Question: All the information has been given 2. Answer the following questions by using the Dividend Discount Model. a. In 2021, RMG paid a dividend of

All the information has been given

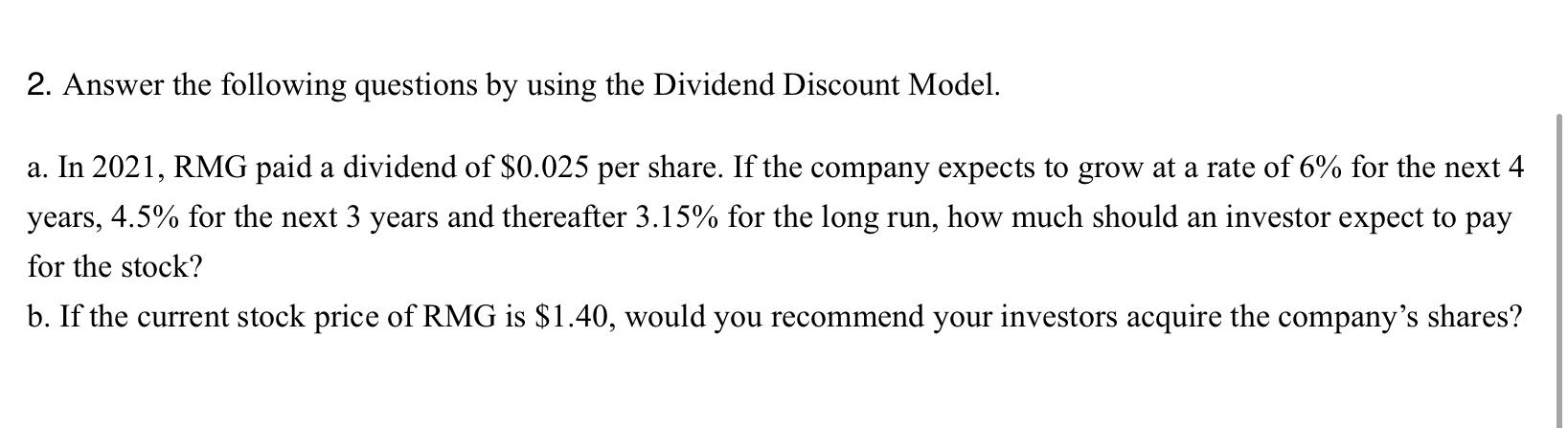

2. Answer the following questions by using the Dividend Discount Model. a. In 2021, RMG paid a dividend of $0.025 per share. If the company expects to grow at a rate of 6% for the next 4 years, 4.5% for the next 3 years and thereafter 3.15% for the long run, how much should an investor expect to pay for the stock? b. If the current stock price of RMG is $1.40, would you recommend your investors acquire the company's shares? Year 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 As at 31 August ($) 0.7300 0.7900 0.9933 1.3267 1.4567 1.5350 1.1000 1.0700 0.9800 0.8200 1.4100 2. Answer the following questions by using the Dividend Discount Model. a. In 2021, RMG paid a dividend of $0.025 per share. If the company expects to grow at a rate of 6% for the next 4 years, 4.5% for the next 3 years and thereafter 3.15% for the long run, how much should an investor expect to pay for the stock? b. If the current stock price of RMG is $1.40, would you recommend your investors acquire the company's shares? Year 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 As at 31 August ($) 0.7300 0.7900 0.9933 1.3267 1.4567 1.5350 1.1000 1.0700 0.9800 0.8200 1.4100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts