Question: All the information provided is already uploaded Exercise 2 (LO 2) Subsidiary sale of shares to noncontrolling interest. Truck Company owns a 90% interest in

All the information provided is already uploaded

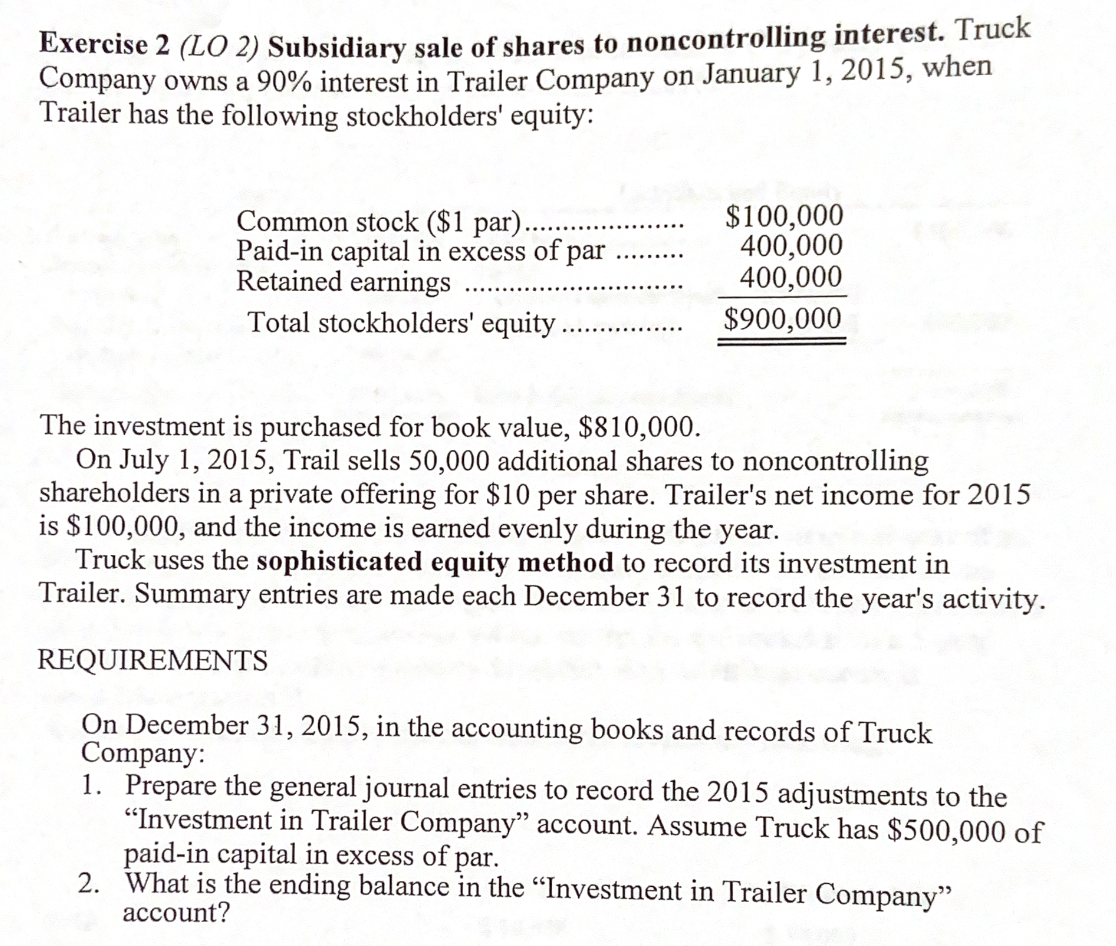

Exercise 2 (LO 2) Subsidiary sale of shares to noncontrolling interest. Truck Company owns a 90% interest in Trailer Company on January 1, 2015, when Trailer has the following stockholders' equity: Common stock ($1 par)..... Paid-in capital in excess of par Retained earnings Total stockholders' equity $100,000 400,000 400,000 $900,000 The investment is purchased for book value, $810,000. On July 1, 2015, Trail sells 50,000 additional shares to non ntrolling shareholders in a private offering for $10 per share. Trailer's net income for 2015 is $100,000, and the income is earned evenly during the year. Truck uses the sophisticated equity method to record its investment in Trailer. Summary entries are made each December 31 to record the year's activity. REQUIREMENTS On December 31, 2015, in the accounting books and records of Truck Company: 1. Prepare the general journal entries to record the 2015 adjustments to the Investment in Trailer Company' account. Assume Truck has $500,000 of paid-in capital in excess of par. 2. What is the ending balance in the Investment in Trailer Company account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts