Question: all three please Question 3 (15 Points) You're currently a buy-side analyst working for a big asset manager. You believe that investing in Microsoft (Ticker:MSFT)

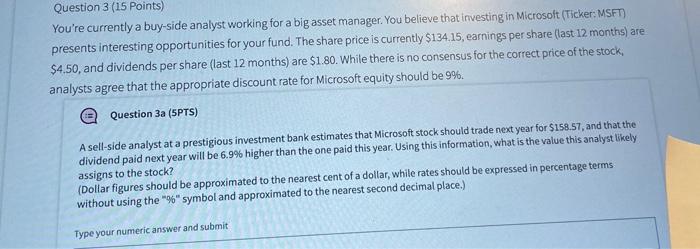

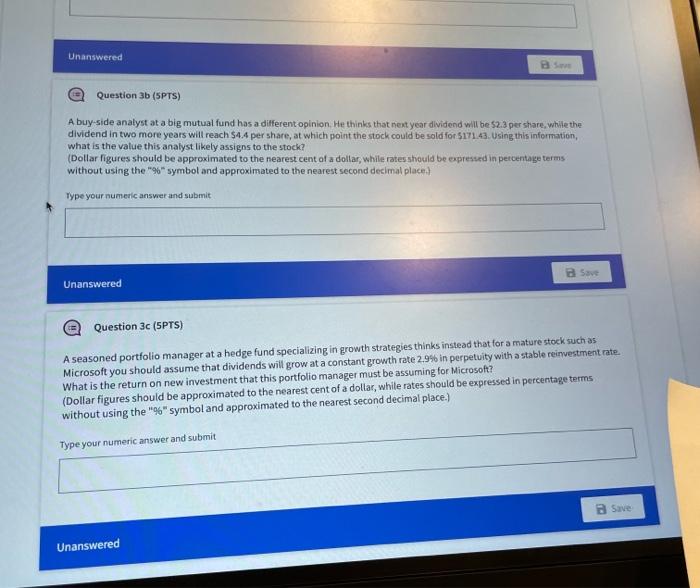

Question 3 (15 Points) You're currently a buy-side analyst working for a big asset manager. You believe that investing in Microsoft (Ticker:MSFT) presents interesting opportunities for your fund. The share price is currently $134.15, earnings per share (last 12 months) are $4.50, and dividends per share (last 12 months) are $1.80. While there is no consensus for the correct price of the stock, analysts agree that the appropriate discount rate for Microsoft equity should be 9%. Question 3a (5PTS) A sell-side analyst at a prestigious investment bank estimates that Microsoft stock should trade next year for $158.57, and that the dividend paid next year will be 6.9% higher than the one paid this year. Using this information, what is the value this analyst likely assigns to the stock? (Dollar figures should be approximated to the nearest cent of a dollar, while rates should be expressed in percentage terms without using the "96" symbol and approximated to the nearest second decimal place.) Type your numeric answer and submit Unanswered Question 3b (5PTS) A buy-side analyst at a big mutual fund has a different opinion. He thinks that next year dividend will be $2.3 per share, while the dividend in two more years will reach 544 per share, at which point the stock could be sold for S17143. Using this information, what is the value this analyst likely assigns to the stock? (Dollar figures should be approximated to the nearest cent of a dollar, while rates should be expressed in percentage terms without using the symbol and approximated to the nearest second decimal place.) Type your numeric answer and submit B Save Unanswered e Question 3c (SPTS) A seasoned portfolio Manager at a hedge fund specializing in growth strategies thinks instead that for a mature stock such as Microsoft you should assume that dividends will grow at a constant growth rate 2.9% in perpetuity with a stable reinvestment rate What is the return on new investment that this portfolio manager must be assuming for Microsoft? (Dollar figures should be approximated to the nearest cent of a dollar, while rates should be expressed in percentage terms without using the "%" symbol and approximated to the nearest second decimal place) Type your numeric answer and submit Save Unanswered Question 3 (15 Points) You're currently a buy-side analyst working for a big asset manager. You believe that investing in Microsoft (Ticker:MSFT) presents interesting opportunities for your fund. The share price is currently $134.15, earnings per share (last 12 months) are $4.50, and dividends per share (last 12 months) are $1.80. While there is no consensus for the correct price of the stock, analysts agree that the appropriate discount rate for Microsoft equity should be 9%. Question 3a (5PTS) A sell-side analyst at a prestigious investment bank estimates that Microsoft stock should trade next year for $158.57, and that the dividend paid next year will be 6.9% higher than the one paid this year. Using this information, what is the value this analyst likely assigns to the stock? (Dollar figures should be approximated to the nearest cent of a dollar, while rates should be expressed in percentage terms without using the "96" symbol and approximated to the nearest second decimal place.) Type your numeric answer and submit Unanswered Question 3b (5PTS) A buy-side analyst at a big mutual fund has a different opinion. He thinks that next year dividend will be $2.3 per share, while the dividend in two more years will reach 544 per share, at which point the stock could be sold for S17143. Using this information, what is the value this analyst likely assigns to the stock? (Dollar figures should be approximated to the nearest cent of a dollar, while rates should be expressed in percentage terms without using the symbol and approximated to the nearest second decimal place.) Type your numeric answer and submit B Save Unanswered e Question 3c (SPTS) A seasoned portfolio Manager at a hedge fund specializing in growth strategies thinks instead that for a mature stock such as Microsoft you should assume that dividends will grow at a constant growth rate 2.9% in perpetuity with a stable reinvestment rate What is the return on new investment that this portfolio manager must be assuming for Microsoft? (Dollar figures should be approximated to the nearest cent of a dollar, while rates should be expressed in percentage terms without using the "%" symbol and approximated to the nearest second decimal place) Type your numeric answer and submit Save Unanswered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts