Question: All thehnlques with NPV profle- Mutually exclusive projects Projects A and B, of equal risk, are altematives for expanding Rona Company'o cupacty, The firm ir

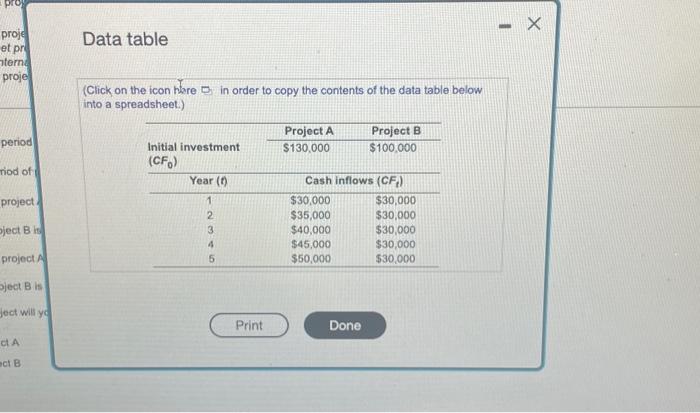

All thehnlques with NPV profle- Mutually exclusive projects Projects A and B, of equal risk, are altematives for expanding Rona Company'o cupacty, The firm ir cost of capial ia 12 , 1 cash flows for each project are shown in the follewing tablo- a. Calculate each project's paybock poriod. b. Calculate the net present value (NPV) for each project. o. Calculate the internal rate of refum (IRR) for each project d. Indicate which project you would recommend. a. The payback period of project A is years. (Round to tho decimal places.) The payback pened of peoject B is years. (Round to two decimsi ploces.) b. The NPV of project A is 5 (Round to the neareat cent.) The NPV of propect B is $ (Round to the neareat cent) c. The TRR of project A is K. (Round to two decimal places) The iRR of propect 8 is W. (Rhound to two decimal places.) d. Which project wa you recomenend? (Select the best answer beiow.) A. Project A B. Project Ei Data table (Click on the icon hare D in order to copy the contents of the data table below into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts