Question: All the same question just different parts Required information Exercise 10-20 (Algo) Complete the accounting cycle using stockholders' equity transactions (LO10-2, 10 . 4,105,108) [The

![4,105,108) [The following information applies to the questions displayed below.] On January](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fbb2064a6c9_14166fbb205d7965.jpg)

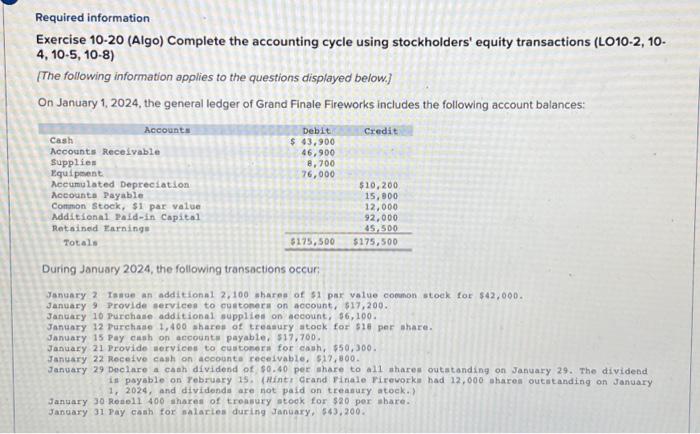

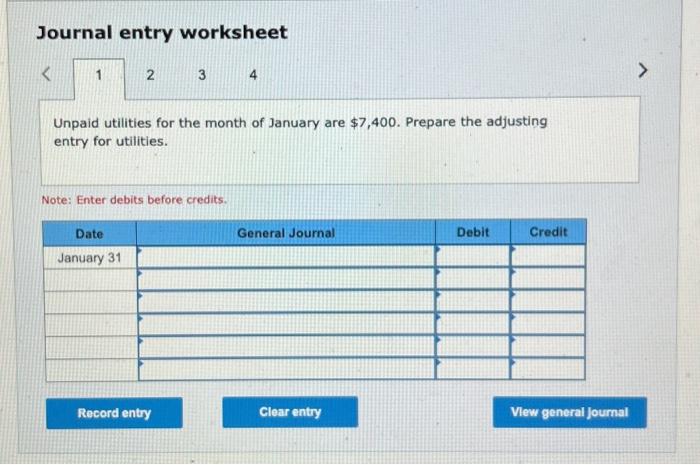

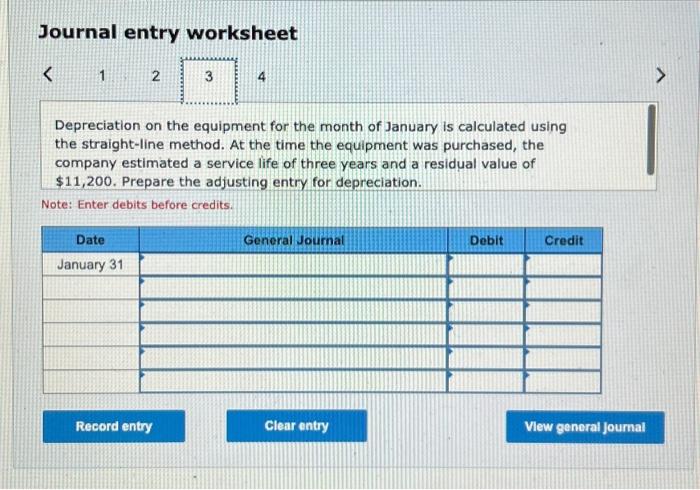

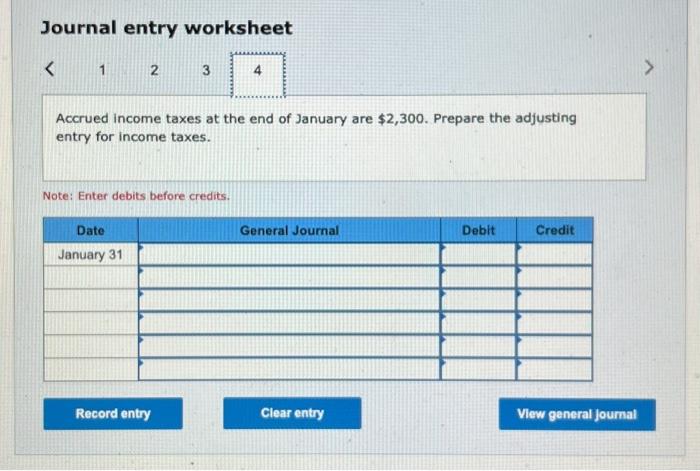

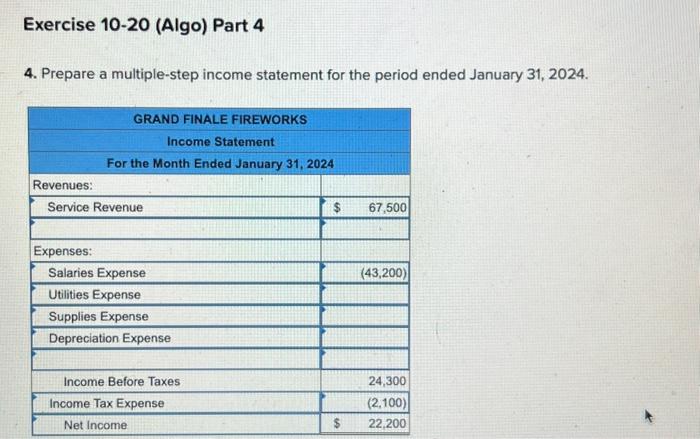

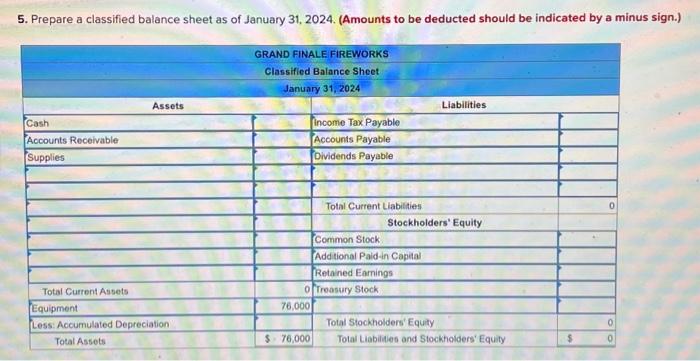

Required information Exercise 10-20 (Algo) Complete the accounting cycle using stockholders' equity transactions (LO10-2, 10 . 4,105,108) [The following information applies to the questions displayed below.] On January 1, 2024, the general ledger of Grand Finale Fireworks includes the following account balances: During January 2024, the following transactions occur: January 2 Tance an additionn1 2,100 wharea of $1 par value cocmon stock for $42,000. January 9 Provide aervicen to cultonera on acoount, $17,200. January 10 Purchase additional supplien on secount, 56,100 . January 12 purchase 1,400 sharea of treasury atock for 516 per ahare. January 15 Pay cush on accounte payable, 517,700. January 21 Provide wervicen to customera for cash, $50,300. January 22 Receive cash on accounta recelvable, 517,800. Janvary 29 Declare a caah dividend of $0.40 per whare to all ahare outatanding on January 29. The dividend in payable on Yebruary 15. (Mintr Grand Finale rirevorkm had 12,000 oharea outatanding on January 1 , 2024, and dividende are not paid an treanury atock. January 30 Reabll 400 tharea of treanury stook for $20 per whare. January 31 Pay cash for salaries during January, 543,200. Journal entry worksheet Unpaid utilities for the month of January are $7,400. Prepare the adjusting entry for utilities. Note: Enter debits before credits. Journal entry worksheet Supplies at the end of January total $6,300. Prepare the adjusting entry for supplies. Note: Enter debits before credits. Journal entry worksheet Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a service life of three years and a residual value of $11,200. Prepare the adjusting entry for depreciation. Note: Enter debits before credits. Journal entry worksheet Accrued income taxes at the end of January are $2,300. Prepare the adjusting entry for income taxes. Note: Enter debits before credits. GRAND FINALE FIREWORKS Adjusted Trial Balance January 31, 2024 Accounts 4. Prepare a multiple-step income statement for the period ended January 31, 2024. 5. Prepare a classifled balance sheet as of January 31, 2024. (Amounts to be deducted should be indicated by a minus sig

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts