Question: all the page PPE 57-3. (eaming Objective 2: Determining the cost of individual assets in a lump.com purchase of assets) Farab Diaribution Service pays $110,000

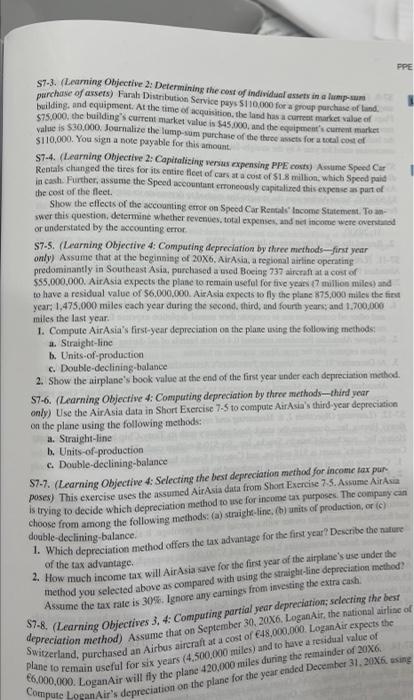

PPE 57-3. (eaming Objective 2: Determining the cost of individual assets in a lump.com purchase of assets) Farab Diaribution Service pays $110,000 for a group purchase of land. Building, and equipment. At the time of acquisition, the land has a current market value of $75.000, the building's current market value is $45.00, and the equipment's current marker valoe is $30,000. Journalize the lamp-som purchase of the these assets for a total cost of $110,000. You sign a note payable for this amount $7-4. (Learning Objective 2: Capitalising verses expensing PPE costs) Assume Speed Car Rentals changed the tires for its entire fleet of cars at a cost of $1.8 million, which Speed paid in cash. Further, assume the Speed accountant erroneously capitalized this expense as part of the cost of the fleet. Show the effects of the accounting error on Speed Car Rentals Income Statement. To swer this question, determine whether revenues, total expenses and set income were overstand or understated by the accounting error 57-5. (Learning Objective 4: Computing depreciation by three methods---first year only) Assume that at the beginning of 20X6, AirAsia, a regional airline operating predominantly in Southeast Asia, purchased a med Boeing 737 aircraft at a cost of $55,000,000. AirAsia expects the plane to remain useful for five years 7 million miles) and to have a residual value of $6.000.000. AirAsia expects to fly the plane 875,000 miles the first year: 1,475,000 miles each year during the second third and fourth years and 1.700,000 miles the last year. 1. Compute AirAsia's first-year depreciation on the plane using the following methods a. Straight-line b. Units-of-production c. Double-declining-balance 2. Show the airplane's book value at the end of the first year under each depreciation method. 57-6. (Learning Objective 4: Computing depreciation by three methods--third year only) Use the AirAsia data in Short Exercise 7-S to compute AirAsia's third-year depreciation on the plane using the following methods: a. Straight-line b. Units-of-production c. Double-declining-balance 87-7. (Learning Objective 4: Selecting the best depreciation method for income tax pur poses) This exercise uses the assumed AirAsia data from Short Exercise 7-5. Assume AirAsa is trying to decide which depreciation method to use for income tax purposes. The company can choose from among the following methods: (a) straight-line. (b) units of production, or (c) double-declining balance 1. Which depreciation method offers the tax advantage for the first year Describe the nature of the tax advantage 2. How much income tax will AirAsia save for the first year of the airplane's use under the method you selected above as compared with using the straight-line depreciation method Asszime the tax rate is 30%. Ignore any camings from investing the extra cash. S7-8. (Learning Objectives 3. 4: Computing partial year depreciation; selecting the best depreciation method) Assume that on September 30, 20X6, Logan Air, the national airline of Switzerland, purchased an Airbus aircraft at a cost of 48.000.000. Logan Air expects the plane to remain useful for six years (4.500.000 miles) and to have a residual value of 6,000,000. Logan Air will fly the plane 420,000 miles during the remainder of 20X6 Compute Logan Air's depreciation on the plane for the year ended December 31, 20X6. Ing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts