Question: All value comes from future cash flows, and making positye net present value decisions is the sign of a good steward of capital and management.

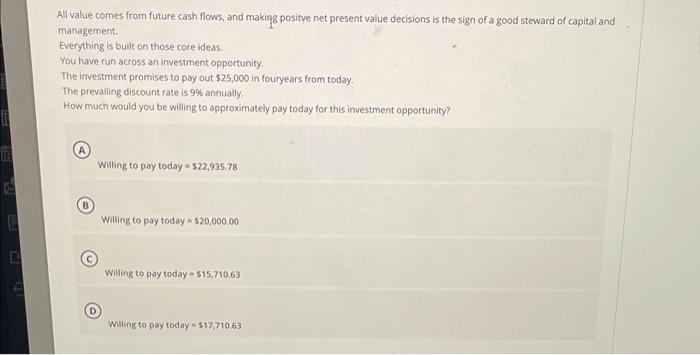

All value comes from future cash flows, and making positye net present value decisions is the sign of a good steward of capital and management. Everything is bult on those core ideas. You have run across an investment opportunity. The investment promises to pay out $25,000 in fouryears from today. The prevaling discount rate is 9% annually. How much would you be willing to approximately pay today for this investment opportunity? Willing to pay today =$22,935.78 Willing to pay today =520,000.00 Witing to pay today = \$15,710.63 Wiling to pay today = $17,710.63

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts