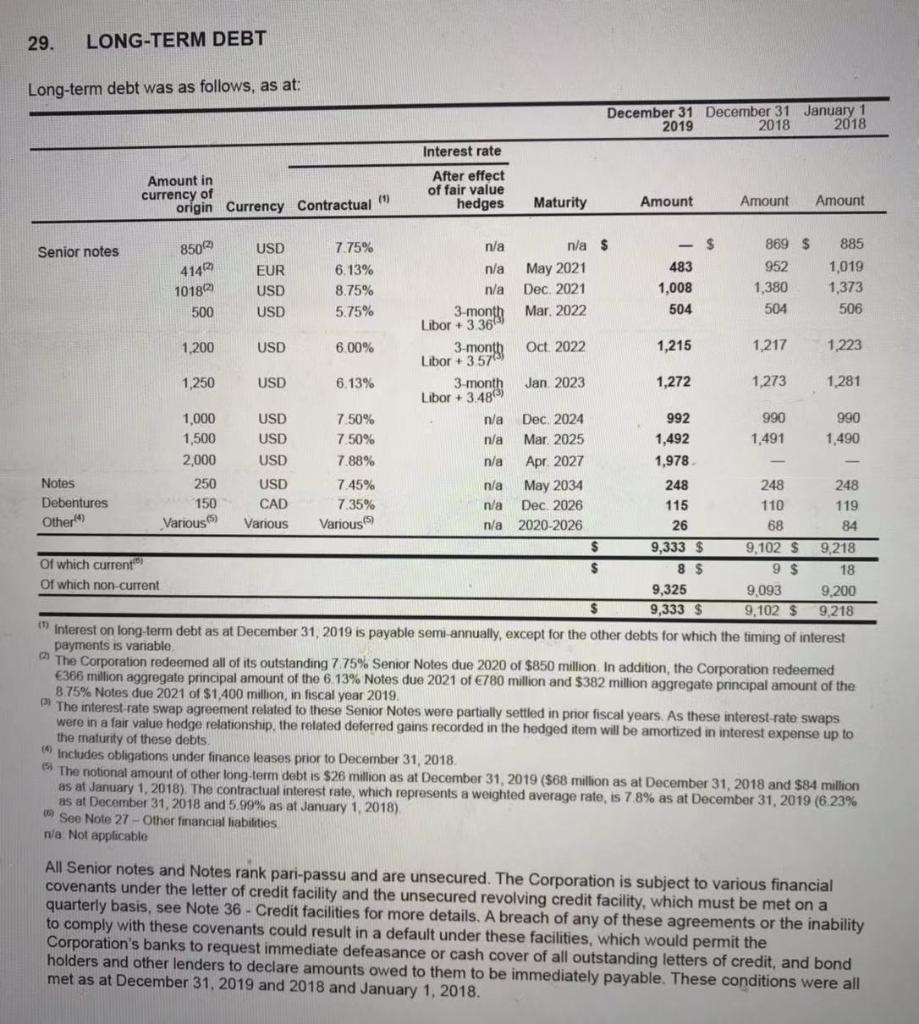

Lee expected to incorporate the range of preferred shares and their most recent dividend payouts (see p. 127 of the Annual Report) into his cost of capital calculations. He assumes that the growth rate of all the preferred shares dividends is zero. He also assumes that both Class A and Class B common shares have the same cost of equity. When calculating the cost of debt, he would include the company's long-term debt (see p. 199 of the Annual Report). For the debt that has no value for December 31st, 2019 (it is represented as a dash) he assumes that the market value is 0 (i.e., it has been paid off). He further assumed that the amounts of long-term debt on page 199 of the Annual Report (the column with header December 31st, 2019) were the best estimates of the market values in USD. Finally, Lee found the bond prices for all of Bombardier's long-term debt (see Table 1, below; the face value is 100). The bond prices are necessary for the computation of the YTM of each bond with the exception of the "Other" entry, the cost of which he obtained from the footnotes (see p. 199 of the Annual Report). One issue is how to handle fractional years for bond maturities, especially knowing that they are semi-annual bonds. For simplicity, he decided to round the number of periods when computing the YTM of each bond, as seen in Table 1. Using his knowledge of finance, he sat down to punch the numbers and calculate Bombardier's WACC.

Table 1 - Bombardier Bond Prices Years to Issue Price Maturity May 2021 6.125% $99.65 1 December 2021 $100.52 1 8.75% March 2022 $97.75 1 5.75% October 2022 $93.81 2 6.00% January 2023 6.13% $90.44 2 December 2024 $83.75 4 7.50% March 2025 $82.50 7.50% April 2027 $79.63 6 7.88% May, 2034 7.45% $76.50 13 December, 2026 $101.63 6 7.35% FOREIGN EXCHANGE RATES We are subject to currency fluctuations from the translation of revenues, expenses, assets and liabilities of foreign operations with non-U.S. dollar functional currencies, mainly the euro, pound sterling and other European currencies, and from transactions denominated in foreign currencies, mainly the Canadian dollar and pound sterling The foreign exchange rates used to translate assets and liabilities into U.S. dollars were as follows, as at: Euro Canadian dollar Pound sterling December 31, 2019 1.1234 0.7696 1.3204 December 31, 2018 1.1450 0.7337 1.2800 Increase (Decrease) (2%) 5% 3% The average foreign exchange rates used to translate revenues and expenses into U.S. dollars were as follows, for the fourth quarters ended: December 31, 2019 December 31, 2018 Decrease (3%) Euro Canadian dollar Pound sterling 1.1069 0.7574 1.2849 1.1422 0.7582 1.2878 0% 0% The average foreign exchange rates used to translate revenues and expenses into U.S. dollars were as follows, for the fiscal years ended: December 31, 2018 Euro Canadian dollar Pound sterling December 31, 2019 1.1200 0.7537 1.2763 1.1822 0.7729 1.3367 Decrease (5%) (2%) (5%) 0 128 / 236 84.7% SHAREHOLDER INFORMATION (3) Authorized, issued and outstanding share data, as at February 11, 2020 Authorized Issued and outstanding Class A Shares (multiple voting) 3,592,000,000 308,736,929 Class B Shares (subordinate voting)) 3,592,000,000 2,088,866,720 Series 2 Cumulative Redeemable Preferred Shares 12,000,000 5,811,736 Series 3 Cumulative Redeemable Preferred Shares 12,000,000 6,188,264 Series 4 Cumulative Redeemable Preferred Shares 9,400,000 9,400,000 (1) Ten votes each, convertible at the option of the holder into one Class B Subordinate Voting Share. 2) Convertible at the option of the holder into one Class A Share under certain conditions. Net of 39,160,485 Class B Subordinate Voting Shares purchased and held in trust in connection with the PSU and RSU plans. Warrant, share option, PSU and DSU data as at December 31, 2019 Warrants issued and outstanding Options issued and outstanding under the share option plans PSUs and DSUs issued and outstanding under the PSU and DSU plans Class B Subordinate Voting Shares held in trust to satisfy PSU obligations 305,851,872 131,006,338 96,309,753 39,160,485 Information Bombardier Inc. Investor Relations 800 Ren-Lvesque Blvd. West Montral, Qubec, Canada H3B 1Y8 Telephone: +1 514 861 9481, extension 13273 Fax: +1 514 861 2420 SELECTED FINANCIAL INFORMATION The following selected financial information has been derived from, and should be read in conjunction with, the consolidated financial statements for fiscal years ended December 31, 2019, 2018 and 2017 The following table provides selected financial information for the last three fiscal years. Fiscal years ended December 31 2019" 2018 2017 restate $ 16,199 (494) Revenues Net income (loss) attributable to equity holders of Bombardier Inc. $ $ 15,757 (1,797) $ $ 16,236 232 EPS (in dollars) Basic Diluted $ $ $ $ (0.76) (0.76) 0.10 0.09 (0.24) (0.24) $ $ $ $ $ $ Cash dividends declared per share (in Canadian dollars) Class A Shares (multiple voting) Class B Shares (subordinate voting) Series 2 Preferred Shares Series 3 Preferred Shares Series 4 Preferred Shares $ $ $ $ $ $ $ 0.99 1.00 0.90 1.00 1.56 $ $ $ 0.72 0.89 1.56 1.56 $ As at December 31 2019 2018 2017 restateof) Total assets $ 24,972 $ 24.958 $ 24,916 Non-current financial liabilities $ 10,550 $ 10.619 $ 10,165 ("Refer to Note 3 - Changes in accounting policies, to our Consolidated financial statements, for the impact of the adoption of IFRS 16, Leases. Under the modified retrospective approach adopted by the Corporation, 2018 figures are not restated. Restated due to the adoption of IFRS 15, Revenue from contracts with customers. The quarterly data table is shown hereafter. February 12, 2020 29. LONG-TERM DEBT Long-term debt was as follows, as at: December 31 December 31 January 1 2019 2018 2018 Amount in currency of origin Currency Contractual Interest rate After effect of fair value hedges (9) Maturity Amount Amount Amount 85069 Senior notes USD 7.75% n/a n/a $ - $ 869 $ 885 41462 EUR 6.13% n/a May 2021 483 952 1,019 101862 USD 8.75% n/a Dec. 2021 1,008 1,380 1,373 500 USD 5.75% 3-month Mar. 2022 504 504 506 Libor +336 1,200 USD 6.00% 3-month Oct 2022 1,215 1,217 1,223 Libor +3.57 1.250 USD 6.13% 3-month Jan 2023 1,272 1,273 1,281 Libor + 3.483) 1,000 USD 7.50% n/a Dec. 2024 992 990 990 1,500 USD 7.50% n/a Mar. 2025 1,492 1,491 1,490 2,000 USD 7.88% n/a Apr 2027 1,978 Notes 250 USD 7.45% n/a May 2034 248 248 248 Debentures 150 CAD 7.35% n/a Dec. 2026 115 110 119 Other) Various Various Various n/a 2020-2026 26 68 84 $ 9,333 $ 9,102 S 9,218 Of which current $ 8 $ 9 $ 18 Of which non-current 9,325 9,093 9,200 9,333 $ 9,102 $ 9,218 1) Interest on long-term debt as at December 31, 2019 is payable semi-annually, except for the other debts for which the timing of interest payments is variable The Corporation redeemed all of its outstanding 775% Senior Notes due 2020 of $850 million. In addition, the Corporation redeemed 366 million aggregate principal amount of the 6.13% Notes due 2021 of 780 million and $382 million aggregate principal amount of the 8 75% Notes due 2021 of $1,400 million in fiscal year 2019, The interest rate swap agreement related to these Senior Notes were partially settled in prior fiscal years. As these interest-rate swaps were in a fair value hedge relationship, the related deferred gains recorded in the hedged item will be amortized in interest expense up to the maturity of these debts. obligations under finance leases prior to December 31, 2018 The notional amount of other long-term debt is $26 million as at December 31, 2019 (568 million as at December 31, 2018 and $84 million as at January 1, 2018). The contractual interest rate, which represents a weighted average rate, is 78% as at December 31, 2019 (6.23% as at December 31, 2018 and 5.99% as at January 1, 2018) See Note 27 - Other financial liabilities na Not applicable $ () Includes All Senior notes and Notes rank pari-passu and are unsecured. The Corporation is subject to various financial covenants under the letter of credit facility and the unsecured revolving credit facility, which must be met on a quarterly basis, see Note 36 - Credit facilities for more details. A breach of any of these agreements or the inability to comply with these covenants could result in a default under these facilities, which would permit the Corporation's banks to request immediate defeasance or cash cover of all outstanding letters of credit, and bond holders and other lenders to declare amounts owed to them to be immediately payable. These conditions were all met as at December 31, 2019 and 2018 and January 1, 2018. Table 1 - Bombardier Bond Prices Years to Issue Price Maturity May 2021 6.125% $99.65 1 December 2021 $100.52 1 8.75% March 2022 $97.75 1 5.75% October 2022 $93.81 2 6.00% January 2023 6.13% $90.44 2 December 2024 $83.75 4 7.50% March 2025 $82.50 7.50% April 2027 $79.63 6 7.88% May, 2034 7.45% $76.50 13 December, 2026 $101.63 6 7.35% FOREIGN EXCHANGE RATES We are subject to currency fluctuations from the translation of revenues, expenses, assets and liabilities of foreign operations with non-U.S. dollar functional currencies, mainly the euro, pound sterling and other European currencies, and from transactions denominated in foreign currencies, mainly the Canadian dollar and pound sterling The foreign exchange rates used to translate assets and liabilities into U.S. dollars were as follows, as at: Euro Canadian dollar Pound sterling December 31, 2019 1.1234 0.7696 1.3204 December 31, 2018 1.1450 0.7337 1.2800 Increase (Decrease) (2%) 5% 3% The average foreign exchange rates used to translate revenues and expenses into U.S. dollars were as follows, for the fourth quarters ended: December 31, 2019 December 31, 2018 Decrease (3%) Euro Canadian dollar Pound sterling 1.1069 0.7574 1.2849 1.1422 0.7582 1.2878 0% 0% The average foreign exchange rates used to translate revenues and expenses into U.S. dollars were as follows, for the fiscal years ended: December 31, 2018 Euro Canadian dollar Pound sterling December 31, 2019 1.1200 0.7537 1.2763 1.1822 0.7729 1.3367 Decrease (5%) (2%) (5%) 0 128 / 236 84.7% SHAREHOLDER INFORMATION (3) Authorized, issued and outstanding share data, as at February 11, 2020 Authorized Issued and outstanding Class A Shares (multiple voting) 3,592,000,000 308,736,929 Class B Shares (subordinate voting)) 3,592,000,000 2,088,866,720 Series 2 Cumulative Redeemable Preferred Shares 12,000,000 5,811,736 Series 3 Cumulative Redeemable Preferred Shares 12,000,000 6,188,264 Series 4 Cumulative Redeemable Preferred Shares 9,400,000 9,400,000 (1) Ten votes each, convertible at the option of the holder into one Class B Subordinate Voting Share. 2) Convertible at the option of the holder into one Class A Share under certain conditions. Net of 39,160,485 Class B Subordinate Voting Shares purchased and held in trust in connection with the PSU and RSU plans. Warrant, share option, PSU and DSU data as at December 31, 2019 Warrants issued and outstanding Options issued and outstanding under the share option plans PSUs and DSUs issued and outstanding under the PSU and DSU plans Class B Subordinate Voting Shares held in trust to satisfy PSU obligations 305,851,872 131,006,338 96,309,753 39,160,485 Information Bombardier Inc. Investor Relations 800 Ren-Lvesque Blvd. West Montral, Qubec, Canada H3B 1Y8 Telephone: +1 514 861 9481, extension 13273 Fax: +1 514 861 2420 SELECTED FINANCIAL INFORMATION The following selected financial information has been derived from, and should be read in conjunction with, the consolidated financial statements for fiscal years ended December 31, 2019, 2018 and 2017 The following table provides selected financial information for the last three fiscal years. Fiscal years ended December 31 2019" 2018 2017 restate $ 16,199 (494) Revenues Net income (loss) attributable to equity holders of Bombardier Inc. $ $ 15,757 (1,797) $ $ 16,236 232 EPS (in dollars) Basic Diluted $ $ $ $ (0.76) (0.76) 0.10 0.09 (0.24) (0.24) $ $ $ $ $ $ Cash dividends declared per share (in Canadian dollars) Class A Shares (multiple voting) Class B Shares (subordinate voting) Series 2 Preferred Shares Series 3 Preferred Shares Series 4 Preferred Shares $ $ $ $ $ $ $ 0.99 1.00 0.90 1.00 1.56 $ $ $ 0.72 0.89 1.56 1.56 $ As at December 31 2019 2018 2017 restateof) Total assets $ 24,972 $ 24.958 $ 24,916 Non-current financial liabilities $ 10,550 $ 10.619 $ 10,165 ("Refer to Note 3 - Changes in accounting policies, to our Consolidated financial statements, for the impact of the adoption of IFRS 16, Leases. Under the modified retrospective approach adopted by the Corporation, 2018 figures are not restated. Restated due to the adoption of IFRS 15, Revenue from contracts with customers. The quarterly data table is shown hereafter. February 12, 2020 29. LONG-TERM DEBT Long-term debt was as follows, as at: December 31 December 31 January 1 2019 2018 2018 Amount in currency of origin Currency Contractual Interest rate After effect of fair value hedges (9) Maturity Amount Amount Amount 85069 Senior notes USD 7.75% n/a n/a $ - $ 869 $ 885 41462 EUR 6.13% n/a May 2021 483 952 1,019 101862 USD 8.75% n/a Dec. 2021 1,008 1,380 1,373 500 USD 5.75% 3-month Mar. 2022 504 504 506 Libor +336 1,200 USD 6.00% 3-month Oct 2022 1,215 1,217 1,223 Libor +3.57 1.250 USD 6.13% 3-month Jan 2023 1,272 1,273 1,281 Libor + 3.483) 1,000 USD 7.50% n/a Dec. 2024 992 990 990 1,500 USD 7.50% n/a Mar. 2025 1,492 1,491 1,490 2,000 USD 7.88% n/a Apr 2027 1,978 Notes 250 USD 7.45% n/a May 2034 248 248 248 Debentures 150 CAD 7.35% n/a Dec. 2026 115 110 119 Other) Various Various Various n/a 2020-2026 26 68 84 $ 9,333 $ 9,102 S 9,218 Of which current $ 8 $ 9 $ 18 Of which non-current 9,325 9,093 9,200 9,333 $ 9,102 $ 9,218 1) Interest on long-term debt as at December 31, 2019 is payable semi-annually, except for the other debts for which the timing of interest payments is variable The Corporation redeemed all of its outstanding 775% Senior Notes due 2020 of $850 million. In addition, the Corporation redeemed 366 million aggregate principal amount of the 6.13% Notes due 2021 of 780 million and $382 million aggregate principal amount of the 8 75% Notes due 2021 of $1,400 million in fiscal year 2019, The interest rate swap agreement related to these Senior Notes were partially settled in prior fiscal years. As these interest-rate swaps were in a fair value hedge relationship, the related deferred gains recorded in the hedged item will be amortized in interest expense up to the maturity of these debts. obligations under finance leases prior to December 31, 2018 The notional amount of other long-term debt is $26 million as at December 31, 2019 (568 million as at December 31, 2018 and $84 million as at January 1, 2018). The contractual interest rate, which represents a weighted average rate, is 78% as at December 31, 2019 (6.23% as at December 31, 2018 and 5.99% as at January 1, 2018) See Note 27 - Other financial liabilities na Not applicable $ () Includes All Senior notes and Notes rank pari-passu and are unsecured. The Corporation is subject to various financial covenants under the letter of credit facility and the unsecured revolving credit facility, which must be met on a quarterly basis, see Note 36 - Credit facilities for more details. A breach of any of these agreements or the inability to comply with these covenants could result in a default under these facilities, which would permit the Corporation's banks to request immediate defeasance or cash cover of all outstanding letters of credit, and bond holders and other lenders to declare amounts owed to them to be immediately payable. These conditions were all met as at December 31, 2019 and 2018 and January 1, 2018

Step by Step Solution

There are 3 Steps involved in it

To calculate Bombardiers Weighted Average Cost of Capital WACC we need to follow these steps Step 1 Calculate the Cost of Equity The cost of equity ca... View full answer

Get step-by-step solutions from verified subject matter experts