Question: All the info given is right here: Please provide Excel formula tables. Selected data for the Derby Corporation are shown below. Use the data to

All the info given is right here:

Please provide Excel formula tables.

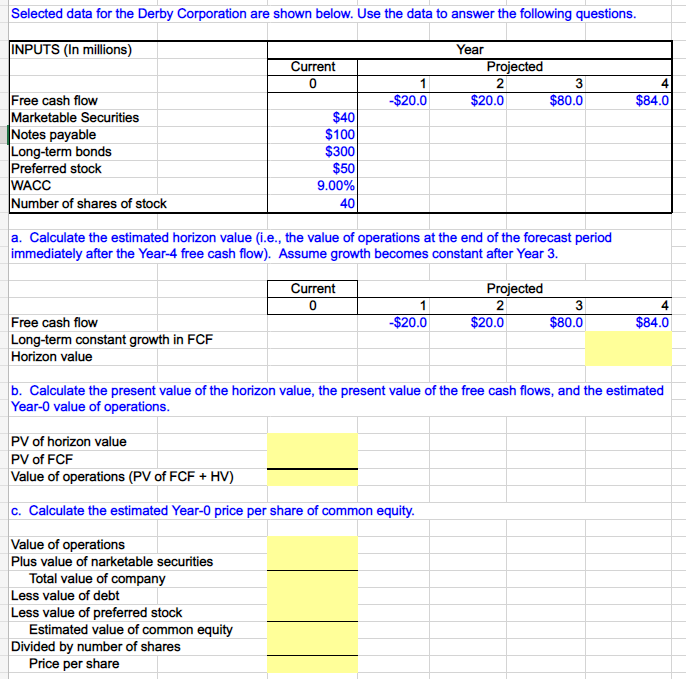

Selected data for the Derby Corporation are shown below. Use the data to answer the following questions. INPUTS (In millions) Year Current Projected 2 0 1 3 Free cash flow -$20.0 $20.0 $80.0 $84.0 Marketable Securities $40 Notes payable $100 Long-term bonds $300 Preferred stock $50 WACC 9.00% 40 Number of shares of stock a. Calculate the estimated horizon value (i.e., the value of operations at the end of the forecast period immediately after the Year-4 free cash flow). Assume growth becomes constant after Year 3. Current 0 Projected 2 1 3 4 Free cash flow -$20.0 $20.0 $80.0 $84.0 Long-term constant growth in FCF Horizon value b. Calculate the present value of the horizon value, the present value of the free cash flows, and the estimated Year-0 value of operations. PV of horizon value PV of FCF Value of operations (PV of FCF + HV) c. Calculate the estimated Year-0 price per share of common equity. Value of operations Plus value of narketable securities Total value of company Less value of debt Less value of preferred stock Estimated value of common equity Divided by number of shares Price per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts