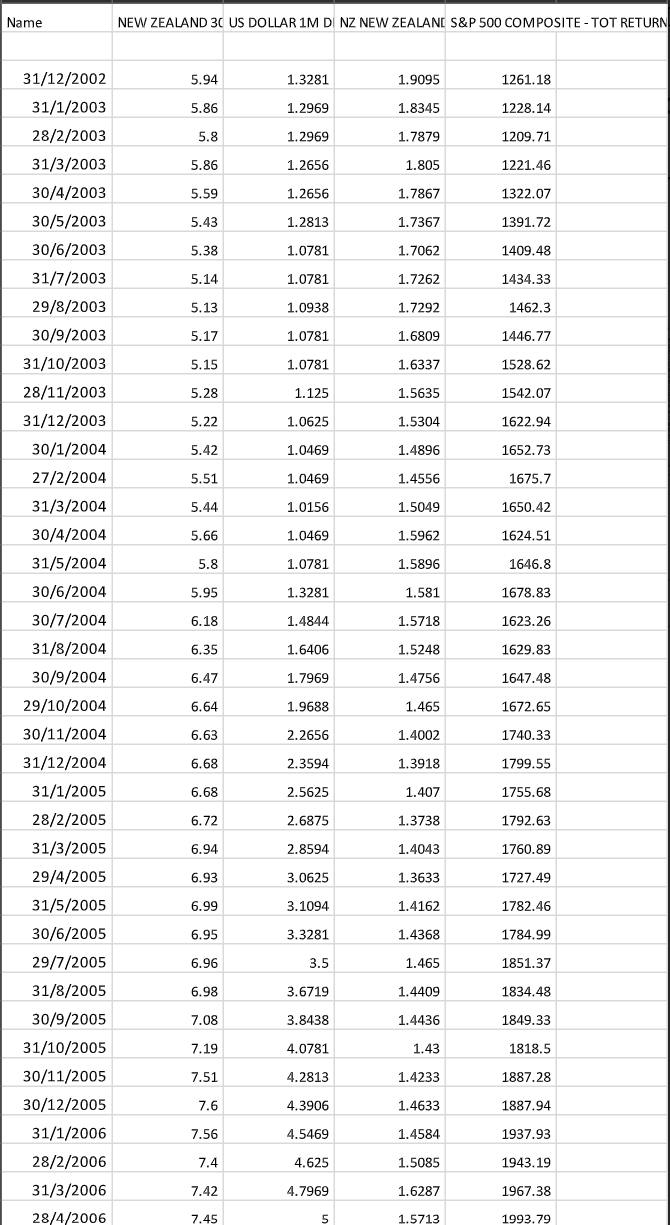

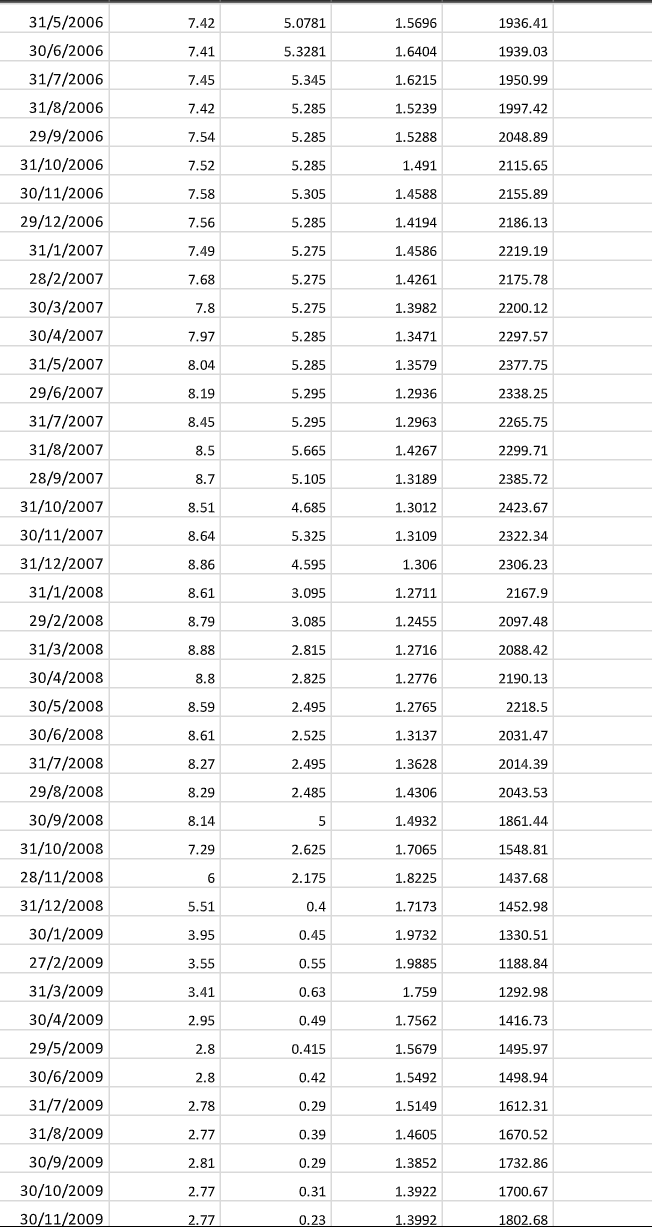

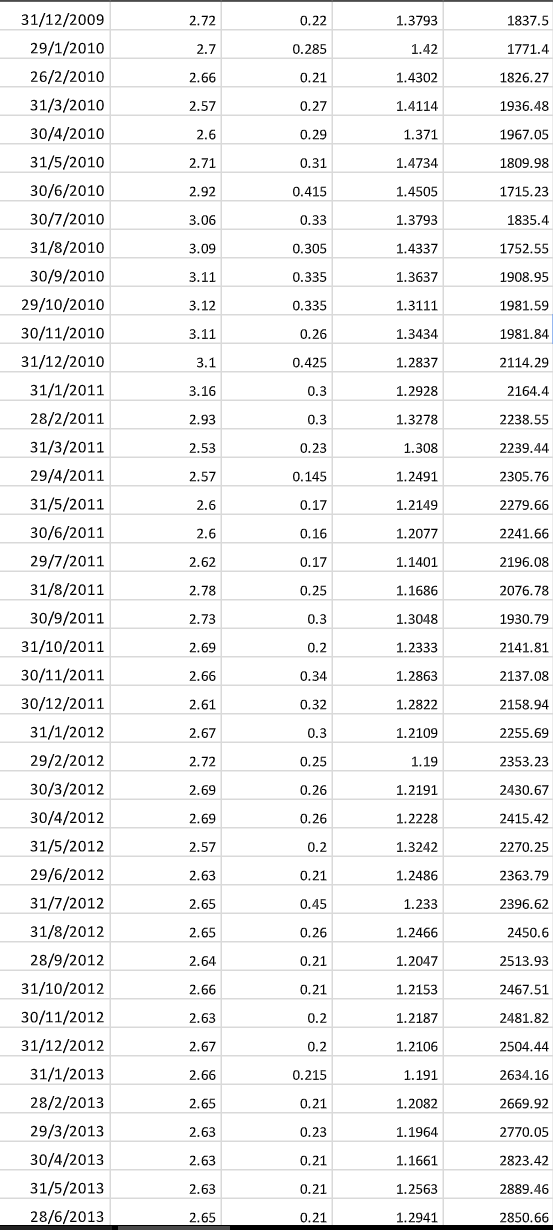

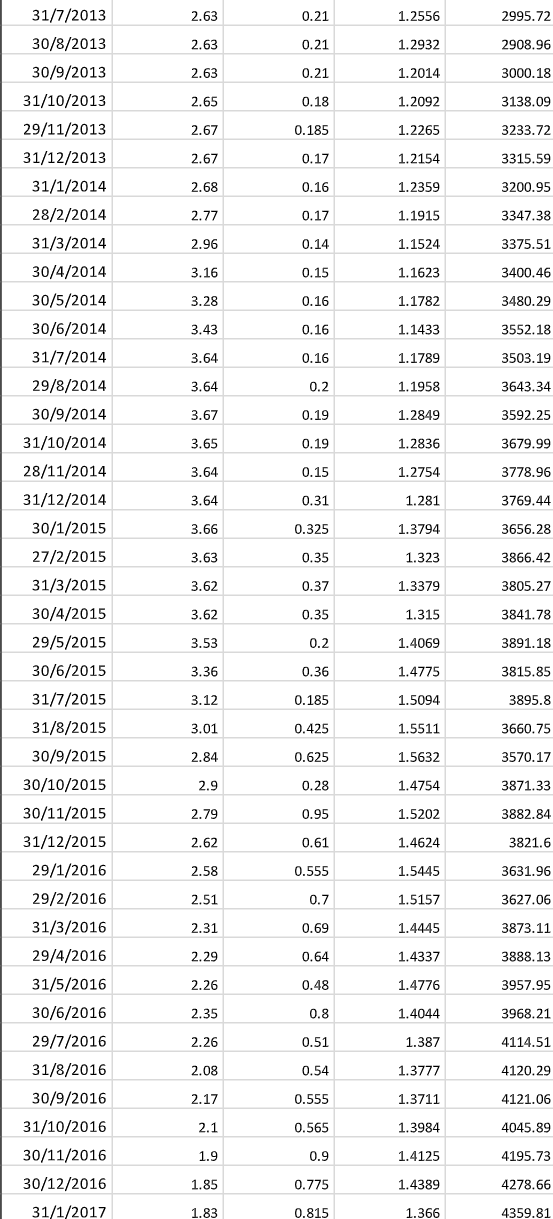

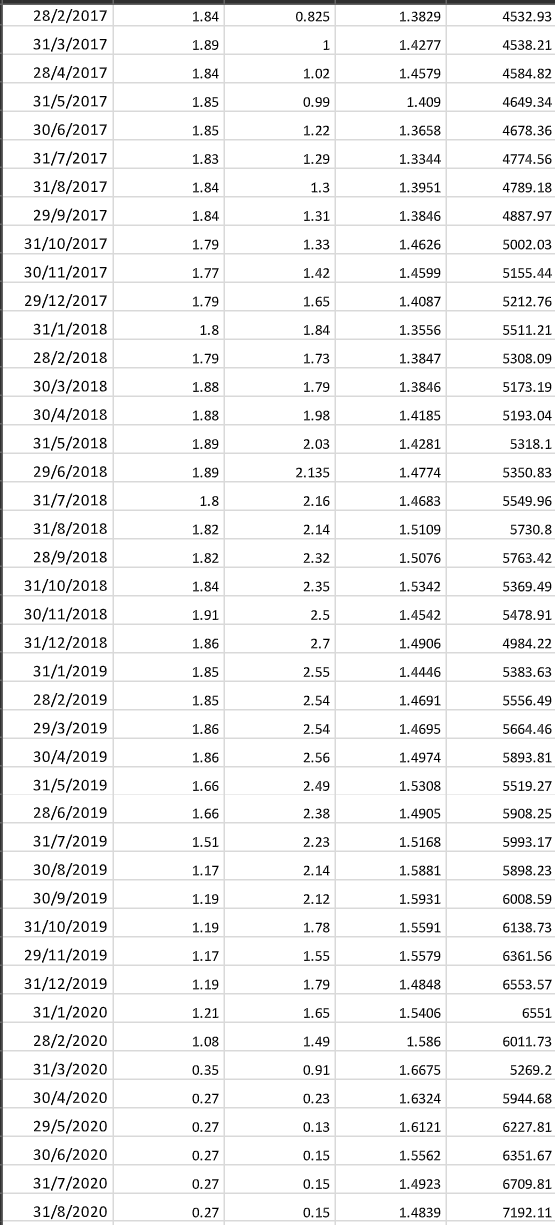

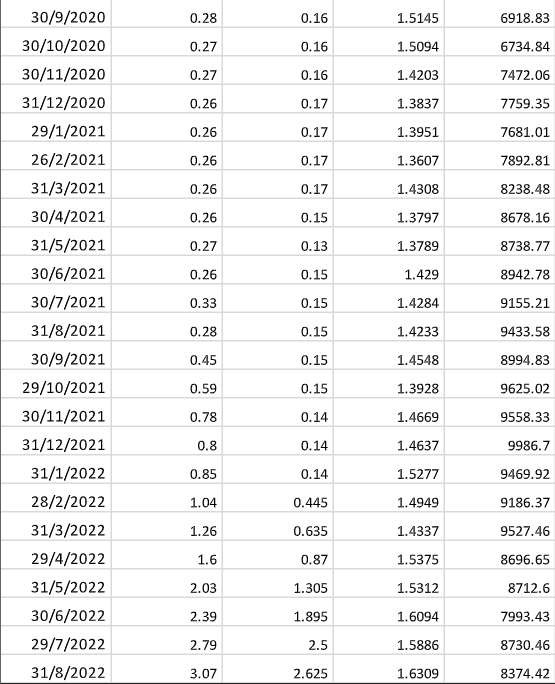

Question: All the table pics are all one table there was no way to post the spreadsheet Name NEW ZEALAND 3C US DOLLAR 1M D NZ

All the table pics are all one table there was no way to post the spreadsheet

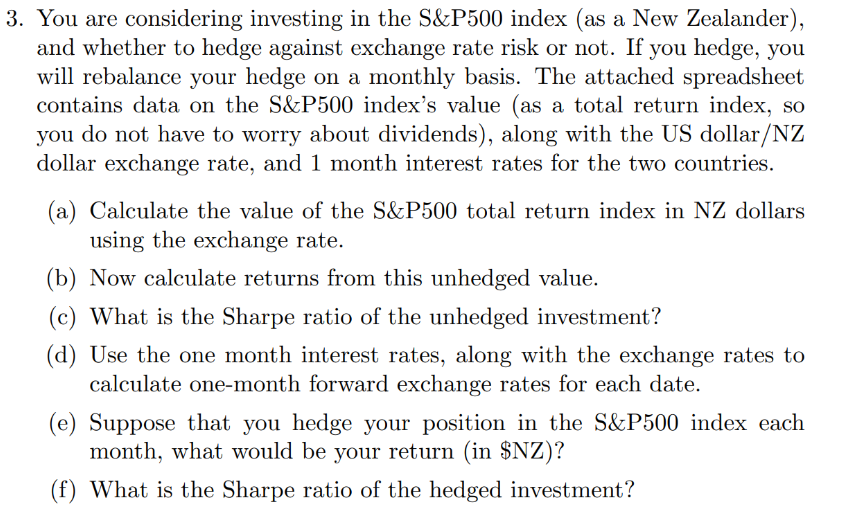

Name NEW ZEALAND 3C US DOLLAR 1M D NZ NEW ZEALAN[ S\&P 500 COMPOSITE - TOT RETURN 3. You are considering investing in the S\&P500 index (as a New Zealander), and whether to hedge against exchange rate risk or not. If you hedge, you will rebalance your hedge on a monthly basis. The attached spreadsheet contains data on the S\&P500 index's value (as a total return index, so you do not have to worry about dividends), along with the US dollar/NZ dollar exchange rate, and 1 month interest rates for the two countries. (a) Calculate the value of the S\&P500 total return index in NZ dollars using the exchange rate. (b) Now calculate returns from this unhedged value. (c) What is the Sharpe ratio of the unhedged investment? (d) Use the one month interest rates, along with the exchange rates to calculate one-month forward exchange rates for each date. (e) Suppose that you hedge your position in the S\&P500 index each month, what would be your return (in $NZ )? (f) What is the Sharpe ratio of the hedged investment? Name NEW ZEALAND 3C US DOLLAR 1M D NZ NEW ZEALAN[ S\&P 500 COMPOSITE - TOT RETURN 3. You are considering investing in the S\&P500 index (as a New Zealander), and whether to hedge against exchange rate risk or not. If you hedge, you will rebalance your hedge on a monthly basis. The attached spreadsheet contains data on the S\&P500 index's value (as a total return index, so you do not have to worry about dividends), along with the US dollar/NZ dollar exchange rate, and 1 month interest rates for the two countries. (a) Calculate the value of the S\&P500 total return index in NZ dollars using the exchange rate. (b) Now calculate returns from this unhedged value. (c) What is the Sharpe ratio of the unhedged investment? (d) Use the one month interest rates, along with the exchange rates to calculate one-month forward exchange rates for each date. (e) Suppose that you hedge your position in the S\&P500 index each month, what would be your return (in $NZ )? (f) What is the Sharpe ratio of the hedged investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts