Question: All three problems please! ill leave good review QS 23-18 (Algo) Pricing using variable cost LO P6 GoSnow sells snowboards. Each snowboard requires direct materials

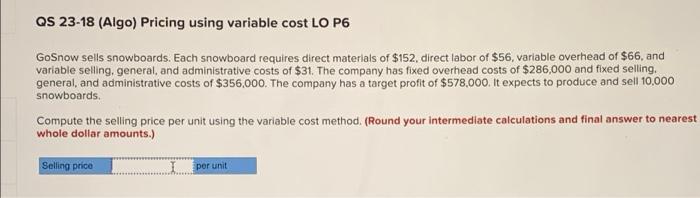

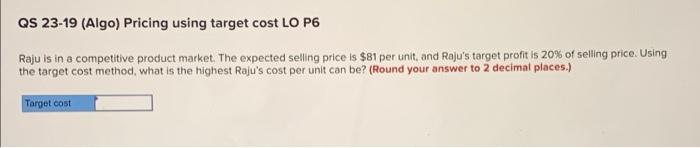

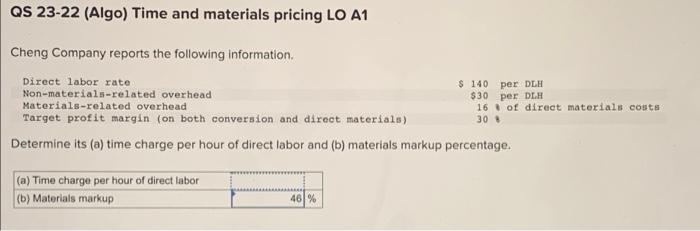

QS 23-18 (Algo) Pricing using variable cost LO P6 GoSnow sells snowboards. Each snowboard requires direct materials of $152, direct labor of $56, variable overhead of $66, and variable selling, general, and administrative costs of $31. The company has fixed overhead costs of $286,000 and fixed selling general, and administrative costs of $356,000. The company has a target profit of $578,000. It expects to produce and sell 10,000 snowboards Compute the selling price per unit using the variable cost method. (Round your intermediate calculations and final answer to nearest whole dollar amounts.) Selling price per unit QS 23-19 (Algo) Pricing using target cost LO P6 Raju is in a competitive product market. The expected selling price is $81 per unit, and Raju's target profit is 20% of selling price. Using the target cost method, what is the highest Raju's cost per unit can be? (Round your answer to 2 decimal places.) Target cost QS 23-22 (Algo) Time and materials pricing LO A1 Cheng Company reports the following information Direct labor rate $ 140 per DLH Non-materials-related overhead $30 per DEH Materials-related overhead 16 # of direct materials costs Target profit margin (on both conversion and direct materials) 30 Determine its (e) time charge per hour of direct labor and (b) materials markup percentage. (a) Time charge per hour of direct labor (b) Materials markup 46%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts