Question: All the same question, just different parts Required information COMP4-2 (Algo) Recording Transactions (Including Adjusting and Closing Entries), Preparing Financial Statements, and Performing Ratio Analysis

All the same question, just different parts

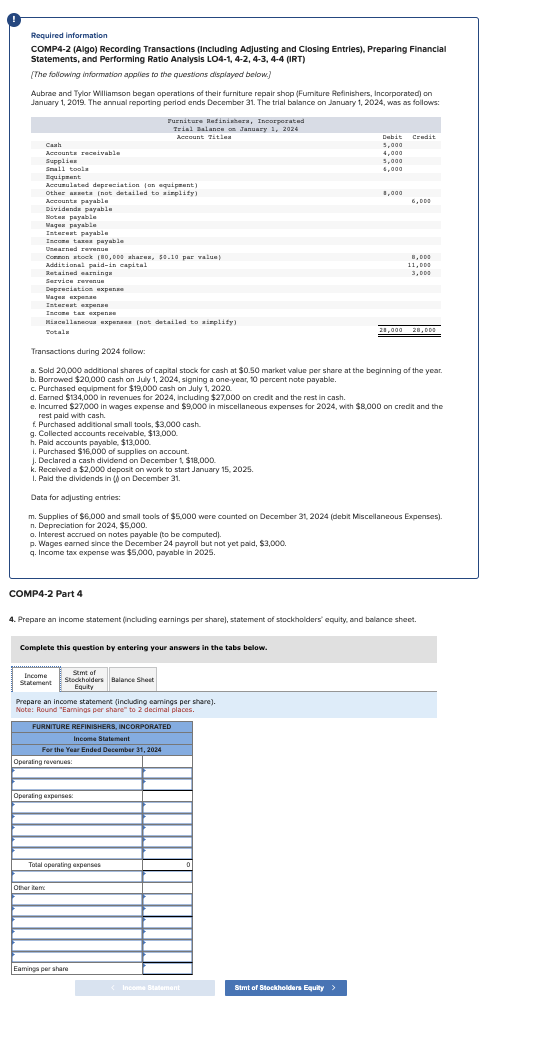

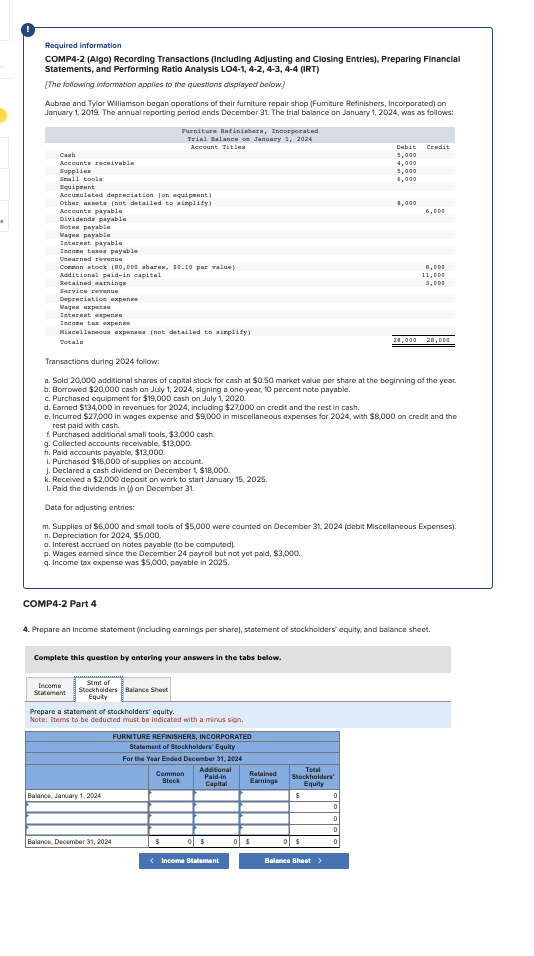

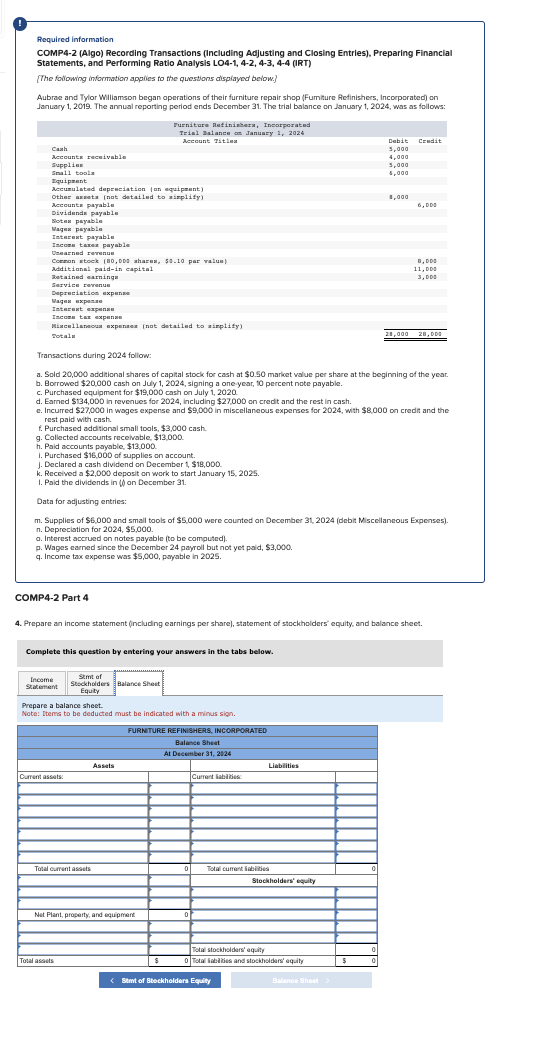

Required information COMP4-2 (Algo) Recording Transactions (Including Adjusting and Closing Entries), Preparing Financial Statements, and Performing Ratio Analysis LO4-1, 4-2, 4-3, 4-4 (IRT) [The following information applies to the questions dispiayed beiow.] Aubrae and Tylor Wiliamson began aperations of their furniture repair shop (Fumiture Aefinishers, Incorporated) on January 1, 2019. The annual reporting period ends December 31. The trial balance an January 1, 2024, was as follows: Transactions during 2024 follow: a. Sold 20,000 additional shares of capital stock for cash at $0.50 market value per share at the beginning of the year. b. Borrowed $20,000 cash on July 1,2024 , signing a oneyear, 10 pereent note payable. c. Purchased equipment for $19,000 cash on July 1,2020 d. Eamed $134,000 in revenues for 2024, including $27,000 on credit and the rest in cash. c. Incurred $27,000 in wages expense and $9,000 in miscellanecus experses for 2024 , with $8,000 on credit and the rest paid with cash. f. Purchased additional small tools, $3,000 cash. g. Collected accounts recelvable, $13,000. h. Paid accounts payable, $13,000. I. Purchased $16.000 of supplics on account. 1. Declared a cash dividend on December 1, \$18,000. k. Received a $2,000 deposit on work to start January 15,2025 . I. Paid the dividends in ( an December 31 . Data for adjusting entries: m. Supplies of $6,000 and smail tooks of $5,000 were counted on December 31, 2024 (debit Miscellaneous Expenses). . Depreciation for 2024, $5,000. a. Interest accrued on notes payable (to be computed). p. Wages earned sinee the December 24 payroll but not yet paid, $3,000. q. Income tax expense was $5,000, payable in 2025 . COMP4-2 Part 4 4. Prepare an income statement (including earnings per share), statement of stockholders' equity, and balance sheet. Complete this question by entering your answers in the tabs below. Prepare an income statemert (including eamings per share). Note: Round "Eamings per share" to 2 decimal places. Required information COMP4-2 (Algo) Recording Transactions (Including Adjusting and Closing Entries), Preparing Financial Statements, and Performing Ratio Analysis LO4-1, 4-2, 4-3, 4-4 (IRT) [The following informution applikes to the questions dispiayed beiow.] Aubree and Tylor Miliamson began aperations of their furniture repair shop (Fumiture Aefinishers, Incorporated) on January 1, 2019. The annual reporting period ends December 31 . The trial bolance on January 1,2024 , was as follows: Transactions during 2024 follow: a. Sold 20,000 additional shares of capital stock for cash at $0.50 market value per share at the beginning of the year. b. Borrowed $20,000 cash on July 1,2024 , signing a oneyear, to percent note payable. c. Purchased equiament for $19,000 cash on July 1,2020 d. Eamed $134,000 in revenues for 2024 , including $27,000 on credt and the rest in cash. e. Incurred $27,000 in wages expense and $9,000 in miscellanecus experses for 2024 , with $8,000 on credit and the rest paid with cash. f. Purchased additional small tools, $3,000 cash. g. Collected accounts recehable, $13,000. h. Paid accounts payable, $13,000. i. Purchased $16,000 of supplies on account. J. Declared a cash dividend on December 1,\$18,000. k. Received a $2,000 deposit on work to start January 15,2025. I. Paid the dividends in (h) Den December 31 . Data for adjusting entries: m. Supplies of $6,000 and small took of $5,000 were counted an December 31,2024 (debit Miscellancous Expenses). n. Depreciation for 2024, $5,000. a. Interest accrued on notes payable (to be computed). p. Wages earned since the December 24 payroll but not yet paid, $3,000. q. Income tax expense was $5,000, payable in 2025 . COMP4-2 Part 4 4. Prepare an income statement (including earnings per share), statement of stockholders' equity, and balance sheet. Complete this question by entering your answers in the tabs below. Prepare a statement of stockholders' equity. Note: Items to be deducted must be indicated with a minus sipn. Required information COMP4-2 (Algo) Recording Transactions (Including Adjusting and Closing Entries), Preparing Financial Statements, and Performing Ratio Analysis LO4-1, 4-2, 4-3, 4-4 (IRT) [The following information applices to the questions dispiayed beiow.] Aubrae and Tylor Miliamson began operations of their furniture repair shop (Fumiture Aefinishers, Incoeporated) on Jantary 1, 2019. The annual reporting period ends December 31 . The trial balance on January 1,2024 , was as foilows: Transactions during 2024 follow: a. Sold 20,000 additional shares of capital stock for cash at $0.50 marloet value per share at the beginning of the year. b. Borrowed $20,000 cash on July 1,2024 , signing a one-year, 10 percent note payable. c. Purchased equipment for $19,000 cash cn July 1,2020 d. Eamed $134,000 in revenues for 2024 , including $27,000 on credi and the rest in cash. c. Incurred $27,000 in wages expense and $9,000 in miscellanecus expenses for 2024 , with $8,000 on credit and the rest paid with cash. f. Purchased addianal small tools, $3,000cash. g. Collected accounts recehable, $13,000 h. Paid accounts payable, $13,000. i. Purchased $16.000 of supplies on account. J. Declared a cash dividend on December 1, \$18,000. k. Received a \$2,000 deposit on work to start January 15,2025. I. Paid the dividends in $ an December 31. Data for adjusting entrics: m. Supplies of \$6,000 and small took of $5,000 were counted on December 31, 2024 (debit Misceilancous Expenses). n. Depreciation for 2024,$5,000. o. Interest acerued on notes payabie (to be computed). p. Wages earned since the December 24 payroll but not yet paid, $3,000. q. Income tax expense was $5,000, payable in 2025. COMP4-2 Part 4 4. Prepare an income statement (including earnings per share), statement of stockholders' equity, and balance sheet. Complete this question by entering your answers in the tabs below. Prepare a balance sheet. Note: Itema to be deducted must be indicated with a minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts