Question: all the same question On January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances: The $31,000 beginning balance of

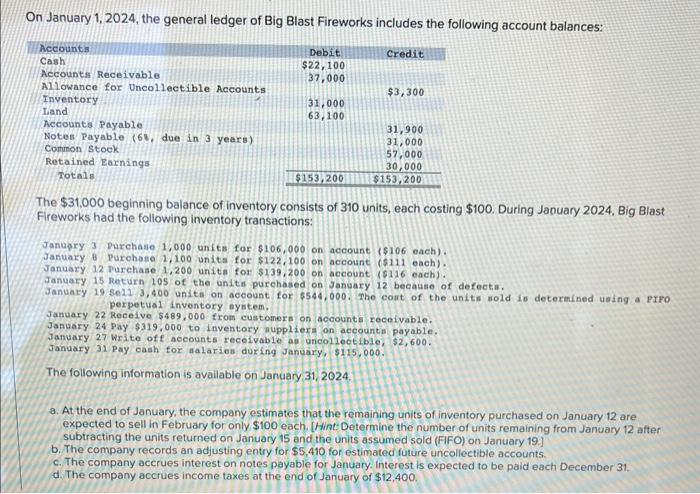

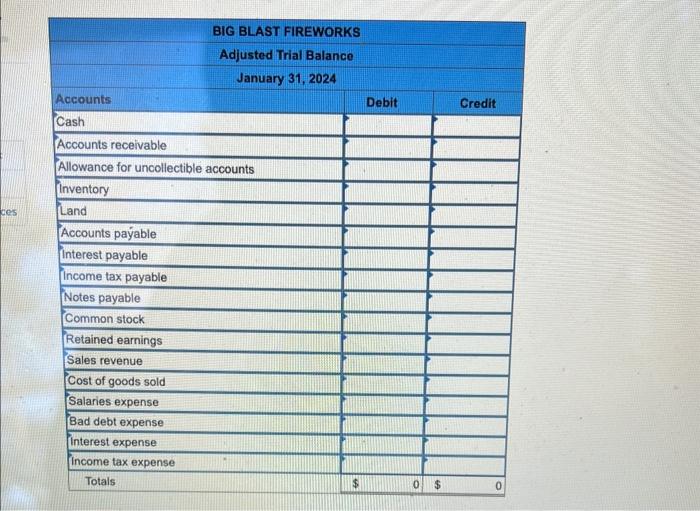

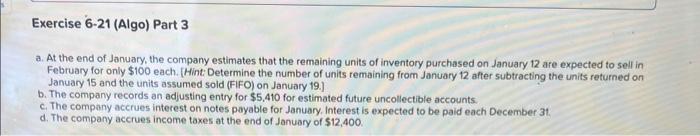

On January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances: The $31,000 beginning balance of inventory consists of 310 units, each costing $100. During January 2024, Big Biast Fireworks had the following inventory transactions: Janupry 3 Purchase 1,000 units for $106,000 on account (\$106 each). January 8 Purohase 1,100 unita for $122,100 on account (\$111 each). January 12 Purchase 1,200 unita for $139,200 on account (\$116 each). January is Return 105 of the units purchased on January 12 because of defecta. January 19se213,400 unita on account for 5544,000 . The cont of the unitin wold in determined using a prro perpetual inventory aystem. January 22 Receive $489,000 from customers on accounts receivable. January 24 pay $319,000 to inventory nupplieri on accounts payable. January 27 Write of f accounts recoivable ae uncollectible, $2,600. January 31 Pay cash for dalaries during January, $115,000. The following information is available on January 31,2024. a. At the end of January, the company estimates that the remaining units of inventory purchased on January 12 are expected to sell in February for only $100 each. [Hint: Determine the number of units remaining from January 12 after subtracting the units retumed on January 15 and the units assumed sold (FFFO) on January 19.] b. The company records an adjusting entry for $5,410 for estimated future uncollectible accounts. c. The company accrues interest on notes payable for January. Interest is expected to be paid each December 31 . a. At the end of January, the company estimates that the remaining units of inventory purchased on January 12 are expected to sell in February for only $100 each. [Hint: Determine the number of units remaining from January 12 after subtracting the units returned on January 15 and the units assumed sold (FIFO) on January 19.] b. The company records an adjusting entry for $5,410 for estimated future uncollectible accounts. c. The company accrues interest on notes payable for January. Interest is expected to be paid each December 31. d. The company accrues income taxes at the end of January of $12,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts