Question: all the steps nd-bond refunding. Jupiter Ltd. has a callable butstanding bond issue with a face value of $7,000,000, which was issued 5 years ago

all the steps

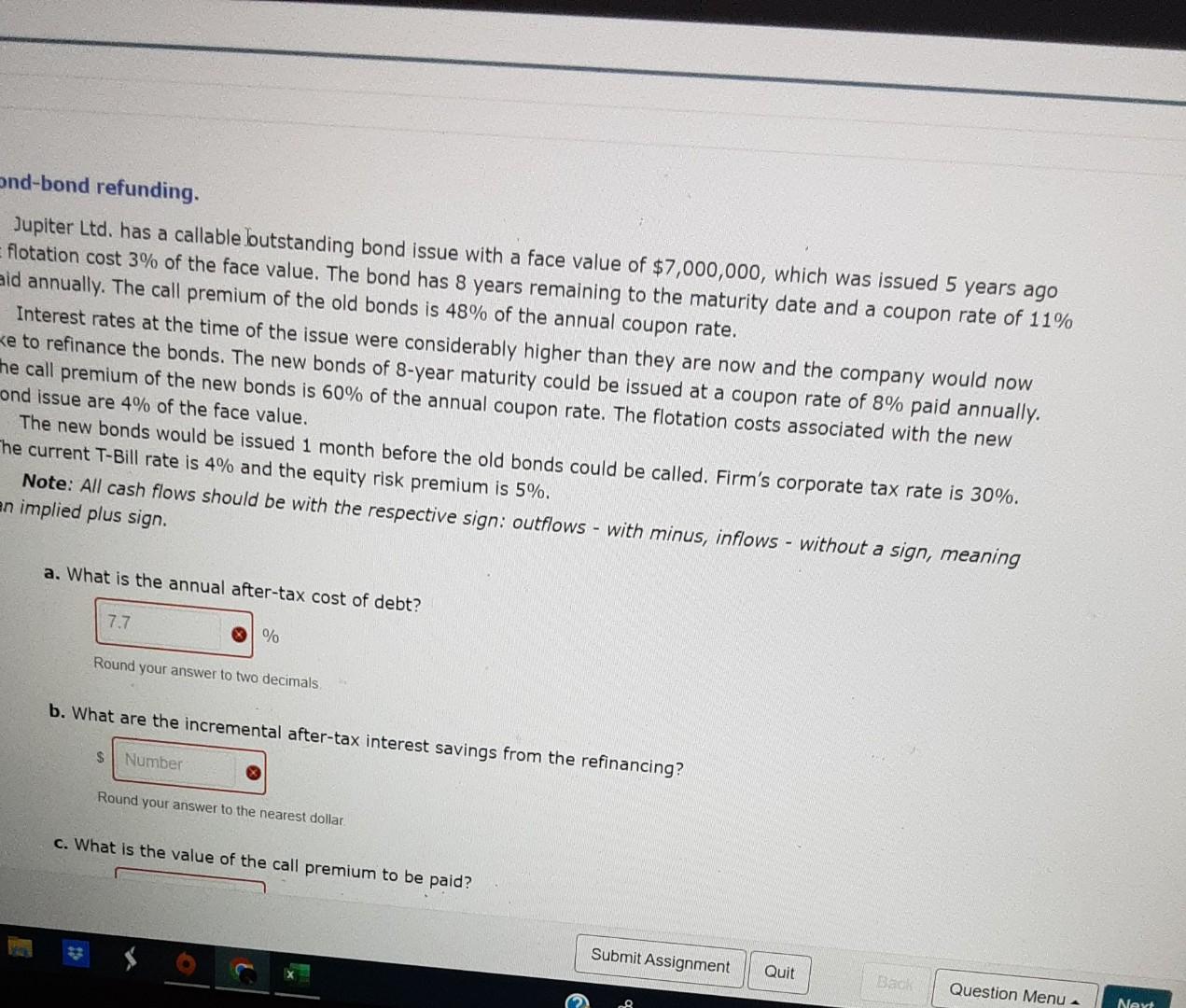

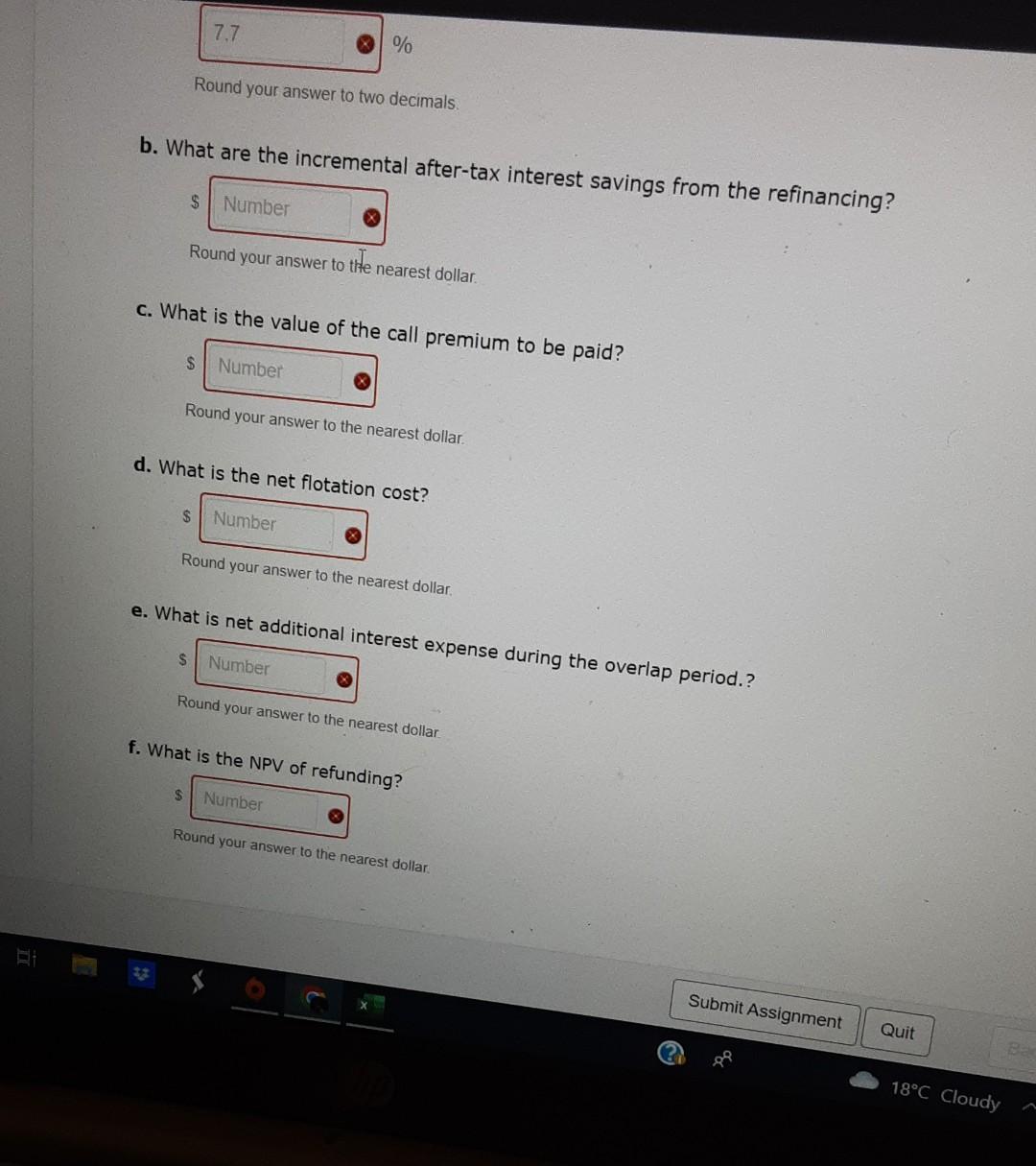

nd-bond refunding. Jupiter Ltd. has a callable butstanding bond issue with a face value of $7,000,000, which was issued 5 years ago flotation cost 3% of the face value. The bond has 8 years remaining to the maturity date and a coupon rate of 11% id annually. The call premium of the old bonds is 48% of the annual coupon rate. Interest rates at the time of the issue were considerably higher than they are now and the company would now e to refinance the bonds. The new bonds of 8 -year maturity could be issued at a coupon rate of 8% paid annually. le call premium of the new bonds is 60% of the annual coupon rate. The flotation costs associated with the new ind issue are 4% of the face value. The new bonds would be issued 1 month before the old bonds could be called. Firm's corporate tax rate is 30%. he current T-Bill rate is 4% and the equity risk premium is 5%. Note: All cash flows should be with the respective sign: outflows - with minus, inflows - without a sign, meaning implied plus sign. a. What is the annual after-tax cost of debt? % Kound your answer to two decimals b. What are the incremental after-tax interest savings from the refinancing? Truund your answer to the nearest dollar. c. What is the value nf tha call premium to be paid? Round your answer to two decimals. b. What are the incremental after-tax interest savings from the refinancing? $ Round your answer to the nearest dollar. c. What is the value of the call premium to be paid? Round your answer to the nearest dollar. d. What is the net flotation cost? Found your answer to the nearest dollar. e. What is net additional interest expense during the overlap period.? Ruund your answer to the nearest dollar. f. What is the NPV of rofi. ding? nd-bond refunding. Jupiter Ltd. has a callable butstanding bond issue with a face value of $7,000,000, which was issued 5 years ago flotation cost 3% of the face value. The bond has 8 years remaining to the maturity date and a coupon rate of 11% id annually. The call premium of the old bonds is 48% of the annual coupon rate. Interest rates at the time of the issue were considerably higher than they are now and the company would now e to refinance the bonds. The new bonds of 8 -year maturity could be issued at a coupon rate of 8% paid annually. le call premium of the new bonds is 60% of the annual coupon rate. The flotation costs associated with the new ind issue are 4% of the face value. The new bonds would be issued 1 month before the old bonds could be called. Firm's corporate tax rate is 30%. he current T-Bill rate is 4% and the equity risk premium is 5%. Note: All cash flows should be with the respective sign: outflows - with minus, inflows - without a sign, meaning implied plus sign. a. What is the annual after-tax cost of debt? % Kound your answer to two decimals b. What are the incremental after-tax interest savings from the refinancing? Truund your answer to the nearest dollar. c. What is the value nf tha call premium to be paid? Round your answer to two decimals. b. What are the incremental after-tax interest savings from the refinancing? $ Round your answer to the nearest dollar. c. What is the value of the call premium to be paid? Round your answer to the nearest dollar. d. What is the net flotation cost? Found your answer to the nearest dollar. e. What is net additional interest expense during the overlap period.? Ruund your answer to the nearest dollar. f. What is the NPV of rofi. ding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts